Ethereum (ETH) price has increased more than 3% in the past 24 hours, showing signs of recovery as the year comes to a close. In contrast to Solana and Bitcoin, which reached new highs in 2024, ETH failed to reach this milestone.

Key indicators such as RSI and DMI suggest that bullish momentum is gradually forming, as ETH is approaching a key resistance level at $3,523. Whether the altcoin can break higher or retest lower support levels will determine its short-term price trajectory.

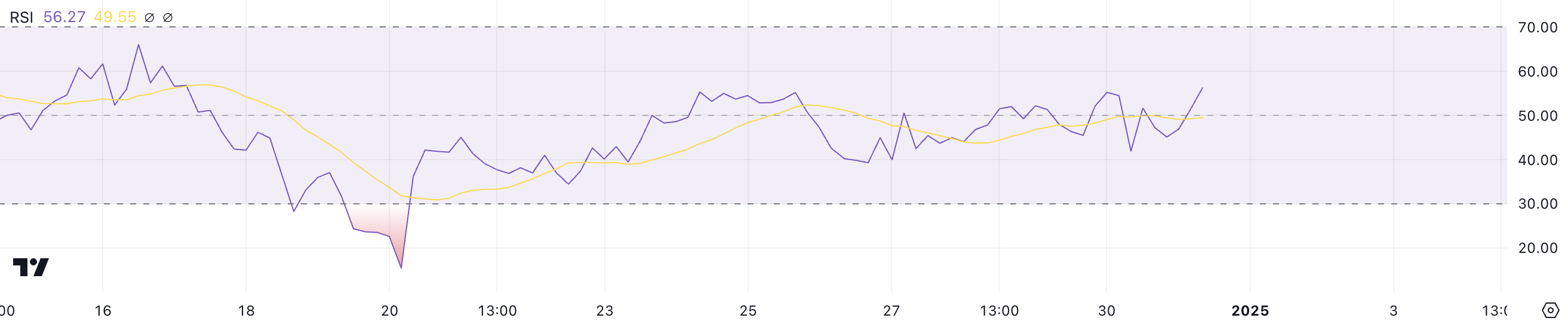

ETH RSI Is Rising

Ethereum’s Relative Strength Index (RSI) is currently at 56.2, reflecting a steady recovery after dipping below 20 on December 20. This recovery shows that buying pressure has gradually returned. again, bringing ETH out of oversold conditions and into neutral or slightly bullish territory.

An RSI at 56.2 shows that the momentum is leaning more towards the positive side, signaling the possibility of a slight upside for ETH price as it stabilizes.

RSI is a momentum indicator that measures the speed and strength of price movements on a scale of 0 to 100. Values above 70 indicate overbought conditions, often signaling the possibility of price declines, while Values below 30 suggest oversold conditions, which could lead to a recovery.

With Ethereum’s RSI at 56.2, it remains in neutral territory but is approaching bullish territory. In the short term, this could mean that ETH has the space to grow moderately, although the lack of strong momentum could significantly limit price upside without a stronger increase in buying pressure.

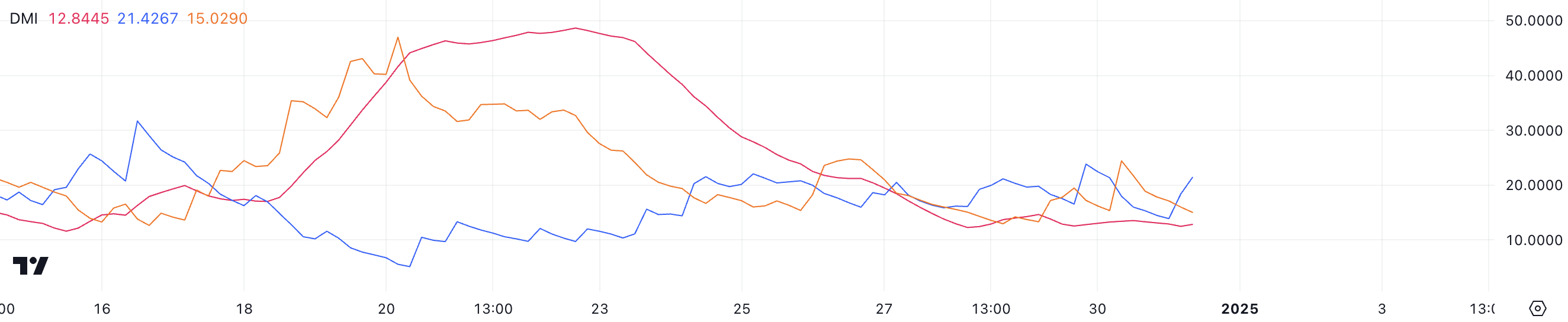

Ethereum DMI Implies Bullish Conversion

ETH’s DMI chart shows that ADX is currently at 12.8, having remained below the 20 threshold since December 27. This low ADX level indicates that the trend strength is weak, reflecting a lack of momentum strong in both directions.

However, the +DI line recently surpassed -DI, with +DI rising to 21.4 and -DI at 15, suggesting that buying pressure has begun to prevail over selling pressure. This setup shows the early stages of a potential uptrend, although weak ADX signals that the trend is not yet firmly established.

The Average Directional Index (ADX) level measures the strength of a trend, regardless of its direction, on a scale of 0 to 100. Values above 25 indicate a strong trend, while indicators Below 20 indicates weak or non-existent trend strength. +DI (Upward Index) tracks buying pressure, while -DI tracks selling pressure.

When +DI crosses above -DI and takes on a higher value, bullish momentum begins to build. However, for ETH’s uptrend to gain traction, ADX needs to break above 20 to confirm stronger trend momentum. In the short term, ETH may see a gradual increase, but a steady increase will depend on an increase in overall trend strength.

ETH Price Prediction: Potential Upside of 16%

If a strong uptrend forms, ETH price could test resistance at $3,523, marking an important milestone in the recovery effort.

A break above this level could pave the way for continued gains, with targets at $3,827 and potentially $3,987, a level ETH has not tested since December 17.

On the other hand, if the current momentum fails to form a strong uptrend, Ethereum price could return to support at $3,300, a level that was tested on December 27 and December 30.

Failure to hold this support could lead to further declines, with the next targets at $3,218 and $3,096.