Ethereum continues to face challenges as it struggles to regain the $3,500 threshold, a key milestone to reach $4,000.

Worsening market conditions add to the altcoin’s woes, reducing near-term recovery and leaving investors wondering about the direction of the price.

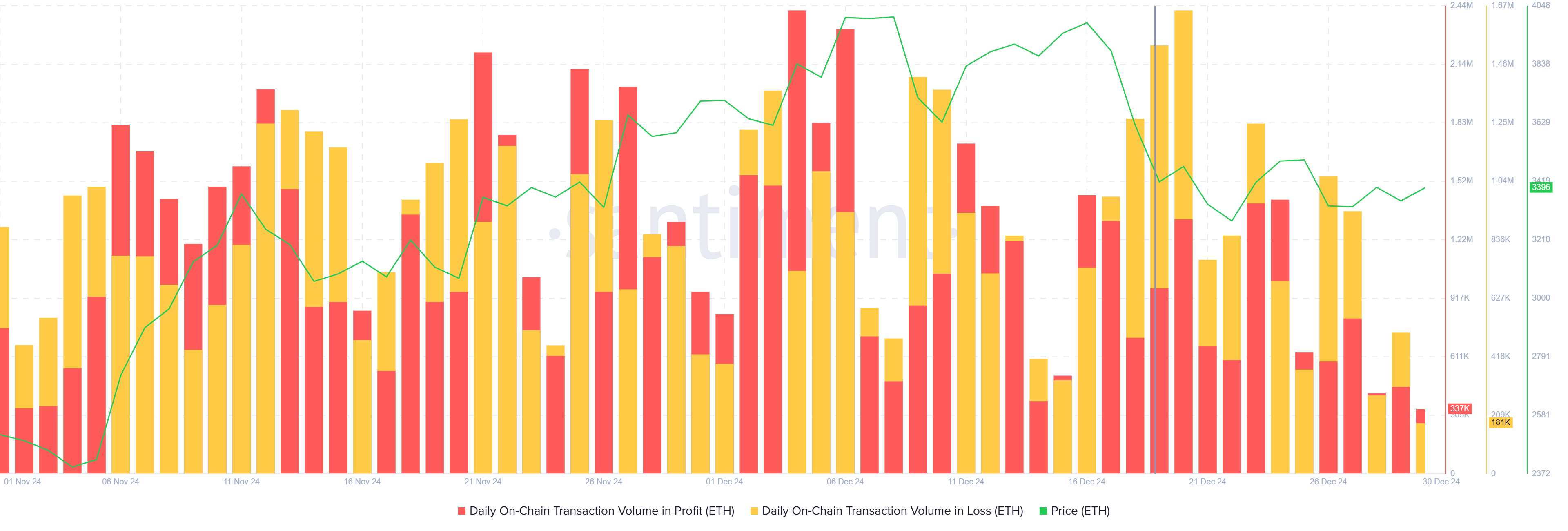

Ethereum Losses Soar

Recent transactions on the Ethereum network have been mostly losses instead of profits. Many investors are panic-selling their investments, especially short-term ones, with the intention of securing profits or reinvesting during downturns. However, these actions often lead to missed opportunities, making the decline worse.

This behavior shows a widespread lack of trust among investors. The tendency to exit positions too early is contributing to increased volatility, making it difficult for Ethereum to recover and stabilize above key support levels.

Ethereum’s Liveliness Index is at its highest level in the past two years, signaling significant activity from long-term (LTH) investors. This index increases when LTH sells off, which is usually a negative sign for price stability.

The continued rise in the Liveliness index, despite falling prices, shows that LTH is prioritizing profit taking over supporting the recovery. This action undermines market confidence and puts further pressure on Ethereum’s price, which could lead to further price declines.

ETH Price Prediction: Resistance Breaks

Ethereum is currently priced at $3,402, holding above the $3,327 support but failing to overcome the $3,524 resistance. This consolidation has been going on for nearly two weeks, reflecting market uncertainty and a lack of strong bullish signals.

Given the current situation, Ethereum will likely continue to consolidate or experience a decline. A pullback could push the altcoin to retest $3,000, prolonging losses for investors and slowing any significant recovery.

Additionally, turning $3,524 into support could neutralize the negative outlook. Achieving this milestone will pave the way Ethereum reaches 3,721 USD, helping this cryptocurrency recover losses and restore investors’ confidence.