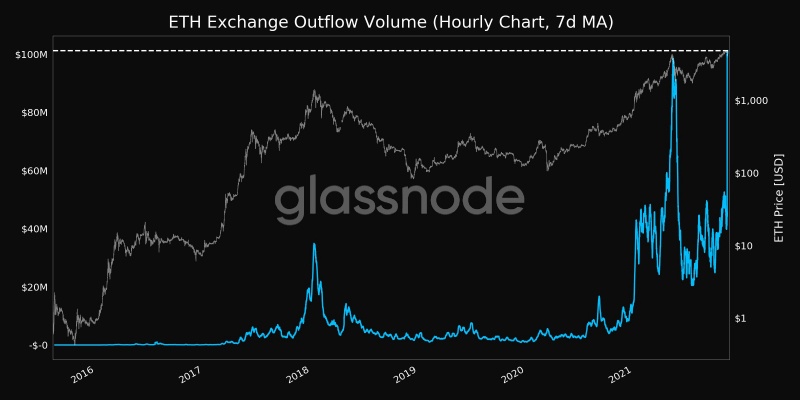

On-chain information displays that outflows from Ethereum (ETH) exchanges hit an all-time large on November 17, when ETH misplaced almost 15% of its worth throughout the week.

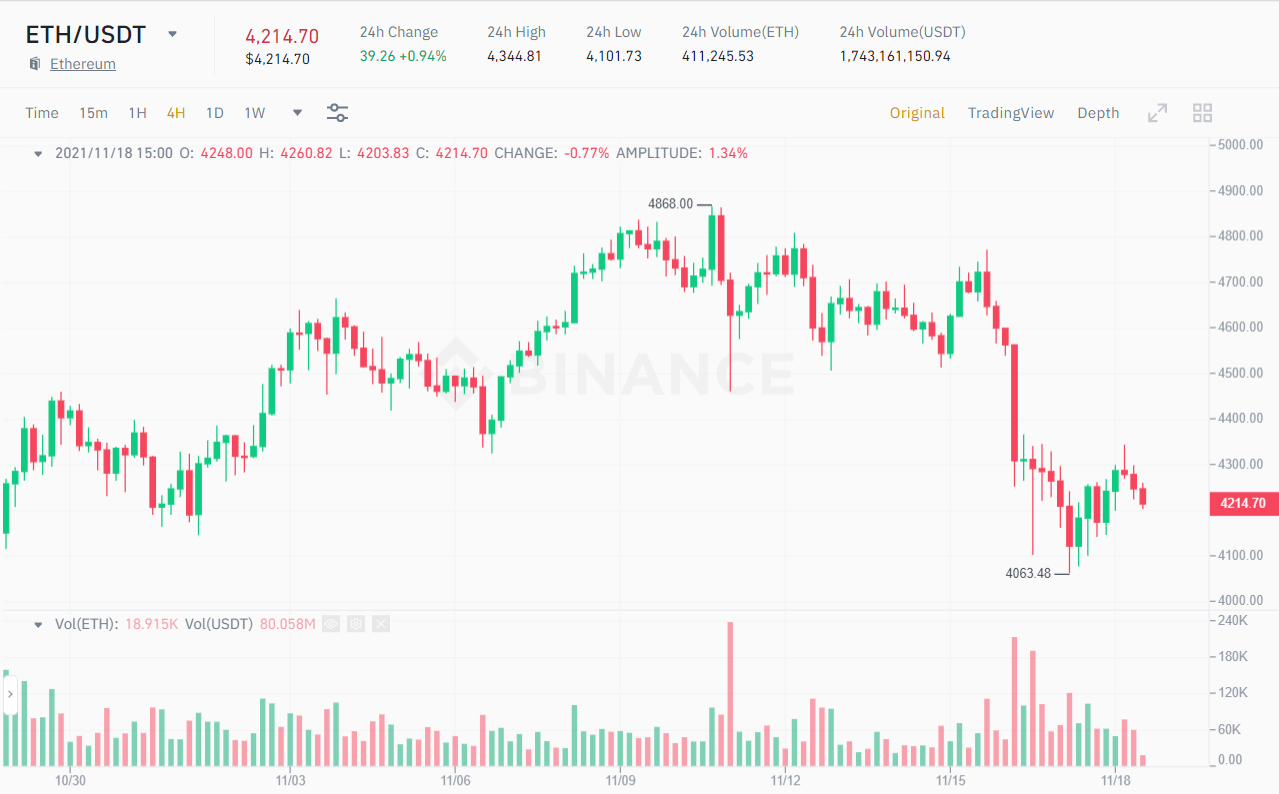

While this week’s industry correction may well place some stress on most traders, seasoned traders seem to have jumped at the possibility to get benefit of the downside. As of press time, ETH is trading at $ 4214.seven just after reaching a help close to $ four,000 in the previous 24 hrs.

– See a lot more: Citadel CEO thinks Ethereum (ETH) will overtake Bitcoin and will ultimately change BTC

According to information from crypto analytics platform Glassnode, the volume of Ethereum outflows from exchanges that have established new ATHs quantities to $ one hundred million in a single day. This signifies that traders are withdrawing their money from exchanges, actively getting rid of the offering stress on ETH.

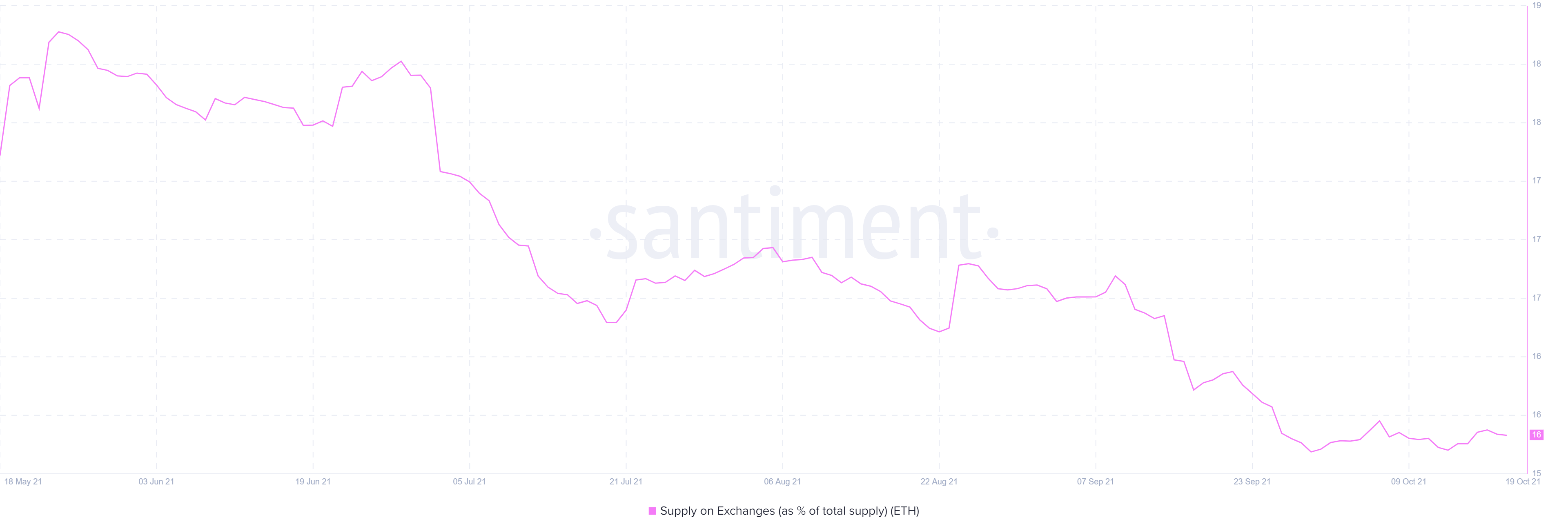

At the exact same time, the percentage of the provide of ETH in reserve on the stock exchange is in sharp decline, about sixteen% of the complete provide circulating on the industry. The signal displays that most Ethereum holders nevertheless feel in the platform’s extended-phrase vision and have purchased in bulk.

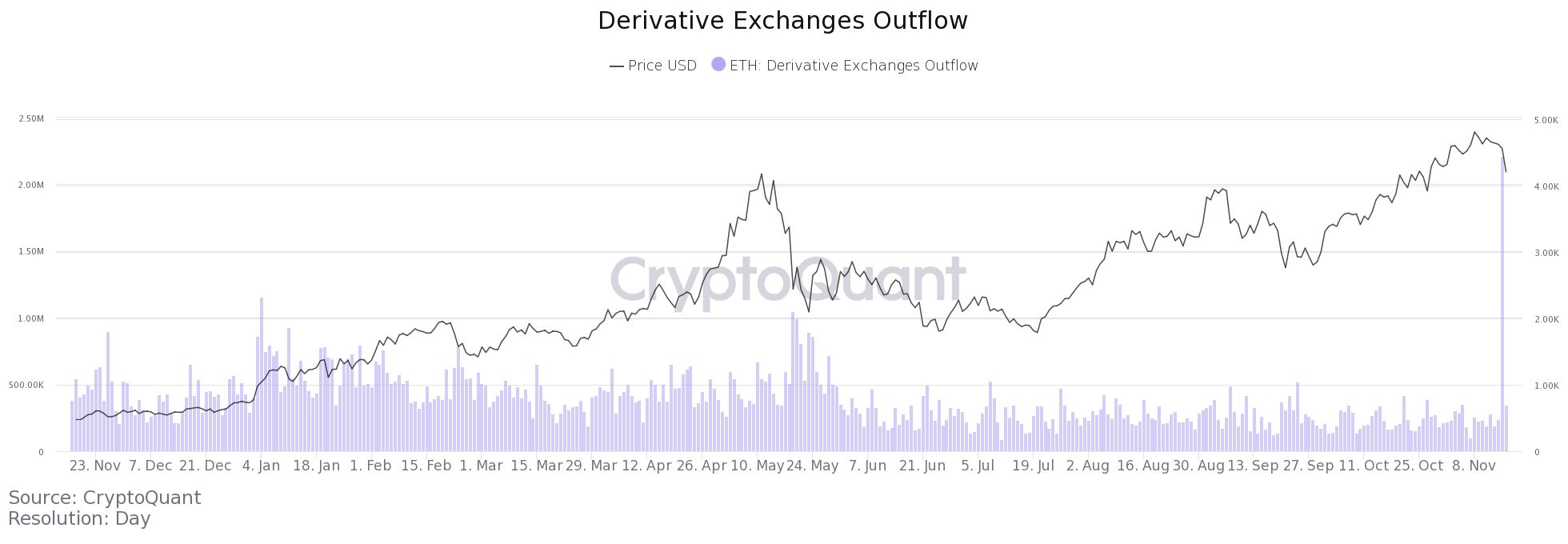

Further evaluation of the foreign exchange information displays that the foreign exchange flows of derivatives have also greater substantially. CryptoQuant information reveals that the sum of ETH withdrawn from derivatives exchanges greater almost ten-fold concerning November 14-15.

Since most of the improve in trading income flows has been correlated with a rise in charges in the spot industry, it is safe and sound to say that most of Ethereum’s retail and whale traders have taken benefit of this week’s drop to improve. their degree of accumulation.

Combined with the truth that Ethereum is burning up a lot more than it was produced, ETH is progressively getting to be scarcer than ever. Many of the world’s foremost monetary institutions are also incredibly supportive of the platform’s extended-phrase possible by beneficial forecasts and the move to improve mass adoption, the long term is particularly open for Ether in the long term.

Synthetic Currency 68

Maybe you are interested: