Ethereum saw a sharp decline of 15% over the past week, resulting in significant losses for investors.

The decline has increased selling pressure as Holder seems more inclined to take profits than hold out amid the volatility. This trend could worsen Ethereum’s downtrend if it continues.

Ethereum losses increase

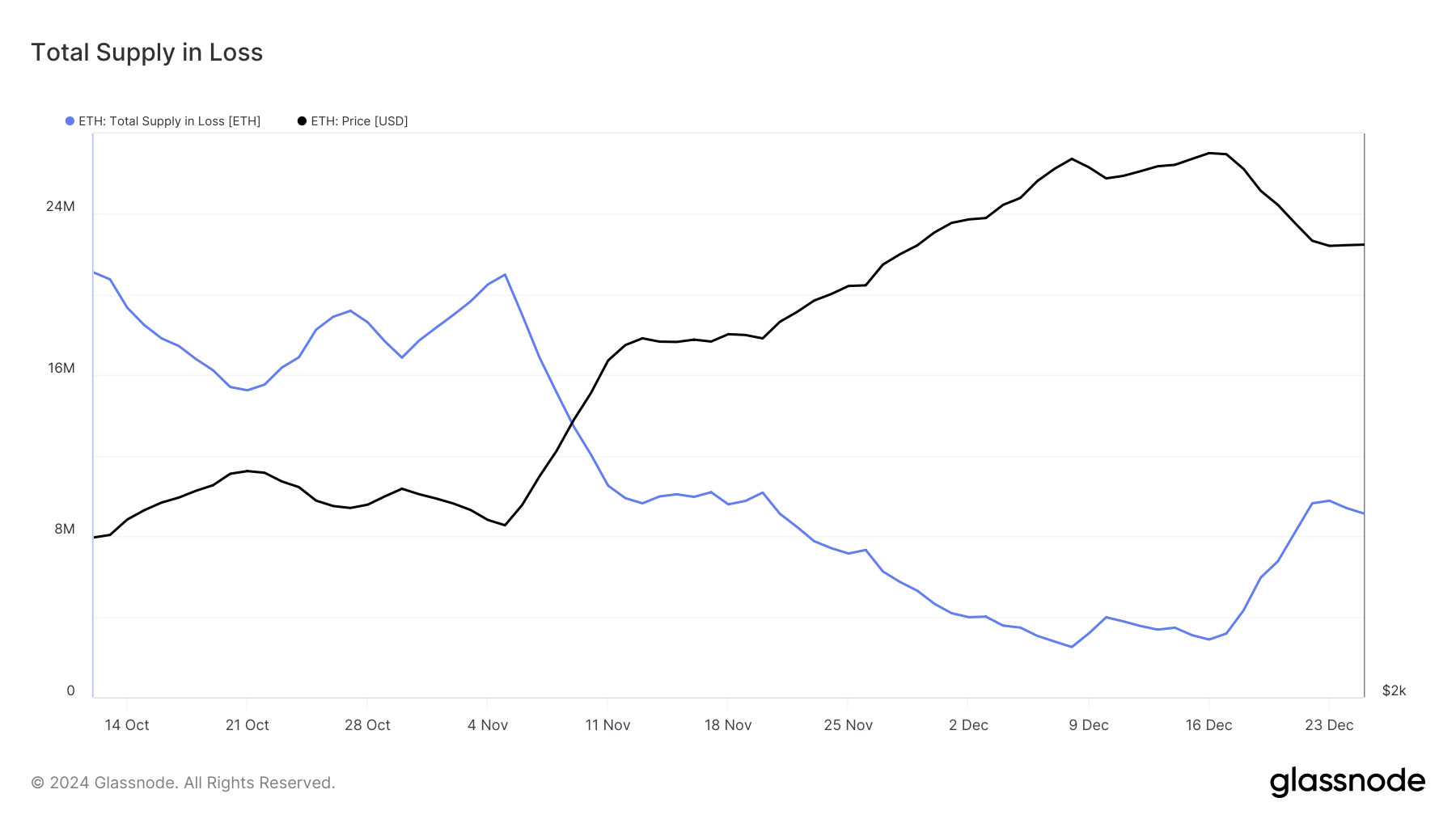

The recent price drop has caused the amount of ETH losses to skyrocket by 7 million ETH in just one week, from 2.7 million ETH to 9.7 million ETH. This supply is now worth more than $23 billion, underscoring the scale of the losses. The huge surge in unrealized losses marked the biggest increase in more than five months, raising concerns about a surge in selling activity.

As losses accumulate, investor behavior shows a shift toward liquidating assets rather than waiting for a recovery. The growing selling trend could push prices lower, putting Ethereum at risk of entering a prolonged bearish phase if market conditions do not improve.

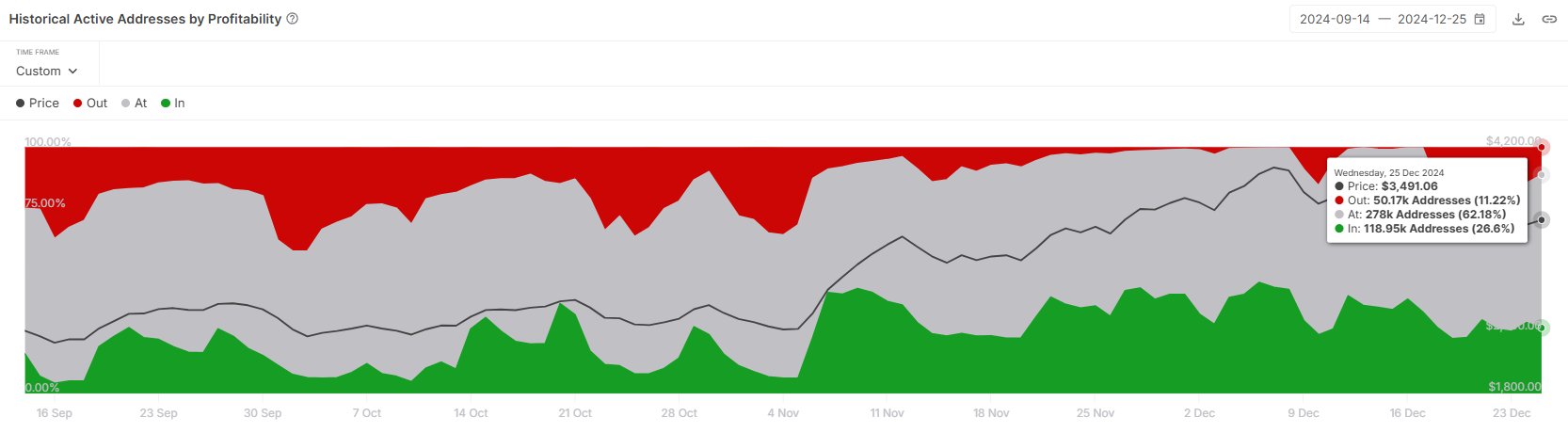

Ethereum’s overall momentum shows signs of potential weakness. Addresses operating in the profit zone currently account for more than 28% of participants on the network. In historical context, when margins surpass 25%, the potential for profit taking increases significantly, often leading to further price declines.

This level of profit suggests that many investors may sell to take profits, increasing existing selling pressure. If this trend continues, Ethereum may have difficulty maintaining its current price level, leading to a deeper price drop.

ETH Price Prediction: Growth is far away

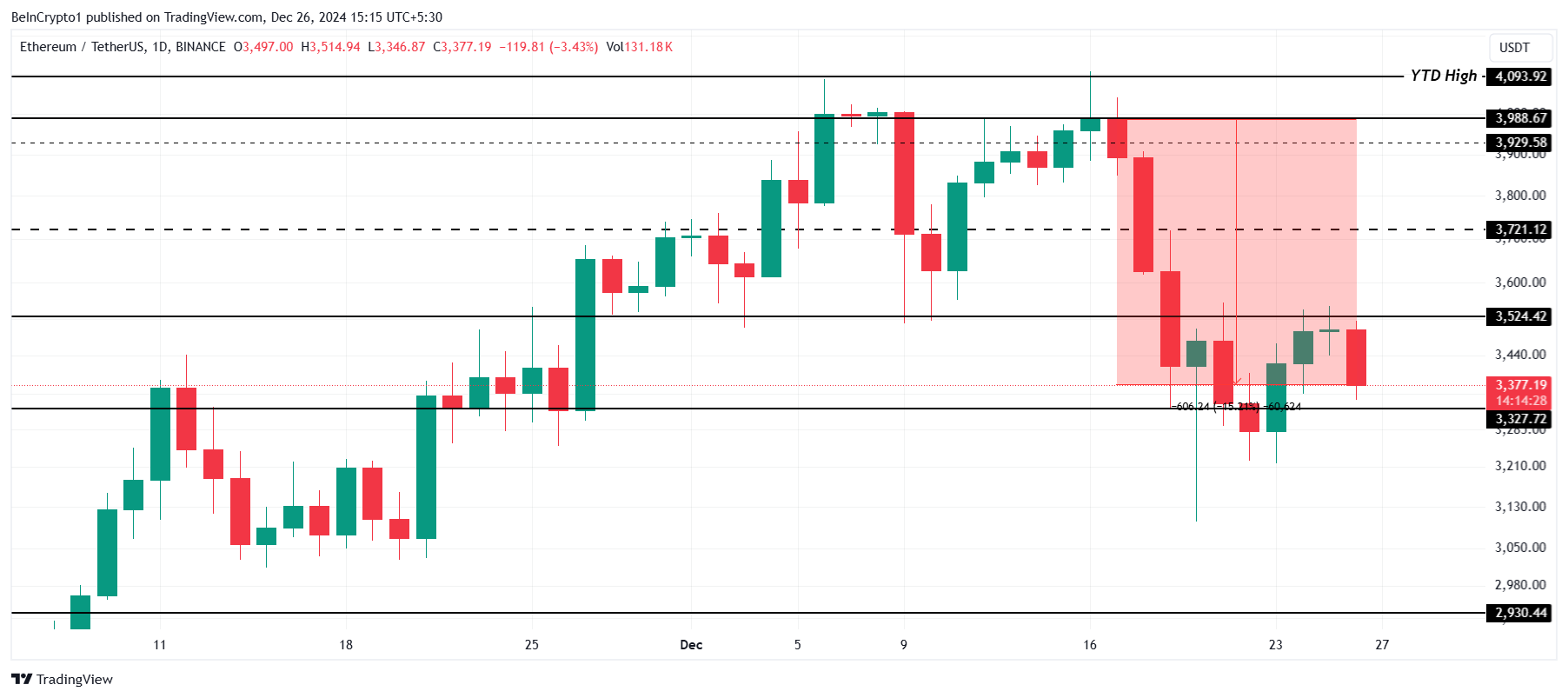

Ethereum price fell to $3,377 after a 15% weekly decline. This is the second time in a month that ETH has failed to establish $4,000 as support, reinforcing the bearish sentiment. The inability to maintain this key threshold leaves Ethereum vulnerable to further corrections.

If the current downtrend continues and selling pressure increases, ETH is at risk of losing support at $3,327. Breaking this mark could push the price below $3,000, signaling a significant bearish period for the altcoin king.

On the contrary, Ethereum is facing a barrier at the $3,524 mark. If this resistance can be turned into support, it could trigger a recovery, pushing the price to around $3,721. The move should dispel fears of further losses, providing a much-needed boost to investor confidence and market sentiment.