Ethereum (ETH) skyrocketed to its highest price in nearly three years on Thursday, December 6, reaching $4,089.

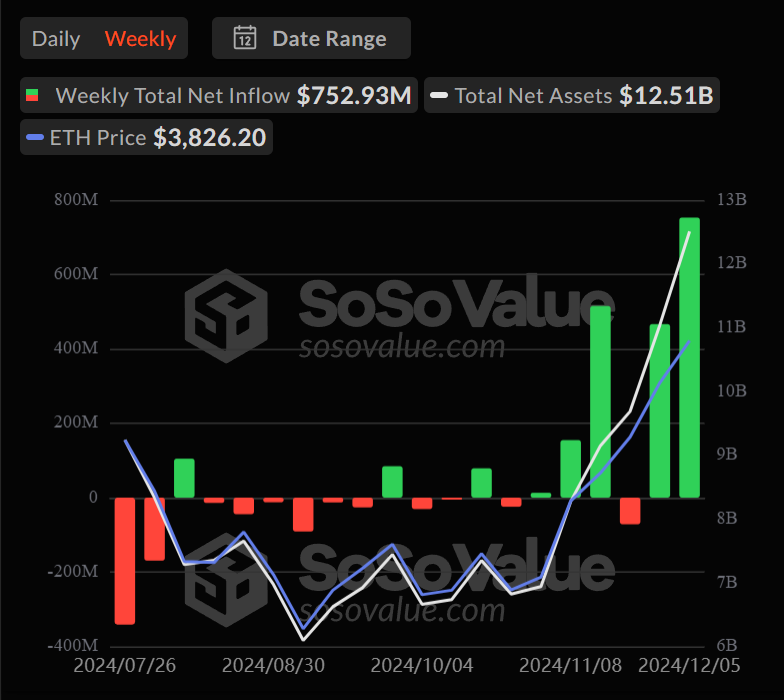

This increase comes after significant institutional interest, with Ethereum ETFs in the US seeing the largest single-day increase in net inflows, reaching $428.4 million on December 5.

Recovery in Institutional Investment in Ethereum ETFs

Leading this flow is BlackRock’s ETHA fund, followed by Fidelity’s FETH. These contributions also pushed Ethereum ETFs to record their largest weekly net inflows since their launch in July.

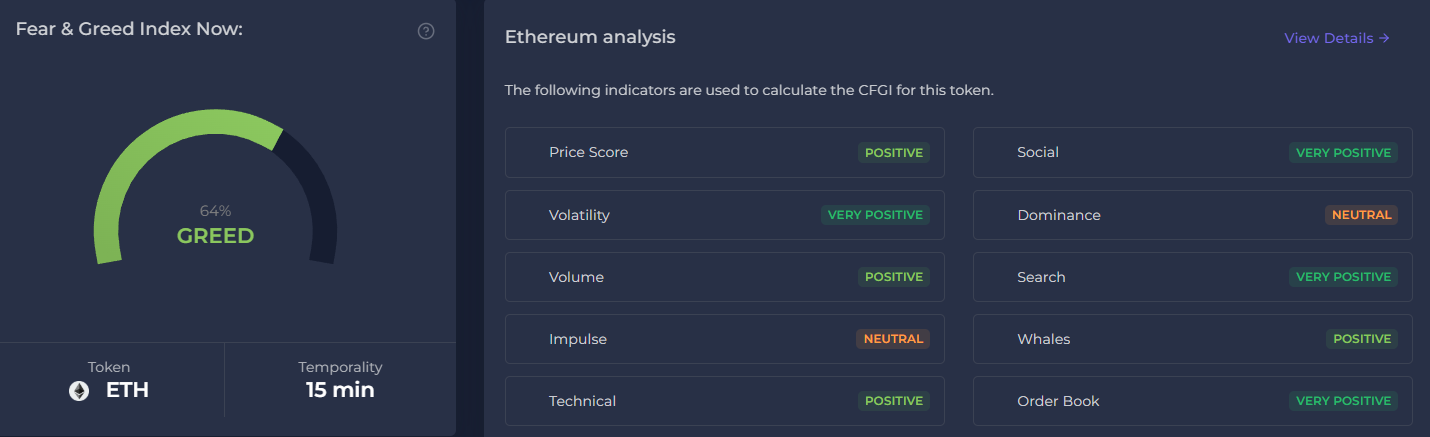

Total weekly inflows reached $752.9 million in the first week of December. This was a record weekly increase for these funds, even without taking into account the final figure for Friday. This wave of institutional investment has fueled Ethereum’s price growth and caused the fear and greed index to shift to “greed,” currently at 65.

Ethereum ETFs have had a slow start in the US compared to Bitcoin ETFs. In the first month of launch, there was only one week of positive cash flow. Currently, total assets across nine ETFs stand at $12.5 billion. This represents about 2.7% of Ethereum’s total supply.

However, November marked a turning point with monthly inflows exceeding $1 billion, showing growing institutional interest despite previous outflows.

A notable development came from the Michigan State Retirement System (SMRS), which became the first state pension fund in the US to invest in an Ethereum ETF. SMRS currently holds 460K shares of Grayscale’s Ethereum and 110K shares of ARK’s Bitcoin ETF as part of a diversified crypto portfolio.

Meanwhile, other altcoins are also joining the ETF race. Firms such as VanEck, 21Shares and Grayscale have applied for approval for the Solana ETF. Likewise, WisdomTree and Bitwise are two of four companies seeking approval for XRP ETFs.

As US regulations appear to be adopting a more crypto-friendly attitude, the ETF market for digital assets is likely to expand.