[ad_1]

Ethereum (ETH) price has increased more than 4% in the past 24 hours, but is still down 17% in the last 30 days. Over the past few days, ETH has managed to hold above the $3,000 level, a key psychological and technical resistance zone that could influence its next move.

Indicators such as the Relative Strength Index (RSI) and Directional Movement Index (DMI) show that although ETH has shown signs of bullishness recently, that strength appears to be waning. ETH’s ability to resume its uptrend or face further correction depends on its ability to hold key support levels and overcome nearby resistance zones.

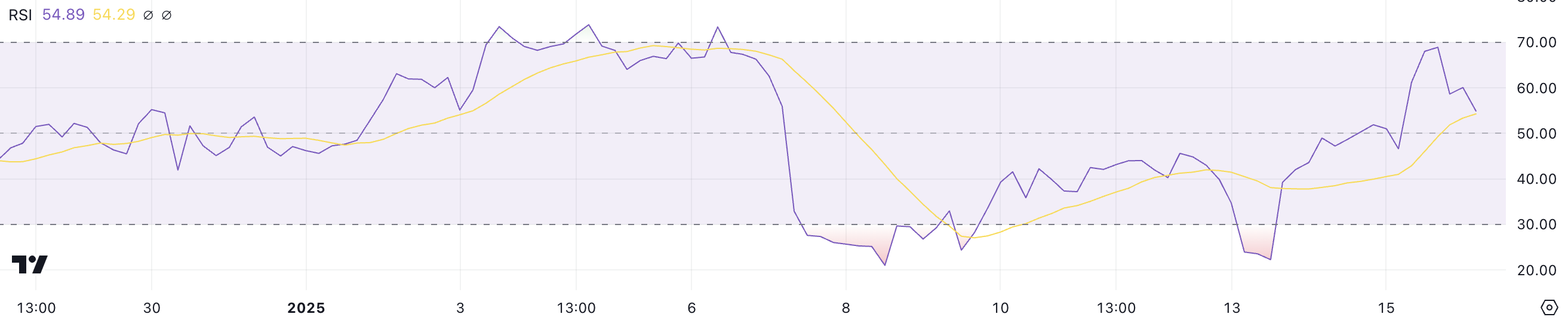

ETH RSI turns down from overbought levels

ETH’s RSI is currently at 54.8, having fallen as low as 22.2 three days ago and peaking at 68.9 just one day ago. This fluctuation shows a rapid change in momentum, as ETH moved from oversold to near overbought levels before stabilizing closer to average.

The RSI’s decline from 68.9 to 54.8 suggests a cooling in the bullish momentum, as selling has prevailed after the recent strong rally.

RSI, a momentum oscillator, measures the speed and intensity of price movements on a scale of 0 to 100. Typically, RSI below 30 signals oversold conditions and a possible bullish reversal, while RSI above 70 indicates an overbought condition, which often precedes a price correction.

With ETH’s RSI currently at 54.8, it is in neutral territory, hinting at a balance between buying and selling pressure. However, a decline from 68.9 could suggest that the recent bullish momentum is losing strength, which could lead to a period of accumulation or mild correction unless new factors trigger growth momentum again. again.

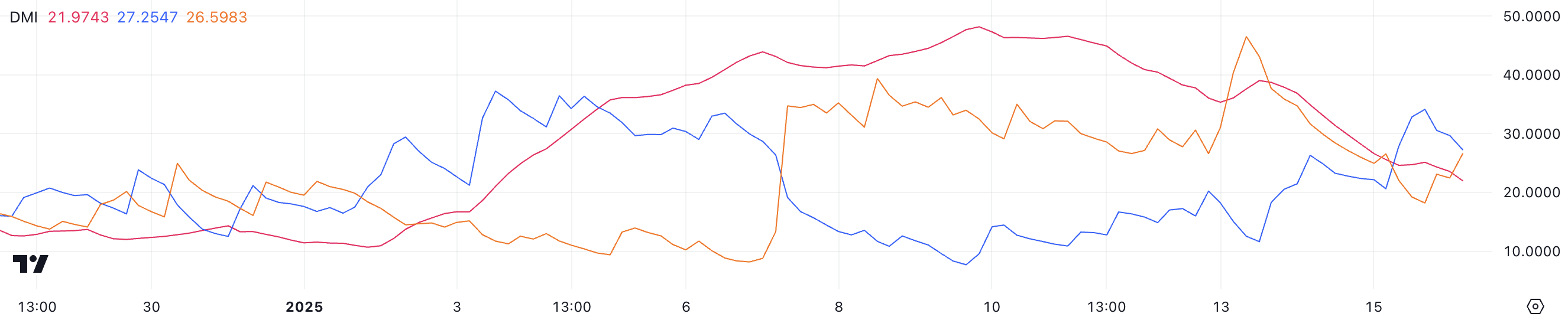

Ethereum’s uptrend may be fading away

Ethereum’s DMI chart shows a current ADX of 21.9, down from 39 three days ago, showing a significant decline in trend strength.

The +DI index fell to 27.2 from 34.1 a day ago, suggesting that bullish momentum is weakening, while the -DI rose to 26.5 from 18.2, signaling selling pressure. increase. This combination reflects a market where buyers are losing their dominance and sellers are becoming more active.

ADX measures trend strength, with values above 25 indicating a strong trend and below 20 signaling a weak or undecided market. Currently, ADX is near 21.9, showing that the strength in ETH’s bid to establish an uptrend is waning.

With +DI only slightly higher than -DI, the balance of power is shifting, suggesting that unless growth momentum recovers, ETH may find it difficult to maintain its uptrend and could enter a phase accumulate or face a correction.

ETH Price Prediction: Can $4,000 be restored in January?

Currently, Ethereum price is attempting to establish a strong uptrend, with short-term moving averages attempting to cross above long-term ones, a classic bullish signal.

However, indicators such as ADX and RSI suggest that bullish momentum may be waning.

If the trend reverses, ETH could test the first level of support at $3,158. If it breaks below this level, ETH price could fall further to $3,014. If this level also fails to hold, ETH could fall to as low as $2,723, representing an 18.4% correction. Conversely, if the uptrend regains strength, ETH could test resistance at $3,545.

A breach of this level could pave the way for a move to $3,745, and if momentum remains strong, Ethereum price could target $4,106. This would be a major milestone, pushing ETH above $4,000 for the first time since mid-December 2024.

[ad_2]