Ethereum price movements have recently attracted attention, as the “altcoin king” has had difficulty overcoming the resistance level of $3,721.

This level continues to be a significant obstacle as Ethereum attempts to recover and approaches its high of $4,107 in December 2024. Although some investors remain optimistic, recent corrections have confirm the caution of others.

Ethereum Investors Are Sending Mixed Signals

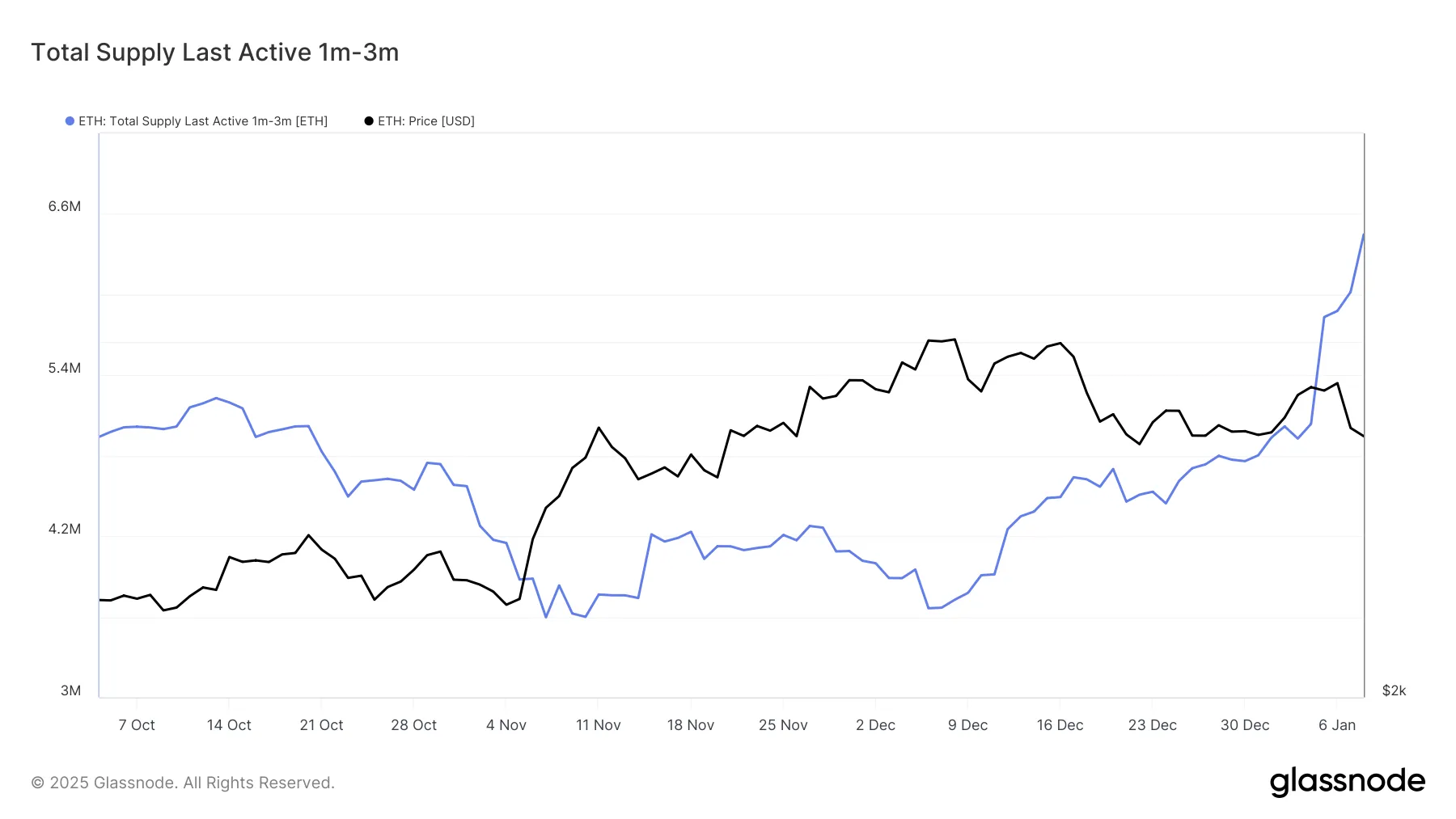

Ethereum supply that has been active for one to three months has recently increased sharply, showing growing endurance among investors. Over the past week, this group’s holdings increased by 1.52 million ETH. This trend shows that despite Ethereum’s recent sharp decline, investors have not turned their positions around, demonstrating optimism about recovery.

However, public sentiment remains divided. While some investors show patience, others still show uncertainty. This mixed behavior highlights Ethereum’s current struggles, with the market trying to find a balance between hope and caution.

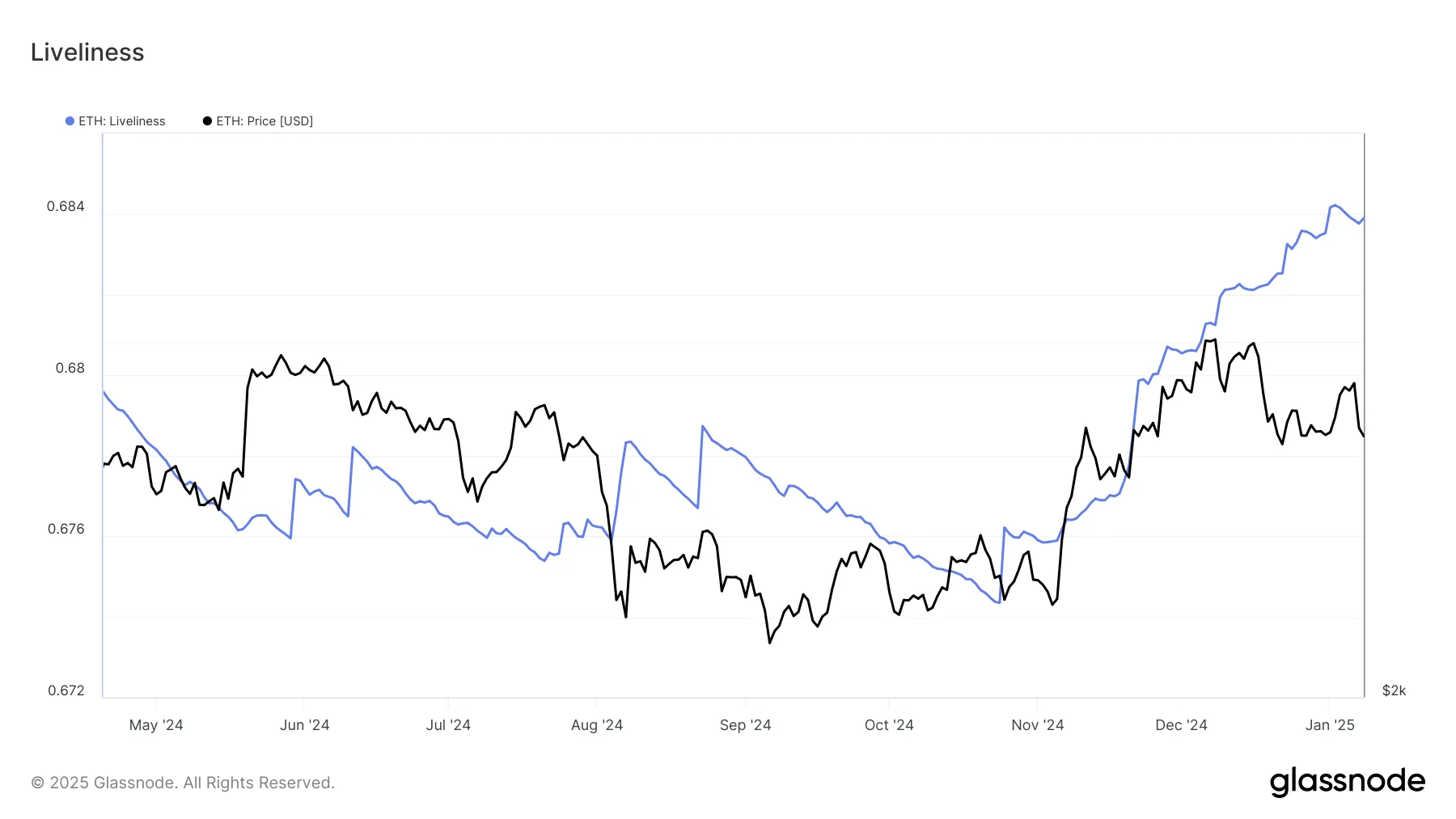

The Liveliness indicator shows active liquidations among investors holding Ethereum. This gauge makes clear that some investors are still selling, possibly due to concerns about a prolonged consolidation or further declines. This selling pressure signals that confidence in the broader market has not yet fully recovered, even as some ETH holders take an optimistic view.

Even so, Ethereum’s ability to hold above key support levels reflects underlying strength. If liquidations subside, the altcoin could regain momentum, moving towards the next key resistance level.

ETH Price Prediction: Overcoming Obstacles

Ethereum price is currently at $3,336, down 9% this week after failing to overcome resistance at $3,721. This decline pushed ETH to test the $3,327 support level, which remains important to avoid further losses. Investors’ conflicting views have created a tug-of-war between hopes of recovery and selling pressure.

Following these moves, Ethereum appears to be preparing for a consolidation between $3,524 and $3,327. This range has played an important role in the past, providing stability during periods of market uncertainty. The prolonged consolidation could help ETH build the momentum needed for a breakout.

If Ethereum takes advantage of the bullish sentiment from investors, it could reclaim $3,721 as support. This would invalidate the neutral-bearish thesis and put ETH on the path to recent highs of $4,107. A successful price rally could rekindle market confidence, attracting more interest in the “altcoin king.”