[ad_1]

Ethereum transaction charges are at all times the most popular subject of debate within the crypto group. Compared to the height in May 2021, the present ETH gasoline price has dropped lots. So what causes this phenomenon? Let’s discover out with Coinlive on this article!

Ethereum transaction charges have already plummeted

Ethereum’s historical past of “expensive” transaction charges is an issue that any consumer available in the market has skilled at the least as soon as.

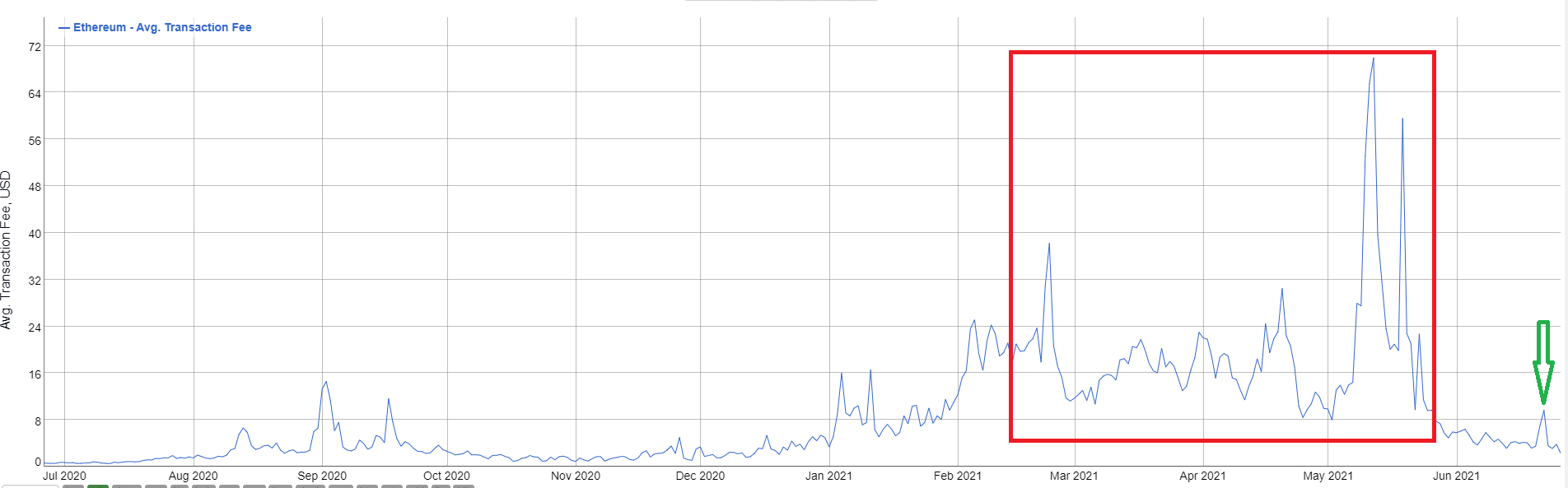

According to information from BitInfoCharts On February 16, 2021, the gasoline price of the Ethereum network reached the typical threshold 14 USD per transaction: the best degree within the final 12 months.

At that point, customers of the Ethereum network confronted extraordinarily excessive charges because of the explosion of decentralized finance. Ethereum-based DeFi initiatives reminiscent of lending and yield farming require fixed transactions, which in flip result in network congestion and improve gasoline tariffs.

Such excessive charges continued till mid-May 2021, peaking at 70 USD/ transactions – an “unbelievable” quantity in comparison with rival blockchains reminiscent of Binance Smart Chain (BSC), Solana, and many others.

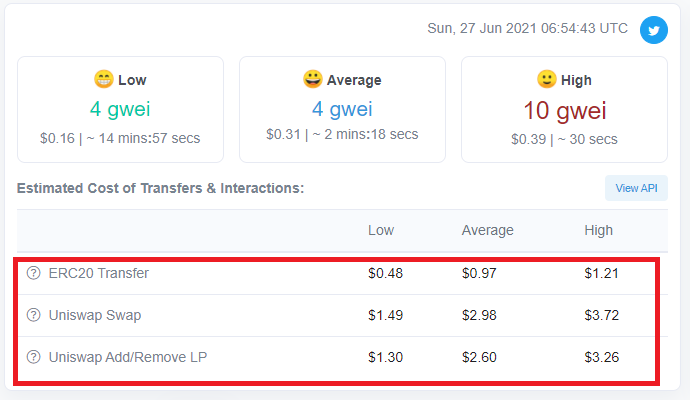

However, a miracle occurred when ETH gasoline tariffs have plummeted thus far in the direction of the tip of June 2021. Users at the moment solely spend extra on common 1 USD for a transaction on Ethereum. Exchanging or including liquidity on Uniswap, Ethereum’s main scorching and paid software, prices simply over 3 USD.

This is the best and most acceptable fee for the final 12 months.

So the query is:

Is it as a result of the lower within the variety of Ethereum transactions results in decrease charges?

Does the grim market trigger customers to now not need to trade?

Let’s check out Ethereum’s on-chain transaction depend information!

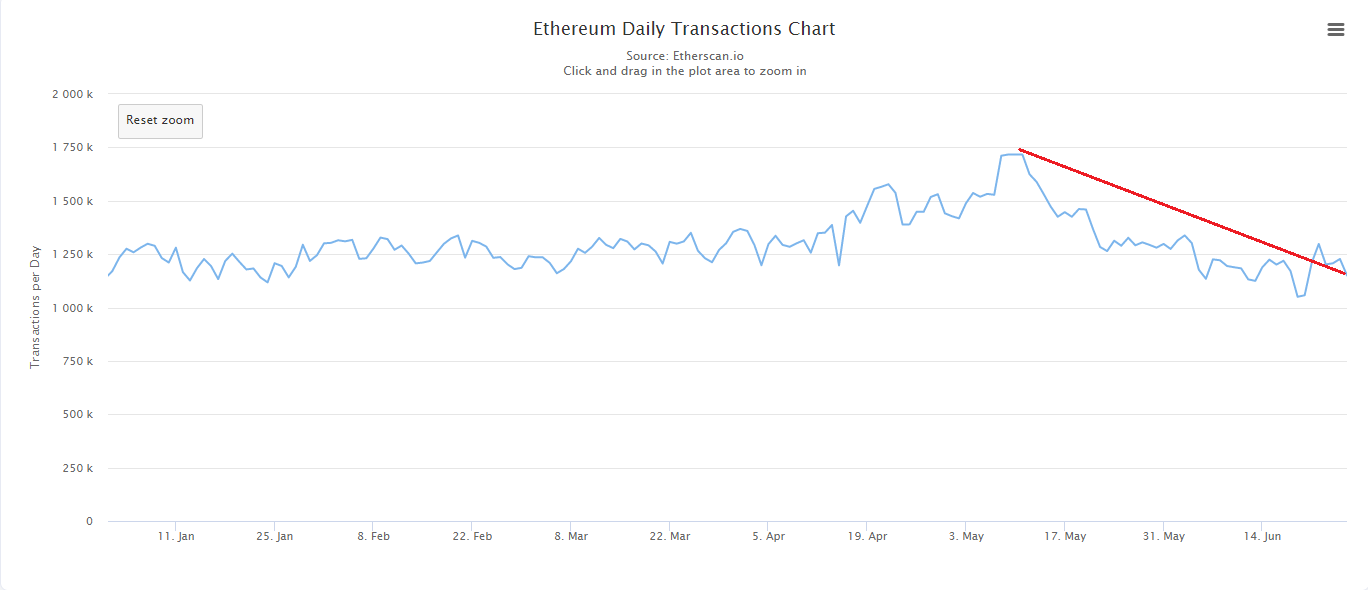

Will Ethereum’s transaction depend lower?

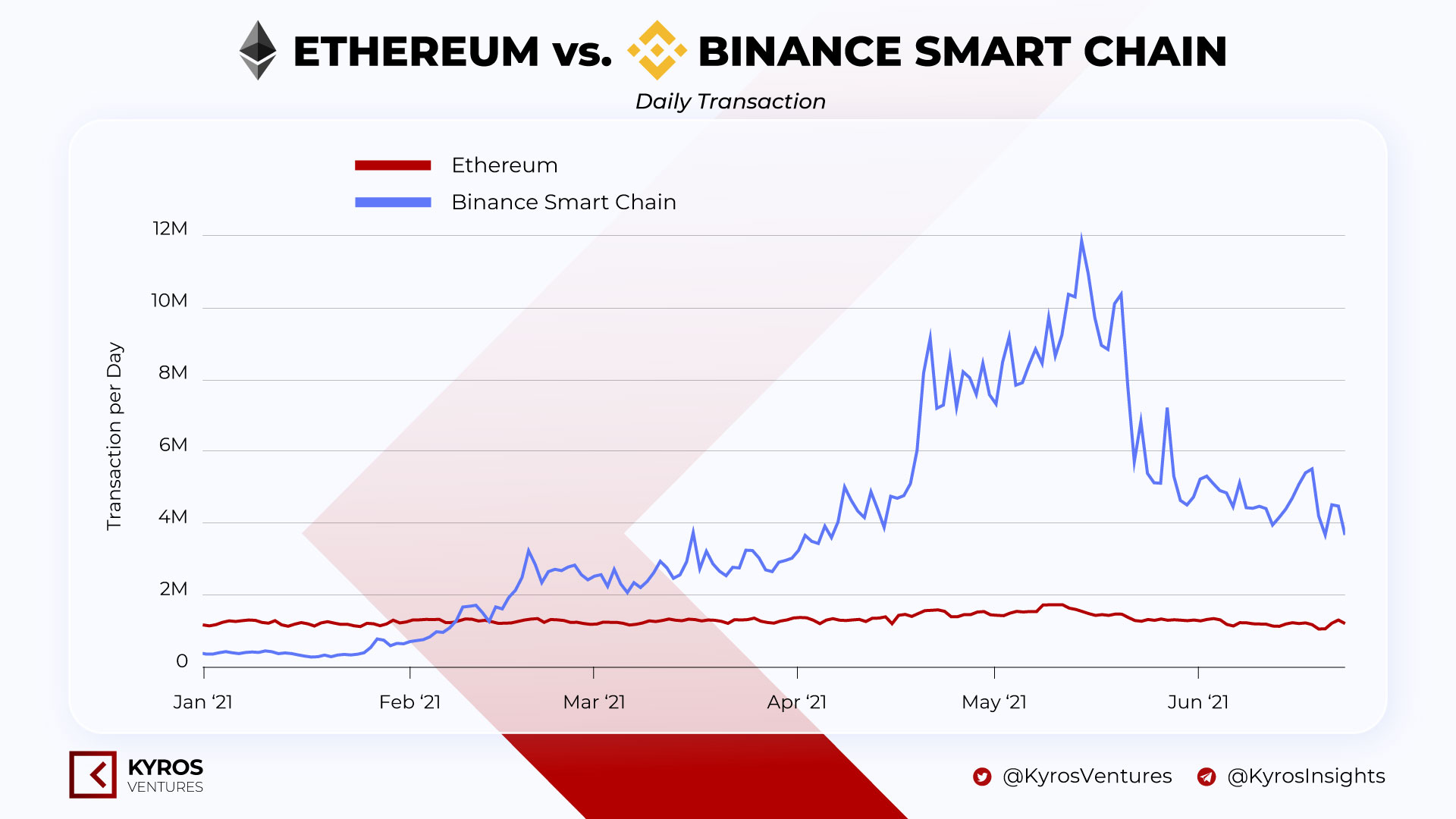

In the Vietnam Cryptocurrency Market Review report within the first half of 2021 with Kyros Ventures, the variety of each day Ethereum transactions has not elevated however it has not decreased an excessive amount of. Compared to the explosive development of BSC transactions, ETH trading seems to be extra “stable” over the previous 12 months.

Comparing the drop from the height to the present one, the drop within the variety of transactions, though there may be, just isn’t as massive because the drop in gasoline tariffs.

Therefore, it may be confirmed that the variety of transactions on Ethereum has not decreased an excessive amount of and was not the principle issue that led to the lower in gasoline tariffs.

So the rationale for the sharp drop in Ethereum gasoline charges is:

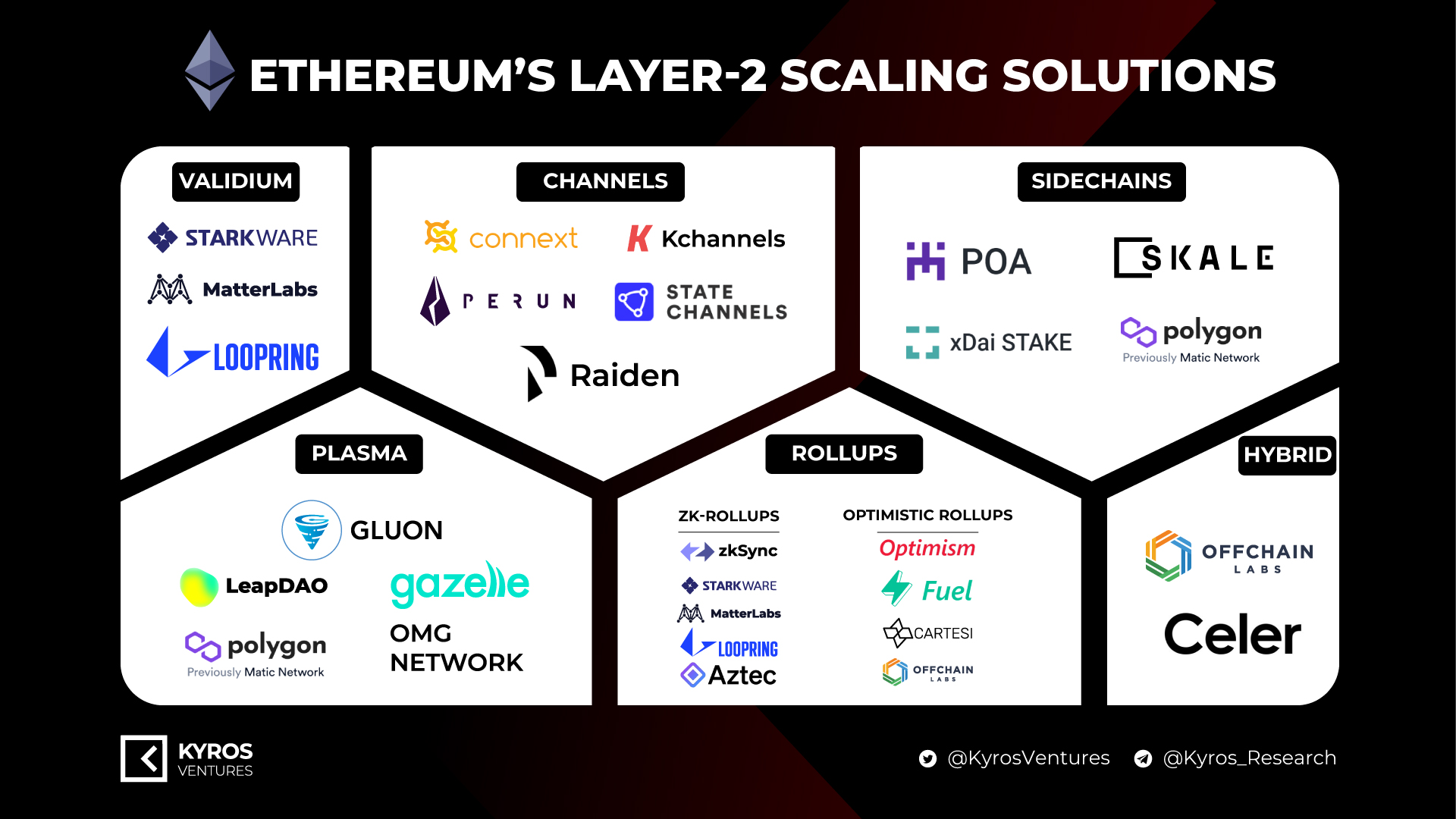

The explosion of 2nd degree scaling options (Level 2)

As defined within the article Kyros Kompass # 3: Level 2 picture overview, the present degree 2 scaling options on Ethereum are extraordinarily numerous and explosive.

You can see that with a purpose to assist and prolong Ethereum, Layer 2 options have been approached, constructed and step by step improved in their very own method. Looking at what Polygon (MATIC) or Arbitrum did, we completely don’t deny the effectiveness of Layer 2.

This helps to cut back the strain on the Ethereum network, making the blockchain simpler to breathe. Since then, the price of gasoline has dropped dramatically.

finish

From the above evaluation, it may be hoped that when the market recovers, though the variety of transactions will increase extra strongly, due to Layer 2 options, Ethereum gasoline charges will stay low, serving to customers to expertise DeFi transactions extra simply. .

Furthermore, one of many causes that promote the emergence of “Ethereum Killers” like BSC, Solana (SOL), Near Protocol (NEAR), Avalanche (AVAX), … is as a result of the ETH transaction charges are too costly.

Therefore, when ETH gasoline taxes are simpler to breathe, customers / initiatives who’ve left Ethereum for different blockchains will “rekindle old love”. At that point, the race between blockchain platforms will turn out to be increasingly thrilling and intense.

Jane

Maybe you have an interest:

[ad_2]