[ad_1]

Ethereum’s rally is underway as the coin is trading around the $2,500 price zone, with a market cap at $323.4 billion. According to data from Glassnode, ETH balances on exchanges have been steadily decreasing and recently hit a two-year low, below 8 million ETH.

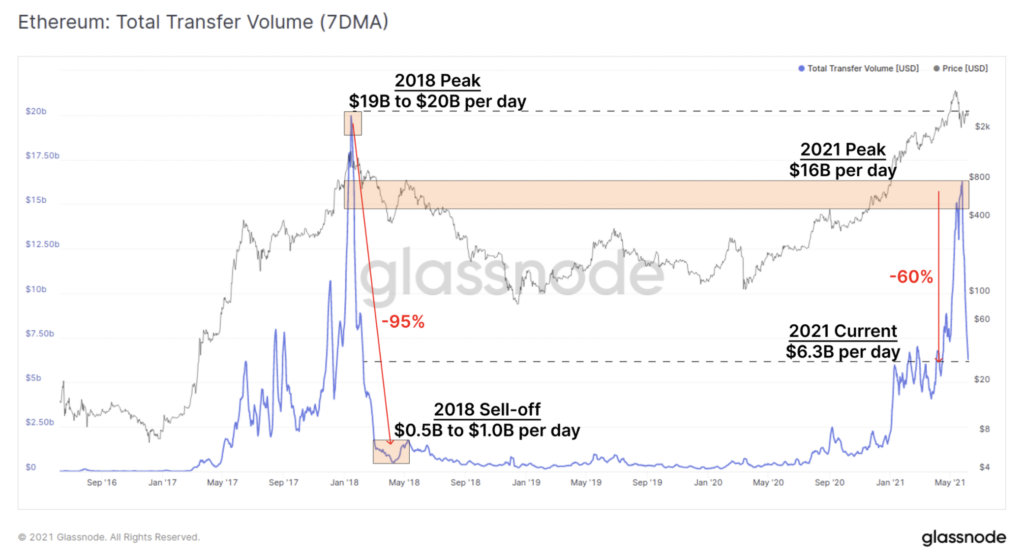

Demand for on-chain Ethereum transactions and Ethereum’s average transaction fees have plummeted in recent times. After some short-term spikes past $50, transaction fees hit a high in April and May 2021. This number is now back to early 2020 levels based on Glassnode data, even , there was a time when gwei hit single digits.

The amount of $ETH on just exchanges reached a 2-year low. 👇 pic.twitter.com/BZxrpovdT9

— Altcoin Daily (@AltcoinDailyio) June 6, 2021

The volume of some on-chain activity indicators has dropped rapidly; Despite this drop, ETH price remains resilient against selling pressure. In the event that selling pressure increases, Ethereum price could drop below $2,400, just like during the May 19 “pitfall”.

The EIP-1559 update is expected to reduce the supply and redistribute Ethereum mining output. Accordingly, EIP 3074 and subsequent compilations are expected, whereby transaction fees are expected to drop significantly. In addition, the launch of ETH 2.0 is predicted to bring sustainability in terms of energy.

Although Ethereum’s correlation with Bitcoin remains high, Ethereum has yet to establish a level of technical or psychological support. However, there is a high probability that this will happen as Bitcoin continues to sustain within the current price range. While altcoin traders are pouring money into Sushiswap, Shiba Inu coin and Sanshu Inu, high market cap altcoins like Ethereum are likely to experience a drop in demand over the next two weeks.

In addition, the slowdown in on-chain activity negatively affects Defi projects and the NFT market. The total number of transactions as well as the transaction value in USD has decreased significantly. Therefore, ETH balances on exchanges hitting a two-year low could represent a near-term uptrend.

Synthetic

Maybe you are interested:

[ad_2]