Ethereum price has faced multiple tests of breaking out of the accumulation zone it has been stuck in since early August, hovering around $2,700.

However, a recent bull run sparked by Bitcoin could continue if long-term Ethereum (LTHs) investors maintain their positions instead of selling. Patience on the part of LTHs will be important in supporting Ethereum’s potential upside.

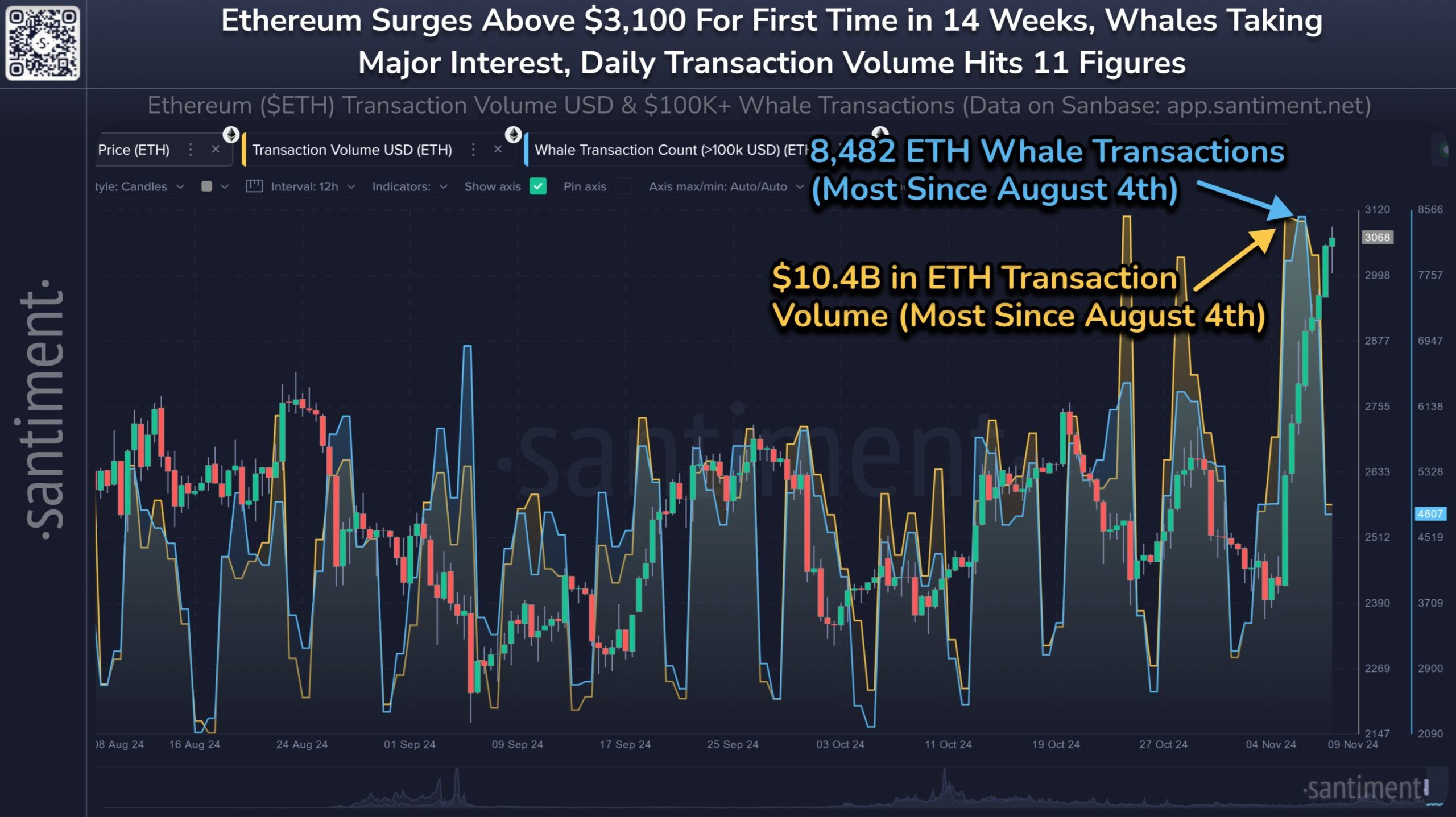

Ethereum Whales In Action

Ethereum whale activity has spiked to a 14-week high, signaling increased interest from large-scale investors. Over the past week, transactions exceeding $1 million increased to 8,482 — the highest number since August. Along with that, the trading volume of “whales” exceeded $10.4 billion, underscoring the important for those who own these large wallets. Their moves often have a significant impact on Ethereum prices, providing stability and driving momentum.

“It is anticipated that any growth from Bitcoin during this bull run, will see gains accruing to Ethereum and possibly pushing it to its own peak while its network activity looks very healthy, “ Santiment commented.

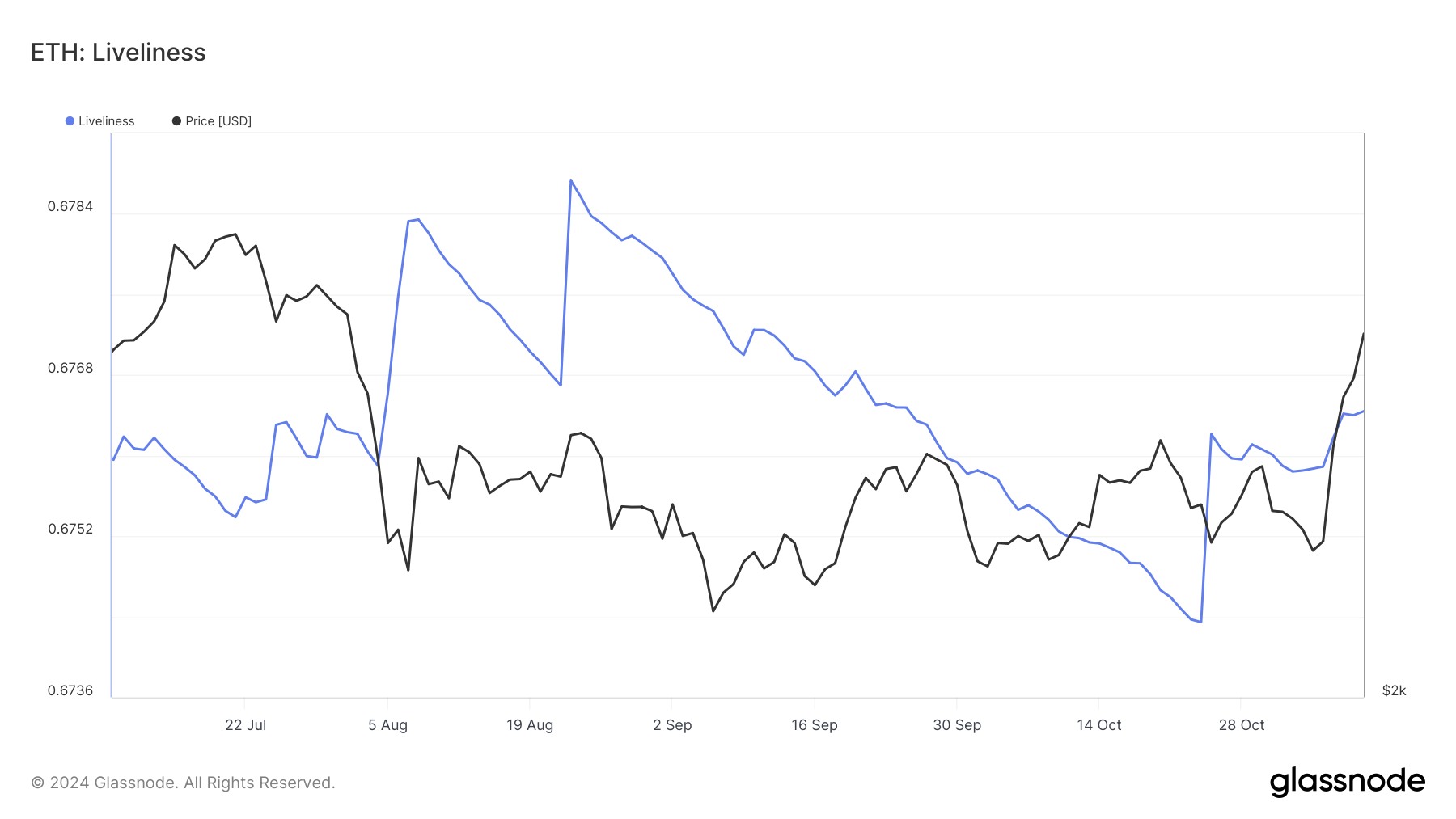

Ethereum’s macro dynamics are also influenced by the rise of the “Liveliness” index, which tracks the behavior of long-term holders. When Liveliness increases, it shows that LTHs are liquidating their positions, while a decrease indicates accumulation. The recent increase in Liveliness shows that some long-term investors are taking profits amid the rise in Ethereum’s price, which could slow the rally if many decide to sell.

However, if Ethereum’s LTHs choose to hold rather than liquidate, the altcoin rally could gain more support. The activity of LTHs remains a double-edged sword: their selling provides liquidity but also increases the risk of downward price pressure. Therefore, Liveliness remains an important factor to watch as it reflects whether LTHs will strengthen or hinder Ethereum’s growth.

ETH Price Forecast: Maintains High Levels

Ethereum price has increased 31.8% in the past five days, currently trading at $3,193. The next resistance level for Ethereum is $3,327, which it must overcome to maintain upward momentum. Breaking through this resistance will demonstrate renewed strength in the market and create momentum for Ethereum to move further.

If the bullish momentum continues, Ethereum could turn the $3,327 resistance into support, potentially pushing the altcoin to $3,524. This additional increase will depend on sustained buying interest from both individual investors and whales, enhancing Ethereum’s price stability.

However, if LTHs continue to liquidate, Ethereum may struggle to surpass $3,327, leading to a possible drop to $2,930. A decline below this support would negate the current bullish outlook, signaling caution among investors.

General Bitcoin News