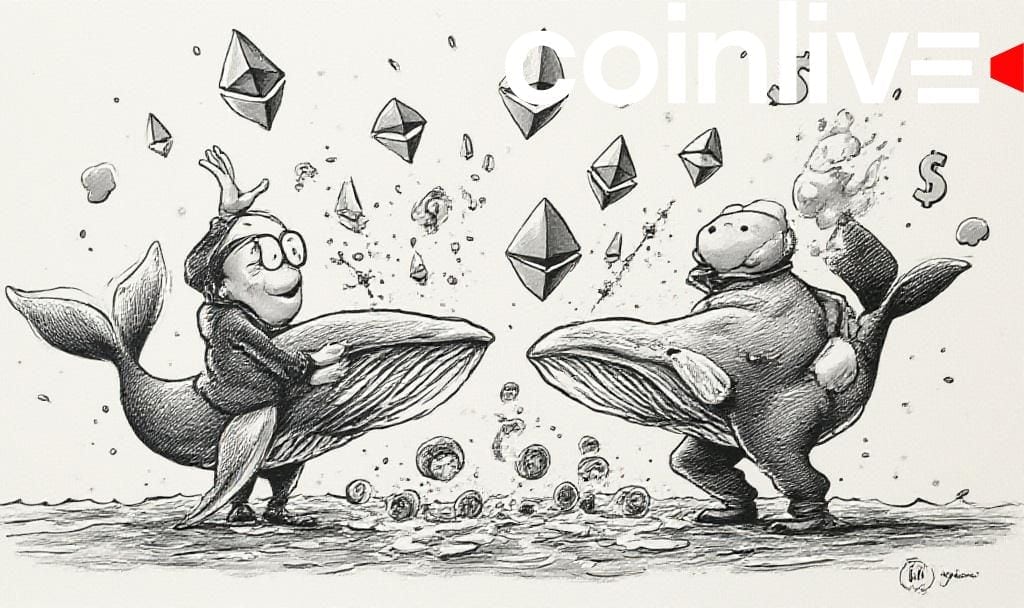

- Massive Ethereum long positions opened by whales and insiders.

- Increased confidence in Ethereum’s potential price movement.

- Potential bullish outcomes for Ethereum and related assets.

Whales and insiders have significantly increased their Ethereum long positions, signaling confidence in the crypto’s potential for a rally, as observed in recent transactions and on-chain data.

Market anticipation grows around Ethereum’s future, fueled by whales’ confidence and institutional inflows, potentially impacting related cryptocurrencies and decentralized finance protocols.

Whales and insiders have significantly increased their long positions in Ethereum. This activity points to a renewed confidence in the cryptocurrency’s price potential, with substantial transactions reaching the market as observed in recent on-chain data. Emelu.eth, an On-Chain Analyst, noted, “Whale 0x89Da opened a 25x leveraged long on 21,966 $ETH ($99.5M) 9 hours ago. This whale had previously completed 53 trades with an 81.13% win rate and a profit of $2M+.” Source

Key players, including the whale wallet 0x89Da, have undertaken notable leveraged long positions. Institutional entities such as BlackRock are suspected to have increased their Ethereum holdings during Q3 2025, as reported in wallet tracking.

The market impact of these activities is evident. Significant whale accumulation typically correlates with an increase in DeFi protocol liquidity and Total Value Locked (TVL). Institutional interest often provides a backbone for market stability. Santiment, an On-Chain Analytics provider, reports, “Addresses holding 100 to 10,000 ETH increased their holdings by 218,470 ETH in the past week,” suggesting whale confidence is returning to Ethereum after recent selling pressure. Source.

With $1.48 billion in Ethereum flowing into ETFs, according to official reports, there is a clear indication of institutional confidence in the cryptocurrency. This could spill over into related markets, affecting Layer 2 solutions and other crypto assets.

Recent market behavior suggests potential bullish momentum for Ethereum, akin to previous surges prompted by similar activities. Such changes often indicate a broader uplift in cryptocurrency markets and ecosystems.

The historical precedent indicates that large, coordinated trades and ETF inflows have historically led to significant rallies for Ethereum. If these trends persist, affected enterprises could include DeFi protocols and crypto exchange-traded funds (ETFs).