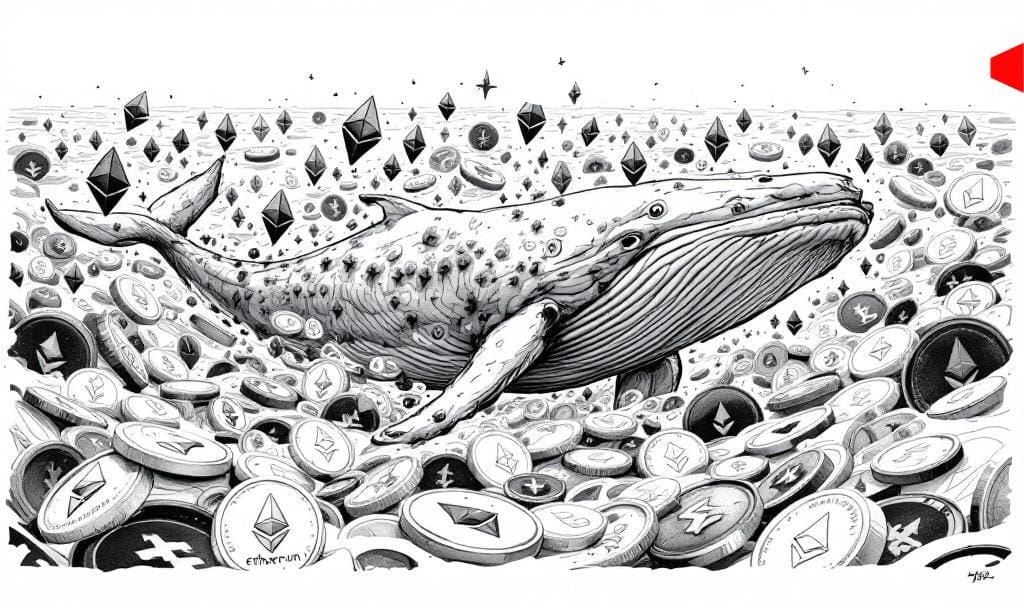

- Ethereum whales accumulate 1.64M ETH amid market downturn.

- Strong conviction buying despite price volatility.

- Potential precursor to price recovery phases.

Ethereum whales, including large institutional players, have made significant ETH acquisitions in October 2025, indicating strategic moves during price declines.

This activity underscores confidence in Ethereum, possibly anticipating future scalability upgrades and reflecting institutional interest amid macroeconomic uncertainties.

Market Dynamics

Ethereum’s largest holders are making significant moves, hitting record accumulation levels. In October 2025, whales amassed 1.64 million ETH, demonstrating powerful market influence amid a price drop. This activity suggests strategic positioning by key players.

Prominent investors and firms like BitMine and Galaxy Digital are heavily involved. A super-whale borrowed 66,000 ETH from Aave to purchase more ETH, indicating strong market conviction. This reflects a calculated approach during a period of reduced prices. Here, Adrian Hoffner, Crypto Analyst, said, “Whale behavior acts as a balancing force between liquidity absorption and market volatility, emphasizing strategic accumulation in the $3,000–$3,100 ETH price range.”

Market Metrics Impact

The rapid accumulation by whales is impacting Ethereum’s market metrics significantly. Liquidity absorption is observed as exchange reserves for ETH reach a 55-month low with whale buying contributing to this effect. Staking inflows remain robust, reflecting sustained institutional interest.

There were significant consequences in the DeFi sector with over $650 million in liquidations amid these whale trades. This includes $130 million linked to ETH long positions, indicating increased volatility and market adjustments affecting the DeFi landscape.

Anticipated Market Shifts

The consolidation of ETH by whales points to potential market shifts. History shows that similar actions have preceded price recovery phases. Strategic accumulation during price lows highlights the market’s ongoing confidence in Ethereum’s long-term potential.

Given historical precedents and current market dynamics, this increase in whale activity suggests anticipated price rebounds. Ethereum’s role in institutional finance is underscored as developments in scalability and network efficiencies continue. These actions could bolster Ethereum’s position in upcoming technological frameworks.