This is the argument of Michael Novogratz, a popular cryptocurrency investor and CEO of the digital financial institution Galaxy Digital.

Answer the interview CNBCMichael Novogratz believes the greatest cryptocurrency in the globe, Bitcoin, will no longer be an inflation hedge investment after the US Federal Reserve (Fed) commences to increase curiosity costs in 2022.

With a complete fixed provide of 21 million BTC, Bitcoin has prolonged been hailed as an efficient hedge towards inflation. This gets to be even extra correct, as the provide of USD in the worldwide money marketplace has doubled considering the fact that early 2020 to in excess of USD eight,000 trillion, following the US administration’s bailout policies prior to the COVID-19 pandemic.

Over the identical time period, the cost of BTC skyrocketed from a reduced of $ three,700 to an all-time higher of $ 69,000 in November 2021, when it was reported that the inflation fee in the United States had reached a higher of three many years in the past. Despite BTC’s correction in the initial half of December, the coin nevertheless rebounded when USD inflation continues to hit a 39-year high in November.

Due to this unsatisfactory information, the US Federal Reserve in its mid-December meeting confirmed that it will phase up the marketplace intervention course of action to progressively withdraw the influence of the financial stimulus packages, then proceed to constantly increase curiosity costs in 2022. , 2023 and 2024. Not only the United States, but also numerous other nations this kind of as Canada, United Kingdom, Germany, Turkey, and so forth. they have reached multi-yr peaks in the final month.

As early as December, Mr. Michael Novogratz stated that details about increasing US inflation is only effective to Bitcoin in the quick phrase, but that will all transform in the medium and prolonged phrase when US money authorities are positive to phase in. in the marketplace to restrict inflation. As a outcome, Bitcoin will more and more shed its appeal as a hedging asset. The coin itself has also misplaced practically all of its development momentum considering the fact that the starting of November and constantly dipped to the bottom of $ 42,000, as Coinlive commented.

In the opposite course, Galaxy Digital CEO thinks it truly is time for the emphasis to progressively shift to Ethereum with the technological possible it can carry. In addition to staying the greatest DeFi platform now with a block worth (TVL) of $ 160 billion, ten occasions increased than the ultimate blockchain followed by Binance Smart Chain, Ethereum has usually been a stepping stone for numerous new strategies and innovations from the cryptocurrency business this kind of as perform-to-earn trending video games, NFT, DAO, and metaverse.

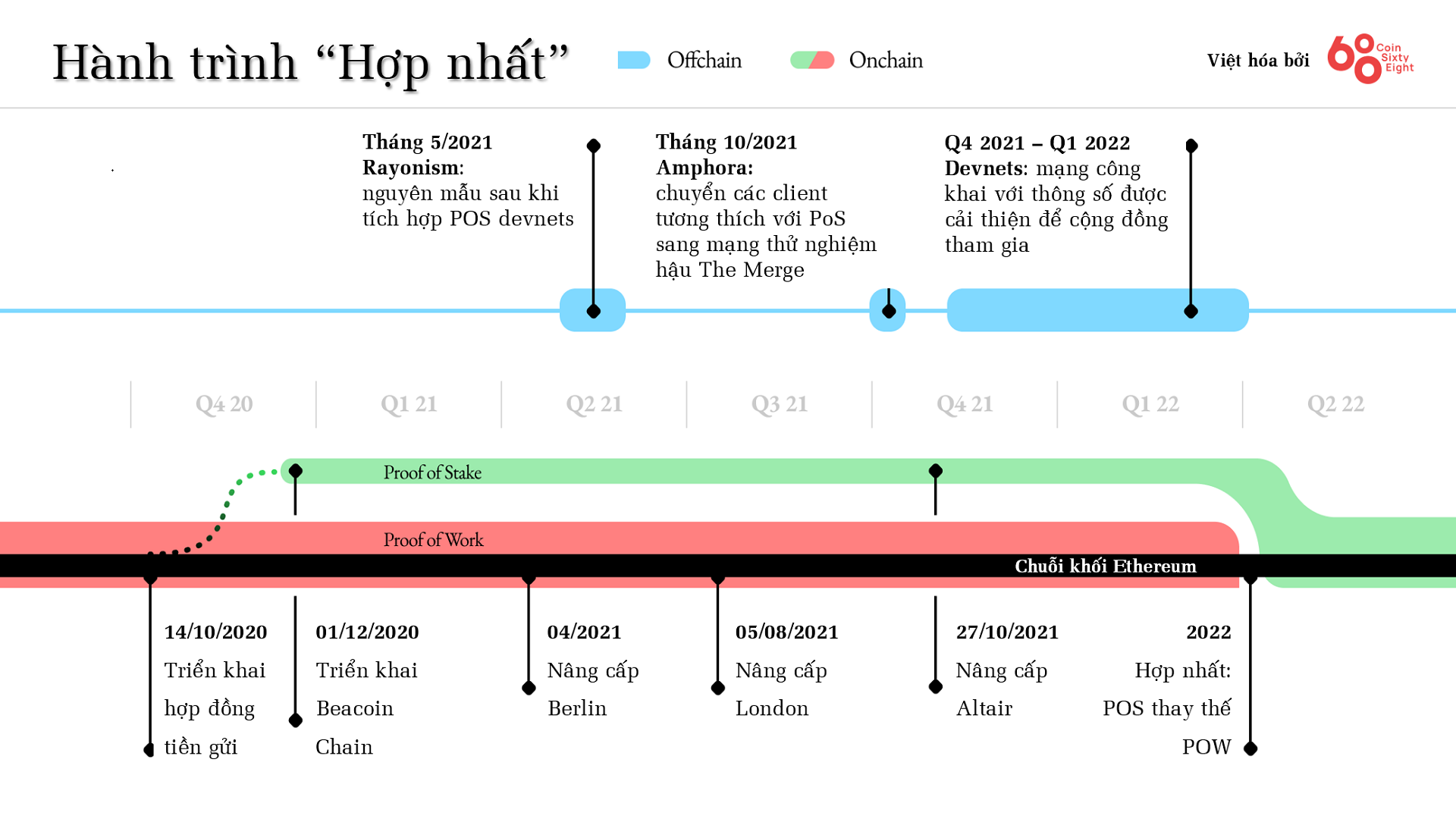

While this blockchain for most of 2021 has usually knowledgeable overcrowding and increasing transaction fuel charges, that has not stopped traders, end users and tasks from coming to this blockchain – a declare for this blockchain. Ethereum. Additionally, Ethereum in 2022 has numerous milestones to seem forward to, which include the emergence of Layer-two remedies to enable decrease overhead and the occasion “The Merge” – the merger of the present Ethereum one. blockchain (utilizing Proof- of-Work) with the Ethereum two. blockchain below building (utilizing Proof-of-Stake).

On December sixteen, the Ethereum developers announced that they had effectively deployed Kintsugi, the Ethereum two. check network, and asked the neighborhood to participate in testing the platform. This is really favourable information, which exhibits that the Ethereum advancement staff is quite established to employ The Merge proper in 2022.

From major to bottom: Geth, Nethermind, Besu (with lighthouse, teku)

Left to proper: Prysm, Lighthouse, Teku, Nimbus, LodestarJoin us on Kintsugi: https://t.co/7DhiKe7YNb#TestingTheMerge pic.twitter.com/hKtBcixFPT

– paritosh (@parithosh_j) December 16, 2021

Synthetic Currency 68

Maybe you are interested: