Ethereum has recently seen significant volatility, falling 12% in the past week, causing significant losses for investors.

However, investment sentiment appears to be changing as Ethereum holders have been accumulating assets rather than selling, showing renewed confidence in the cryptocurrency’s resilience.

Ethereum investors turn to accumulation

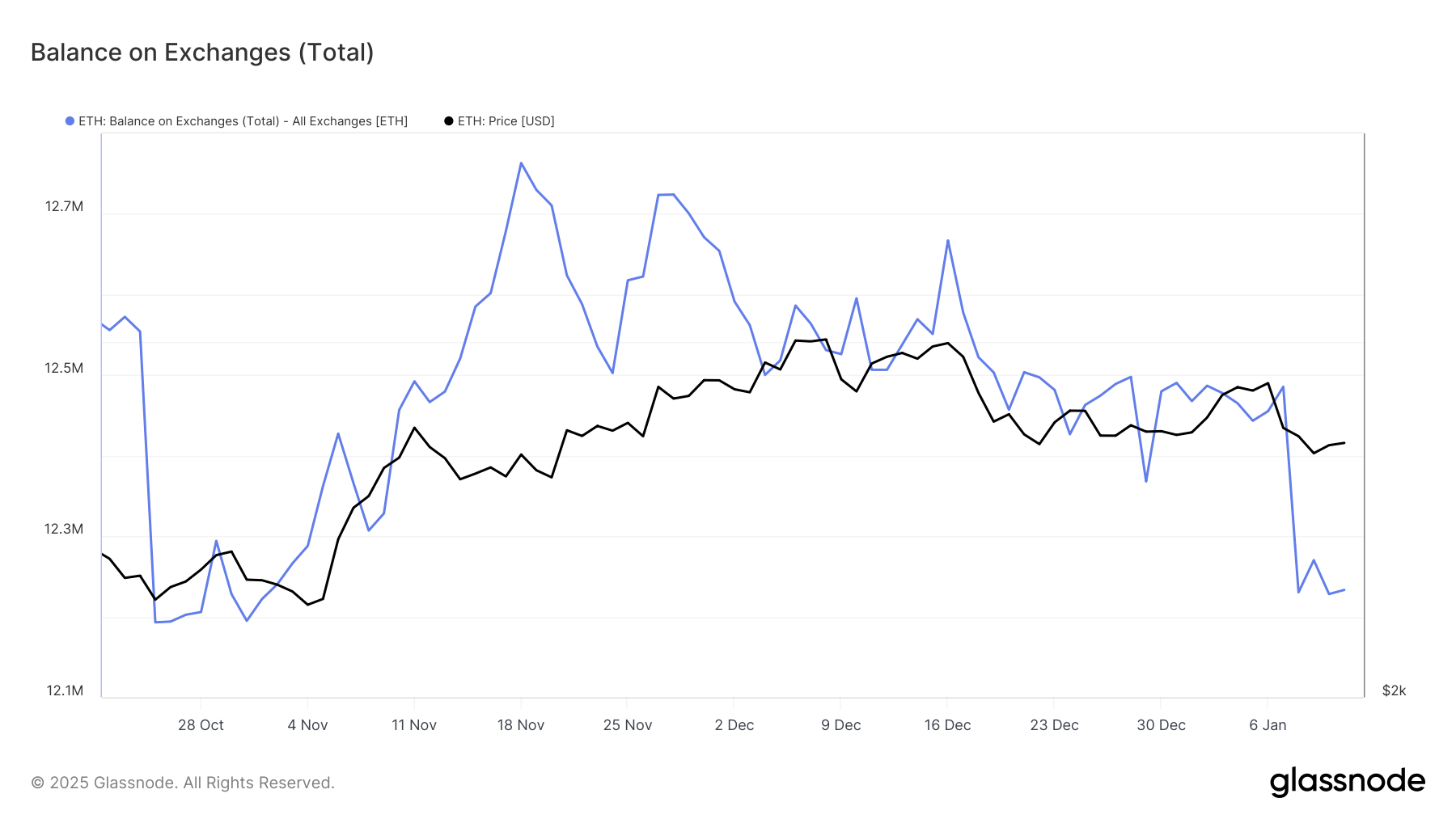

The amount of Ethereum on exchanges has dropped significantly this week, with a drop of 12.5 million ETH. This change reflects the accumulation of investors, who bought about $815 million worth of Ethereum during the price drop. The rapid transfer of ETH from exchanges to personal wallets shows the bullish sentiment of holders trying to take advantage of falling prices.

These accumulation patterns show the strategic approach of investors, aiming to take advantage of current low prices for future profits. This activity represents bullish sentiment, as Ethereum’s scarcity on exchanges could put upward pressure on prices in the coming days.

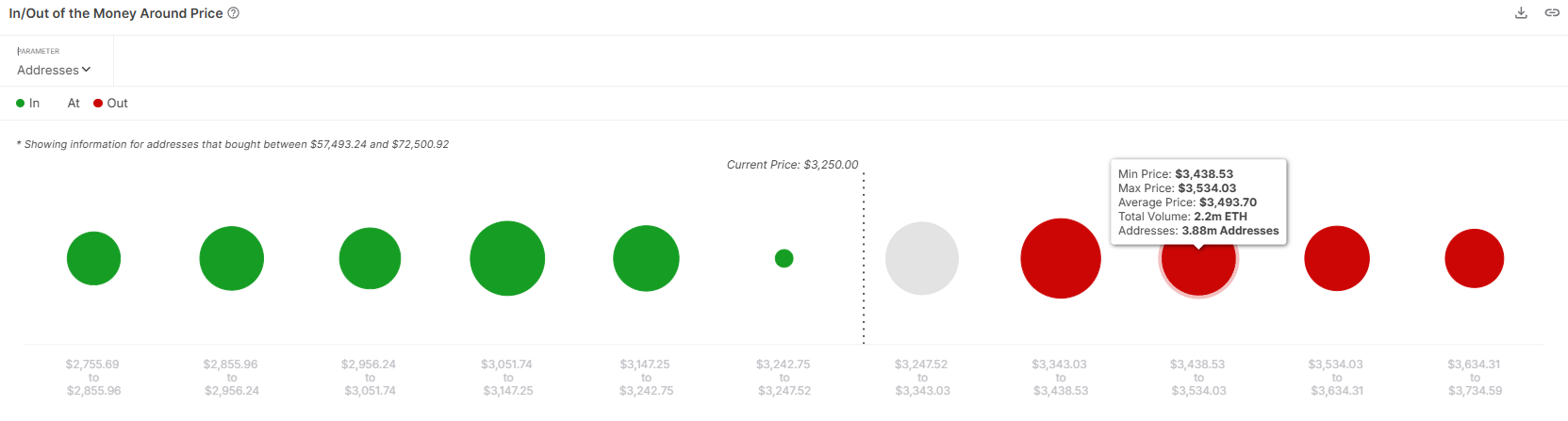

Broader macro dynamics for Ethereum suggest recovery potential. IOMAP (In/Out of the Money Around Price) data shows that bullish sentiment from recent accumulation could push Ethereum towards the next resistance level at $3,524.

Between the current price and this resistance level, approximately 12.5 million Ethereum were purchased. As prices rise, this supply, worth $40 billion at the time of writing, will become profitable.

If Ethereum successfully breaks the $3,524 resistance, it could establish a stronger bullish case. Profit-taking at this level is likely, but renewed confidence could balance the selling pressure and pave the way for a more sustainable rally.

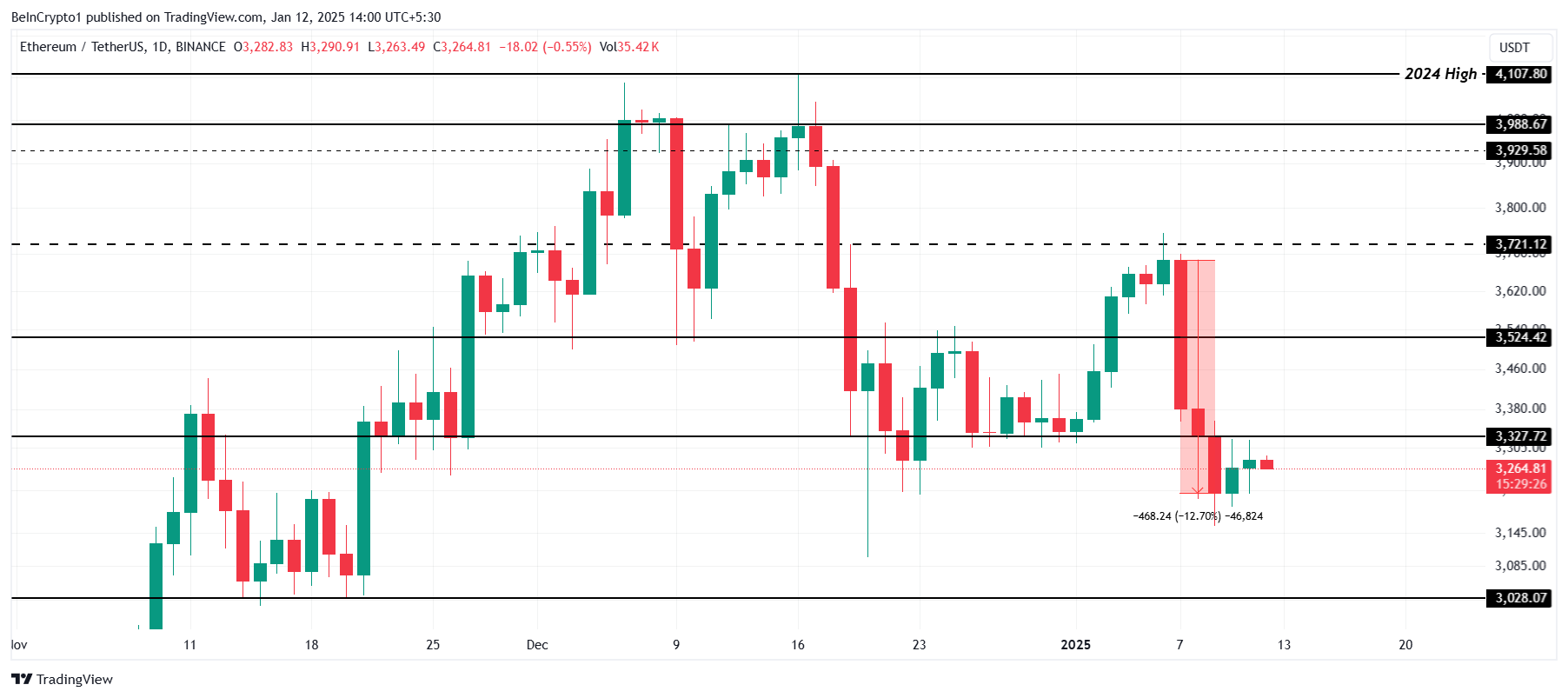

ETH Price Prediction: Resistance at $3,327 is important

Currently, Ethereum is trading at $3,264, following a 12% decline earlier this week. It is below immediate resistance at $3,327, a key level to overcome to gain momentum. This level is crucial to reverse the recent downtrend.

Turning $3,327 into support is crucial for Ethereum to target the next resistance level at $3,524. Maintaining a position above this level could reignite the bullish momentum needed to recover the losses incurred over the past week.

However, if it fails to surpass $3,327, Ethereum price could turn lower. A drop to $3,028 would erase recent gains and also invalidate the bullish outlook, dampening market sentiment and delaying a recovery.