Hence, The Merge of Ethereum is finish. Ethereum just before or just after The Merge is nevertheless Ethereum (ETH). But this occasion also spawned a fork of Ethereum PoW (ETHW) with the “principle” of currently being supported by miners. However, regardless of the identify “Ethereum”, sharing the historical past and code of Ethereum just before, but is ETHW truly a finish undertaking?

Late flowering concept

The Ethereum team’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) was planned lots of many years in the past. The local community is occasionally also “bored” by the truth that Ethereum is late, advancement is not on routine.

However, through that time, it was clear that Ethereum was on its way to PoS and local community-based mostly investment money for miners regardless of opposition: no a single had pointed out the concept of forking the Ethereum chain.

And however, when The Merge was only a handful of months away, on July 28, 2022, the ETH1-ETH2 debate was initiated by an unknown identify: Galois Capital, an investment fund without the need of also substantially relevance to Ethereum.

Since then, we have only just begun hearing about concepts like the split chain, ETHPoW, or the chance that there will be a lot more ETHW just after The Merge.

And unwittingly or intentionally, the proponents of the debate are making an attempt to draw a situation in which the ETH local community will be divided, lots of tasks beneath development on ETH will switch to ETHW. And that ETH will no longer be the only selection inside of the very same local community as Ethereum. (?!)

And right here, EthereumPoW (ETHW) officially appeared on August one, 2022, when The Merge is only a month and a half away. The concept of ETHPoW exists in no time, and the undertaking to comprehend that concept is just “passively pushing the boat”, making rapidly.

After all, what does ETHW have other than relying on the hype surrounding The Merge which is gradually cooling down?

What does EthereumPoW (ETHW) have?

Excavators

ETHW is “supported” by Chandler Guo, a Chinese miner and collects a portion of the miners from ETH. Externally, the undertaking claims to be supported by miners, it is a alternative that does justice to the Ethereum miners and will assist these miners proceed to revenue from the incredibly high priced invested mining facility.

But past these fine lines of PR, we have to request ourselves the query: what is it like to be supported by miners? The project’s blockchain begins up smoothly, transactions are processed effectively, but what else?

Miners normally also operate for revenue. And a lot more or significantly less if miners are dropping income from Ethereum, when they switch to ETHW they just want to make revenue as promptly as feasible. Of program, each ETHW token is mined, miners just want to promote it to make a revenue.

Coinlive has a thorough evaluation posting on this difficulty, you can go through it once more in: Ethereum Forks Have Potential As Community Thinks: What Do Miners Really Want ?.

Exchanges

If the miners are for revenue, then definitely the exchange is the very same. In the debate on who is in favor of ETH1-ETH2, it can be observed that most exchanges pick a neutral stance, leaving open the chance of quoting a split-chain model if there are lots of traders.

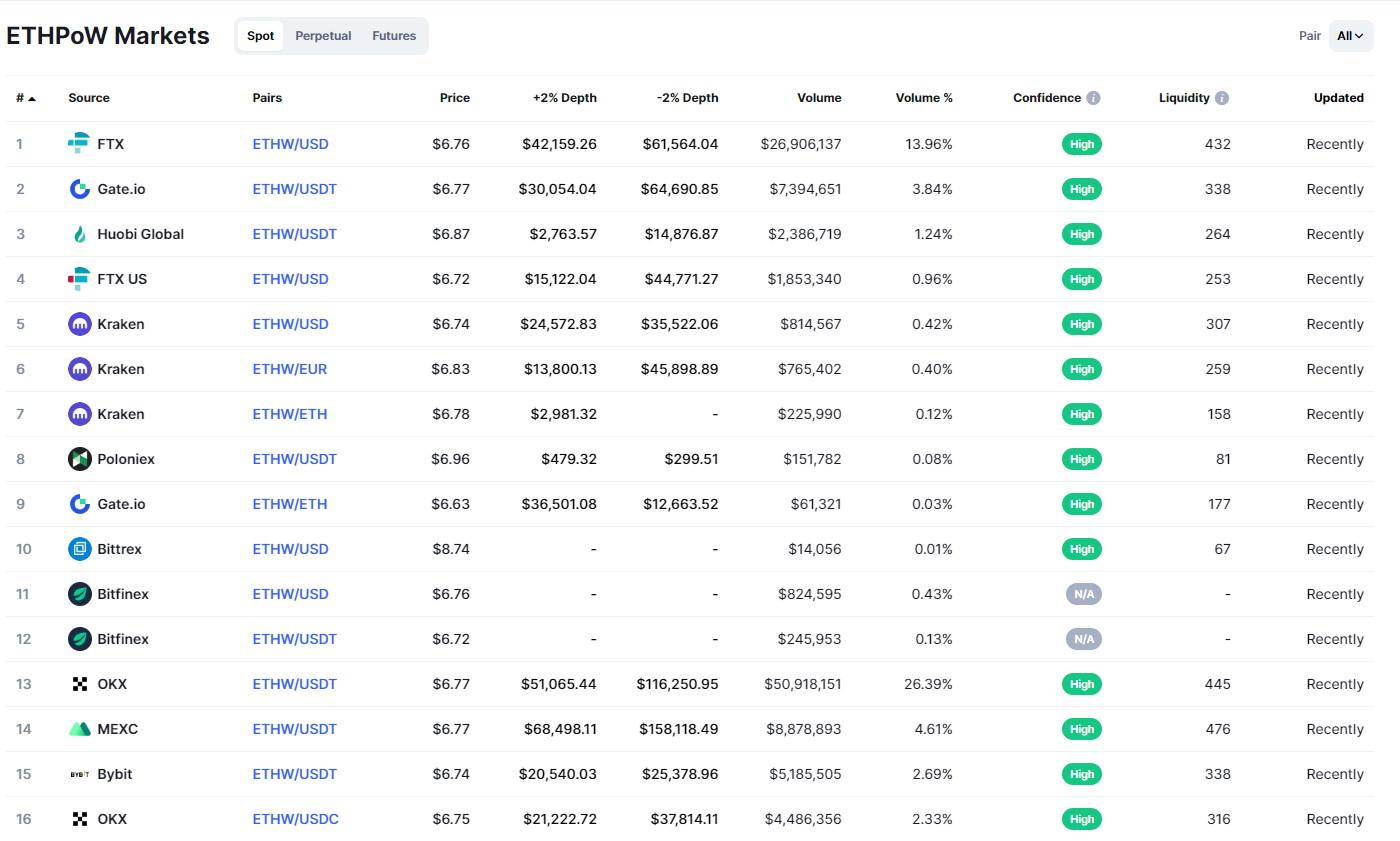

So when The Merge hype reached its peak, ETHW received a good deal of focus, so lots of exchanges begun listing this coin. This is undeniable.

However, please note that ICP has also been listed on lots of exchanges in the previous, top to enormous FOMO but has turned out to be the “trick of the century”. Therefore, currently being listed on lots of exchanges or not is a aspect to contemplate, not the most essential aspect.

DeFi undertaking

Ethereum has come this far thanks to the creation of a solid DeFi ecosystem, building a “blueprint” for basis tasks to observe.

This is also the most debated difficulty on ETH1-ETH2. After all, if there is no DeFi ecosystem all-around, in which will customers come from? So are there any tasks that help Ethereum PoW?

And now, ECOOOOOSYSTEM !!

Feel no cost to submit your undertaking right here –https://t.co/TRnZnyuDcU– EthereumPoW (ETHW) Official #ETHW #ETHPoW (@EthereumPoW) September 15, 2022

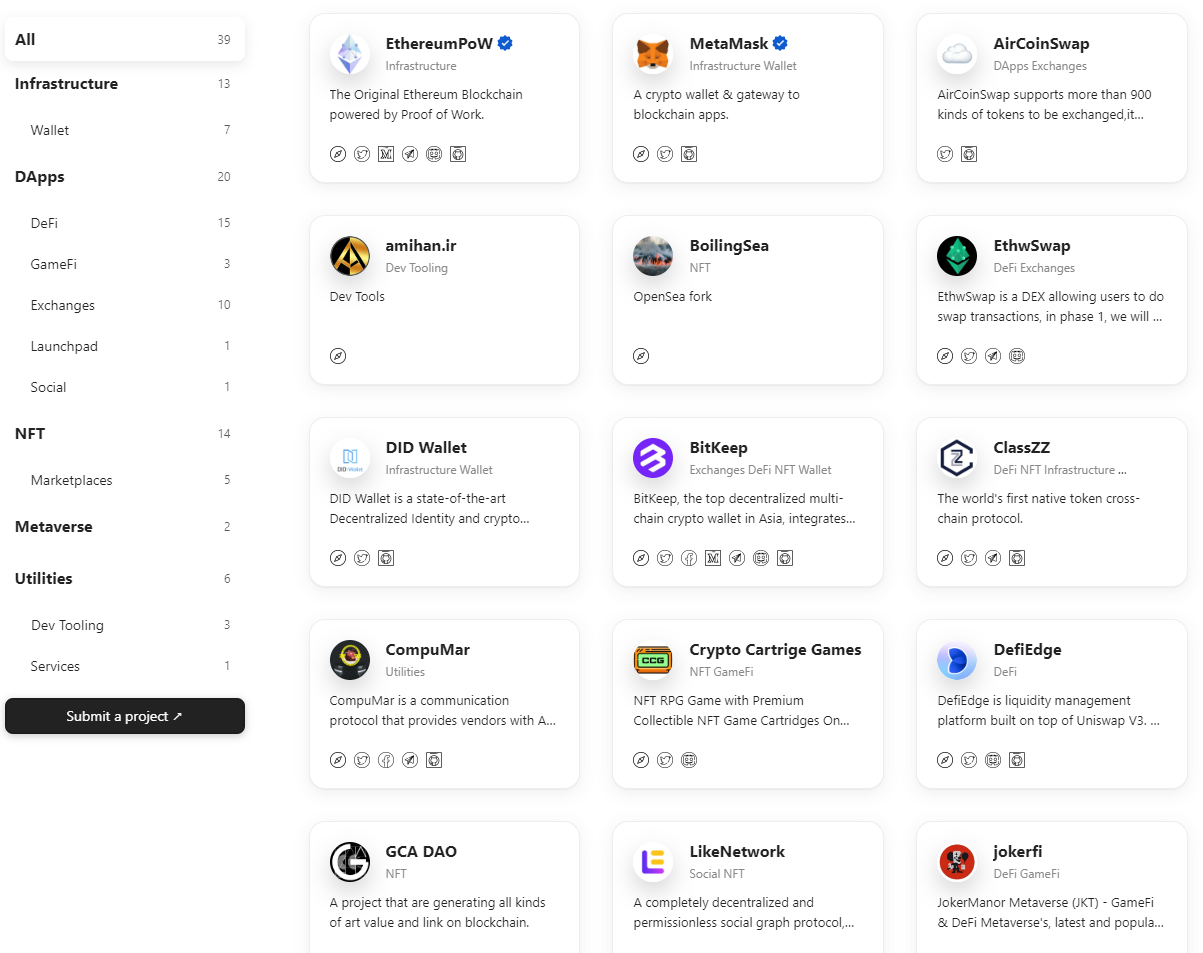

According to the aggregate info, there are presently all-around forty tasks in the ETHW ecosystem. Typical examples involve the MetaMask wallet and the KyberSwap DEX exchange.

Europe is also in solidarity with a younger undertaking like Ethereum PoW. We can only wait and see in the close to long term how ETHW will entice new tasks, carry collectively the developer local community to establish its very own ecosystem.

Since, as pointed out over, incredibly handful of Ethereum-based mostly tasks have ever believed of switching to a chain fork, so the subsequent advancement stage can only rely on ETHW’s core workforce. Also, significant stablecoin elements like USDT and USDC also never help ETHW chain.

Community of customers

It is incredibly clear that the existing ETHW local community is only created up of folks who want to obtain the airdrop.

The airdrop from the division of the publish-The Merge chain has been progressively finished by the exchanges, the rest is the airdrop from some DeFi tasks if they agree to help the two the existing ETH and ETHW chains.

If you have been following the undertaking, you need to have observed that the mindset of the existing ETHW local community is all about airdrops, rewards from splitting the chain, rewards, and so forth. With this kind of a mindset, when you get the airdrop, and then do what? Selling ETHW?

That’s why we have a selling price chart like this:

Difficult long term

With the over proof, it can be observed that ETHW’s long term is not also optimistic. Because definitely, with a local community operating challenging just to “make a profit,” the undertaking workforce will have to perform challenging to establish a sound consumer base.

Conversely, if the core workforce isn’t going to have a advancement strategy however, Ethereum PoW will progressively develop into a coin that exists only on the … selling price chart, there is trading volume, but not lots of folks essentially use it.

Looking back on Ethereum’s most productive fork is Ethereum Classic (And so forth): nevertheless there, there are lots of of these transactions, but forgotten by DeFi flows and new trends. A variety of new tasks sprang up and ran a marathon, when And so forth nevertheless walked gradually.

Giovanna

Maybe you are interested: