While the Fed continues to threaten to increase curiosity charges due to growing inflation, the European Central Bank (ECB) has taken a distinctive strategy.

As reported by CNBC, the ECB’s refinancing fee will continue to be at %. Meanwhile, the marginal lending fee is .25% and the base deposit fee stays at -.five%. This choice may well come as a shock as inflation is even now on the rise in Europe, as in the United States. Inflation more than the identical time period final yr in the EU was five.one%.

On three February, ECB President Christine Lagarde acknowledged that inflation will persist longer than anticipated, but is anticipated to decline quickly by the finish of 2022. If the economic system returns to total-capability curiosity charges, she thinks the inflation could be even increased.

Christine Lagarde also in contrast the inflationary predicament in Europe with that of the United States, saying that the trouble is at this time driven by provide, rather than demand. She concluded that Europe is unlikely to expertise a sudden boost in inflation as the US market place is dealing with.

Over the previous two months, the Fed has repeatedly announced that it will increase curiosity charges to battle inflation, which hit a forty-yr higher of seven% in December. The Fed’s remarks repeatedly have a tendency to be disconcerting. They combine cryptocurrency and stock market place.

As Coinlive reported that, at the final Fed meeting in February, the company temporarily left curiosity charges unchanged until finally the subsequent meeting in March, to make a last choice on when to apply the fee hike, which really should consider area three- four instances this yr.

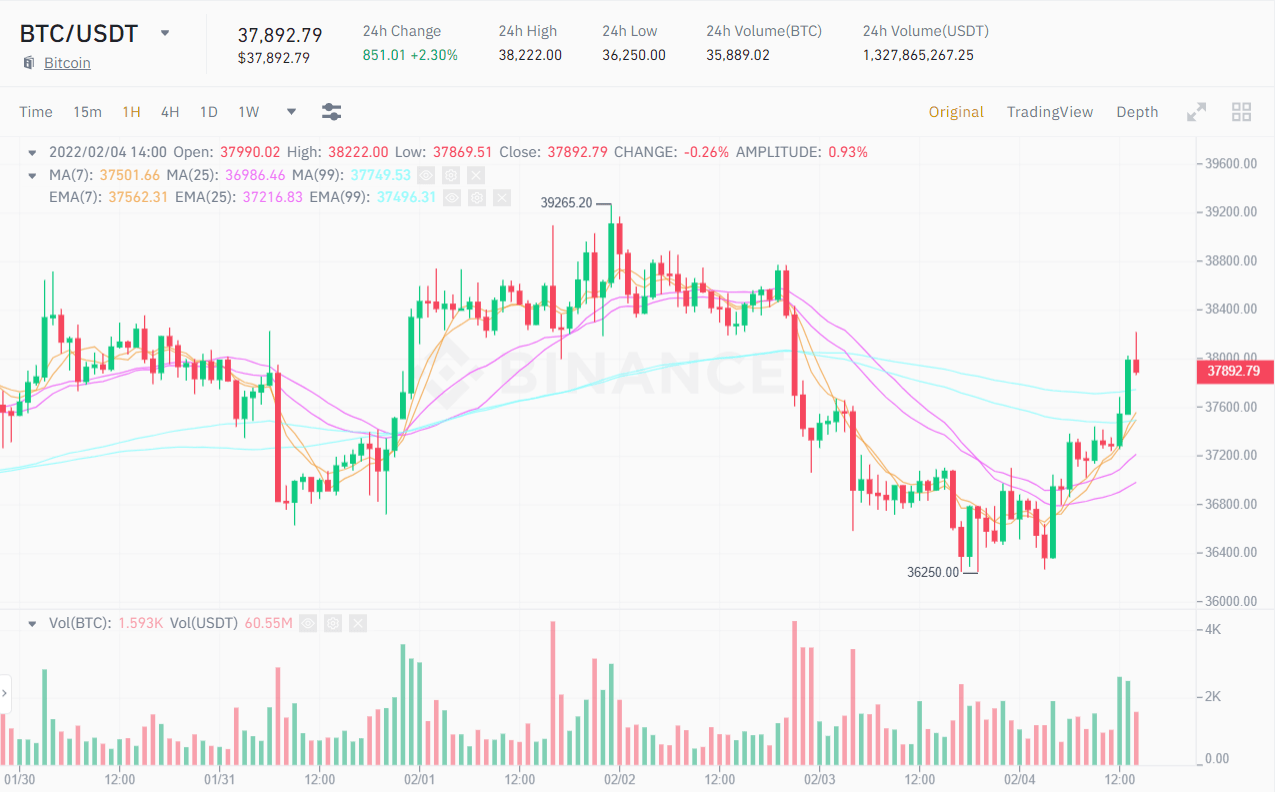

Despite dealing with a correction to $ two,000 when underneath strain from United kingdom tax authorities in the middle of the week, but with information of ECB curiosity charges holding flat, Bitcoin speedily returned to a solid recovery, trading all-around the $ threshold. 38,000 at press time.

Summary of Coinlive

Maybe you are interested: