What is Aurox (URUS)?

Aurox is a trading platform that solves DeFi and DEX lending restrictions by leveraging efficiency in decentralized lending to enhance 4X margin lending, though supplying complete-fledged buy fulfillment, supplying velocity and reduced price by way of l elimination of clever contracts.

Two major merchandise of Aurox

Aurox Lend

DeFi lending platforms currently are plagued with issues and blunders. Due to their reliance on serious-time market place provide and demand, recent platforms can only supply volatile revenue to their customers.

Borrowers also encounter a quantity of other obstacles. Because lending is unauthorized, decentralized lending platforms generally need significant collateral to mitigate the danger of permitting any borrower to withdraw the loaned money. The large price of collateral (in some cases up to double the cost of the loan itself) prospects borrowers to conclude that they do not have to have to use the loans for most of their functions.

Aurox Lend is exclusively created to resolve these issues and much more. Through direct integration with Aurox Trade, Aurox Lend delivers lenders with accessibility to the most successful and most successful portfolio of borrowers: margin borrowers.

As for the loan, by way of Aurox Lend, loan candidates can stay clear of paying out as well considerably for collateral. This is accomplished since Aurox limits withdrawals from its platform when it provides a promise of significantly less than one hundred%, as very well as holding the correct to force the liquidation of borrowed money to compensate for market place declines. . But in contrast to Compound, Aurox Trade will alert customers of quickly transforming markets and enable them to near orders just before liquidation.

While the over may possibly appear restrictive, it essentially enables Aurox Lend to offer you generous loans to borrowers with up to 4x margin. This will deliver ample leverage to totally meet market place demand, though also supplying lenders with a dependable supply of large demand and large curiosity loans. Additionally, large margin costs are probably to appeal to large-executing traders who are prepared to pay out a greater curiosity premium.

Auox trade

Aurox is a centralized terminal that processes and executes transactions quickly through the Aurox Trade engine with no the use of clever contracts. Transactions are executed and settled quickly, though liquidity is ensured by way of direct integration with unique companion exchanges and buy guide aggregation.

By leveraging the liquidity of numerous centralized exchanges, Aurox Trade is in a position to promise reduced slippage, large liquidity and ease of use. In situation most exchanges never assistance margin trading for reduced volume tokens, Auox Trade will resolve this issue. Not only that, Aurox Trade will use Aurox Lend to enable quick marketing of pretty much any token on the market place.

The most potent attribute of the mixture of Aurox Lend and Trade is the capability for traders to revenue from unused money. Most traders have balances in their wallets and trade with no earning any revenue. Centralized exchanges took benefit of this and profited from consumer money. But Aurox Trade intends to alter that. Each trader can opt for to obtain curiosity from any fund in their portfolio. Funds really should by no means be frozen and can be withdrawn at any time. This attribute is created doable by immediately funding margin traders on the platform. Margin currency will be constantly balanced and reused to fund margin orders. With centralized exchanges, they are unable to lend dollars to traders since it can make the exchange illiquid. While Aurox Trade can usually get more loans right from the Aurox Lend protocols.

Aurox Trade is properly created for large executing traders and rookies. Although the acceptance of decentralized exchanges has grown quickly and quickly, the venture realizes that the very best cryptocurrency traders in the globe are unable to accept the large latency, large charges and bad cost execution of the very best decentralized exchanges. As a outcome, the venture created its platform to centralize its trading engine, absolutely getting rid of its reliance on clever contracts. The venture was in a position to effectively use the buy guide to assistance significant orders (as opposed to relying on volatile liquidity pools generally applied immediately by market place makers). With these core attributes, Aurox provides the very best of the two worlds, combining a reduced-latency exchange with escrow assistance and a large-yield DeFi lending platform for cryptocurrency holders.

Basic info about the URUS token

- Token identify: Aurox token

- Ticker: URUS

- Blockchain: Ethereum

- Token typical: ERC-twenty

- To contract: 0x6c5fbc90e4d78f70cc5025db005b39b03914fc0c

- Token sort: Utility, Governance

- Total offer you: Updating

- Circulating provide: Updating

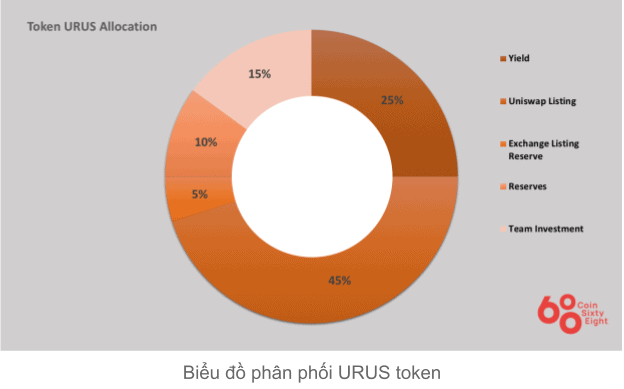

Token allocation

- Yields: 25%

- Uniswap Token List: 45%

- Reserve listed on other exchanges: five%

- Reserves: 10%

- Investment for the venture growth workforce: 15%

What is the URUS token for?

- Cash extraction.

- Stakeout.

- Discount on transaction costs.

- Raise curiosity costs.

URUS token storage wallet

URUS is an ERC20 token, so you will have numerous wallet possibilities to retail outlet this token. You can opt for from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 wallet

- Cool wallets: Ledger, Trezor

How to earn and very own URUS tokens

Buy right on the stock exchange.

Where to acquire and promote URUS tokens?

URUS is at this time trading on two Uniswap and Pancakeswap exchanges with a complete day by day trading volume of roughly $ 22.two million.

Roadmap

Q3 2021

Q4 2021

What is the long term of the Aurox venture, really should I invest in the URUS token?

Aurox is a trading platform with two major merchandise, Aurox Trade and Aurox Lend, two merchandise that had been developed to resolve the exceptional issues of the Dex and DeFi lending platforms. Through this write-up, you will have to have by some means grasped the fundamental info about the venture to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you achievement and earn a great deal from this likely market place.