What is Aurox (URUS)?

Aurox is a trading platform that solves DeFi and DEX lending restrictions by leveraging efficiency in decentralized lending to strengthen 4X margin lending, even though delivering complete-fledged purchase fulfillment, delivering pace and very low price by l elimination of sensible contracts.

Two major goods of Aurox

Aurox Lend

DeFi lending platforms these days are plagued with issues and blunders. Due to their reliance on actual-time marketplace provide and demand, latest platforms can only supply volatile income to their consumers.

Borrowers also encounter a quantity of other obstacles. Because lending is unauthorized, decentralized lending platforms usually need considerable collateral to mitigate the danger of permitting any borrower to withdraw the loaned money. The large price of collateral (in some cases up to double the rate of the loan itself) prospects borrowers to conclude that they do not have to have to use the loans for most of their functions.

Aurox Lend is especially intended to resolve these issues and much more. Through direct integration with Aurox Trade, Aurox Lend supplies lenders with accessibility to the most successful and most successful portfolio of borrowers: margin borrowers.

As for the loan, by Aurox Lend, loan candidates can stay clear of paying out as well substantially for collateral. This is accomplished due to the fact Aurox limits withdrawals from its platform when it features a ensure of significantly less than one hundred%, as properly as holding the proper to force the liquidation of borrowed money to compensate for marketplace declines. . But in contrast to Compound, Aurox Trade will alert consumers of swiftly altering markets and let them to near orders ahead of liquidation.

While the over could seem to be restrictive, it in fact lets Aurox Lend to present generous loans to borrowers with up to 4x margin. This will offer adequate leverage to absolutely meet marketplace demand, even though also delivering lenders with a dependable supply of large demand and large curiosity loans. Additionally, large margin prices are very likely to appeal to large-doing traders who are inclined to shell out a larger curiosity premium.

Auox trade

Aurox is a centralized terminal that processes and executes transactions promptly by way of the Aurox Trade engine without having the use of sensible contracts. Transactions are executed and settled promptly, even though liquidity is ensured by direct integration with unique spouse exchanges and purchase guide aggregation.

By leveraging the liquidity of lots of centralized exchanges, Aurox Trade is in a position to ensure very low slippage, large liquidity and ease of use. In situation most exchanges do not help margin trading for very low volume tokens, Auox Trade will resolve this challenge. Not only that, Aurox Trade will use Aurox Lend to let brief marketing of nearly any token on the marketplace.

The most highly effective characteristic of the mixture of Aurox Lend and Trade is the potential for traders to revenue from unused money. Most traders have balances in their wallets and trade without having earning any revenue. Centralized exchanges took benefit of this and profited from consumer money. But Aurox Trade intends to adjust that. Each trader can pick out to get curiosity from any fund in their portfolio. Funds should really never ever be frozen and can be withdrawn at any time. This characteristic is manufactured feasible by instantly funding margin traders on the platform. Margin currency will be constantly balanced and reused to fund margin orders. With centralized exchanges, they are not able to lend cash to traders due to the fact it can make the exchange illiquid. While Aurox Trade can constantly acquire even further loans immediately from the Aurox Lend protocols.

Aurox Trade is flawlessly intended for large doing traders and novices. Although the acceptance of decentralized exchanges has grown swiftly and swiftly, the task realizes that the very best cryptocurrency traders in the globe are not able to accept the large latency, large expenses and bad rate execution of the very best decentralized exchanges. As a outcome, the task intended its platform to centralize its trading engine, totally getting rid of its reliance on sensible contracts. The task was in a position to efficiently use the purchase guide to help massive orders (as opposed to relying on volatile liquidity pools normally employed instantly by marketplace makers). With these core attributes, Aurox features the very best of each worlds, combining a very low-latency exchange with escrow help and a large-yield DeFi lending platform for cryptocurrency holders.

Basic details about the URUS token

- Token title: Aurox token

- Ticker: URUS

- Blockchain: Ethereum

- Token common: ERC-twenty

- To contract: 0x6c5fbc90e4d78f70cc5025db005b39b03914fc0c

- Token variety: Utility, Governance

- Total present: Updating

- Circulating provide: Updating

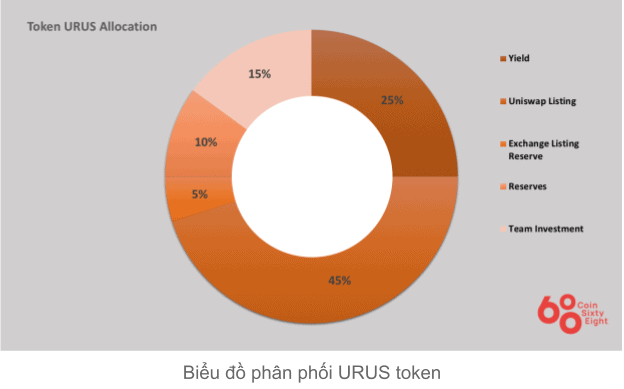

Token allocation

- Yields: 25%

- Uniswap Token List: 45%

- Reserve listed on other exchanges: five%

- Reserves: 10%

- Investment for the task improvement workforce: 15%

What is the URUS token for?

- Cash extraction.

- Stakeout.

- Discount on transaction costs.

- Raise curiosity prices.

URUS token storage wallet

URUS is an ERC20 token, so you will have lots of wallet selections to retailer this token. You can pick out from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 wallet

- Cool wallets: Ledger, Trezor

How to earn and personal URUS tokens

Buy immediately on the stock exchange.

Where to obtain and promote URUS tokens?

URUS is presently trading on two Uniswap and Pancakeswap exchanges with a complete every day trading volume of somewhere around $ 22.two million.

Roadmap

Q3 2021

Q4 2021

What is the long term of the Aurox task, should really I invest in the URUS token?

Aurox is a trading platform with two major goods, Aurox Trade and Aurox Lend, two goods that have been designed to resolve the exceptional issues of the Dex and DeFi lending platforms. Through this posting, you need to have by some means grasped the simple details about the task to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you results and earn a whole lot from this possible marketplace.