What is the Bastion Protocol (BSTN)?

Bastion is a decentralized lending and lending protocol, produced on the basis of an algorithm that adjusts curiosity costs primarily based on provide and demand. The protocol is primarily based on Compound and Aurora.

The vision of Bastione it ought to be NEAR’s liquidity hub, the place no assets are unprofitable and cToken can mix to type the basis of the ecosystem.

Loan and loan it is the central component of any DeFi ecosystem. Relying on Aurora lets Bastion to make a standalone curiosity fee engine with enhanced capital efficiency, rapid transactions, very minimal transaction costs, exact liquidity, and leveraging the core positive aspects of the Close to model consumer encounter.

Bastion presents the probability of:

- Providing sources to earn curiosity

- Mortgage the residence

- Property on loan

- Leverage (working with borrowed capital)

- Current assets (working with borrowed capital)

How does the Bastion protocol get the job done?

What is cToken?

Collateral tokens (cToken) are like LP tokens, they are essentially tokens acquired when depositing sources in Bastion. The cTokens employed recover the underlying tokens and accrue curiosity more than time.

CTokens earn curiosity by their exchange fee: more than time, every cToken can convert into an raising quantity of the underlying asset, even if the quantity of cTokens in the user’s wallet stays continual.

Bastion protocol lets customers to deposit five major assets which includes: ETH, Close to, USDC, USDT, WBTC to obtain cToken

TVL of the over five sorts of assets has reached additional than 380 million bucks. And the volume of company lent has reached more than $ forty million.

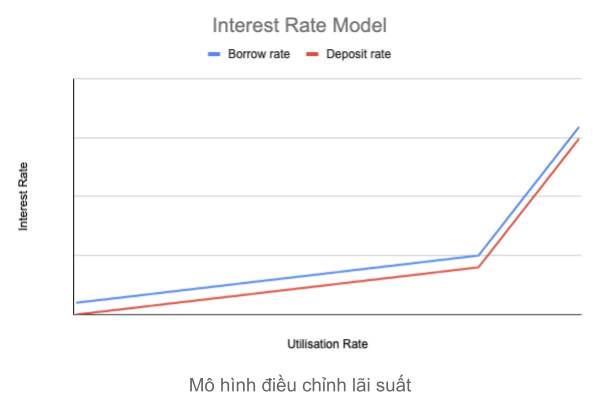

Interest fee model

The curiosity fee on the protocol is established primarily based on the utilization fee, which is the percentage of complete assets borrowed out of complete assets deposited on a individual market place.

Interest costs rise as utilization costs enhance. This self-balancing mechanism encourages folks to deposit additional assets to preserve the solvency of the protocol.

Liquidation

Loan restrict

The loan restrict refers to the greatest quantity a consumer can borrow with the residence they at this time have offered and secured. Settlement takes place when a user’s debt place exceeds the loan restrict (when loan utilization efficiency is> one hundred%),

Use of the loan

The use of borrowed capital is a visual representation of the romance among the complete collateral and the complete worth of the borrowed assets, or in other phrases the liquidation place.

The decrease the% of use, the safer the user’s warranties will be.

Improvement of the use of the loan

To boost loan utilization, customers can:

- Repay aspect or all of the loan quantity

- More ensures

Liquidation

Liquidation takes place when the assets borrowed from a borrower exceed the “loan limit”, which indicates that the ensure does not cover the complete quantity borrowed below the components of the ensure. In the occasion of liquidation, the liquidator will seize out there collateral from accounts that exceed the liquidation threshold and execute market place operations to enable repay the borrower, collecting a charge from the approach.

Oracle

Bastion is integrated with Flux Protocol to supply a supply of pricing information.

Initial cost feeds launched involve: ETH, Close to, WBTC, AR, DAI, USDC and USDT. Additionally, Bastion will leverage Flux to supply supplemental pricing feeds to assistance Aurora’s long term development.

Basic data about the BSTN token

- Token identify: Bation

- Ticker: BSTN

- Blockchain: Aurora

- Token typical: Updating

- To contract: Updating

- Token variety: Utility, Governance

- Total provide: Updating

- Circulating provide: Updating

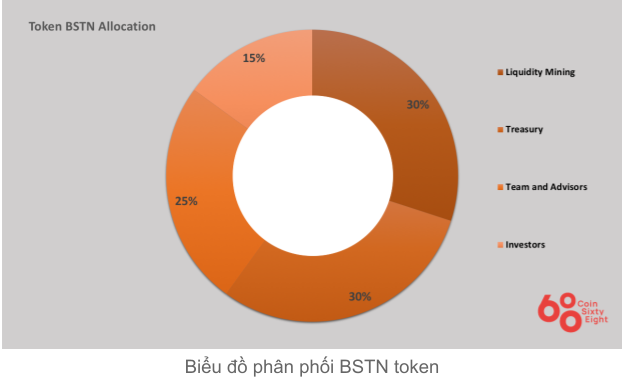

Token allocation

Cash extraction: thirty%

Treasure: thirty%

Team and advisor: 25%

Investors: 15%

Token release system

Updating

What is the BSTN token for?

Administration

Incentive to initiate loan application and supply original deposit fee stability.

BSTN Token Storage Wallet

Updating

How to earn and very own BSTN tokens

Freeze assets which includes: cUSDC, cUSDT, cNEAR and cETH for a time period of one-twelve months to earn BSTN and Close to rewards. The Lockdrop system requires area through

Where to invest in and promote BSTN tokens?

Updating

Roadmap

Updating

Investors

What is the long term of Bastion Protocol task, should really I invest in BSTN tokens or not?

Bastion Protocol is an Aurora-primarily based lending and lending protocol. The task has just finished a funding round from numerous significant investment money this kind of as Parafi Capital and Crypto.com. Through this post, you ought to have by some means grasped the simple data about the task to make your very own personal investment selections for oneself. Coinlive is not accountable for any of your investment selections. I want you results and earn a good deal from this probable market place.