Meme Coin FARTCOIN has recorded 21% growth in the past 24 hours, outperforming all others in the top 100. Currently, this altcoin is trading at $1.01.

On-chain data hints at strong community interest in this Meme Coin, and if this trend continues, FARTCOIN could extend its current gains in the short term. Here’s why.

FARTCOIN Holders Make Long-Term Bets

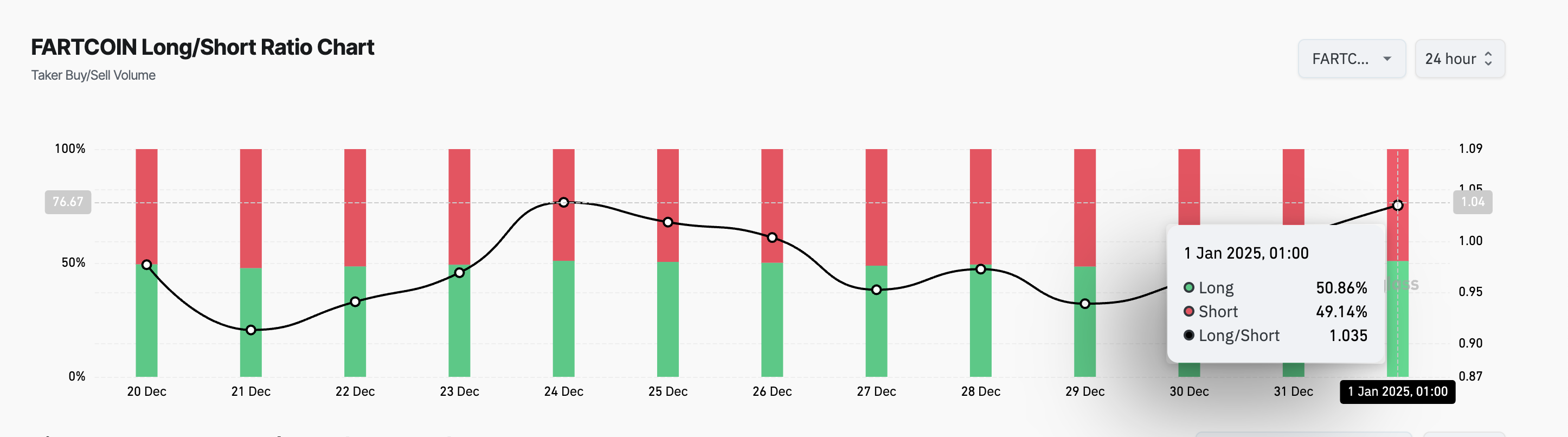

FARTCOIN’s long/short ratio stands at 1.04, confirming demand for long-term positions by derivatives market participants.

The long/short ratio of an asset measures the number of long positions (bullish bets) compared to short positions (bearish bets) in the market. When the ratio is above 1, it shows that many traders are holding long positions, suggesting that the market is expecting prices to rise.

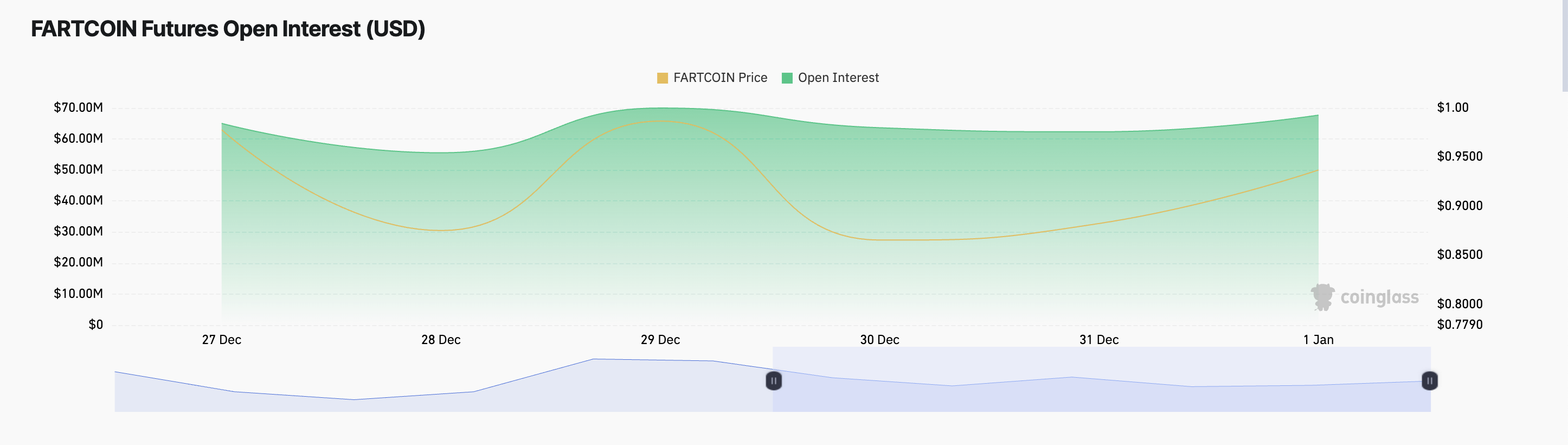

Additionally, the prediction that the price of FARTCOIN will increase has prompted traders to increase their activity. This is reflected in the increase in Meme Coin’s open interest, which according to Coinglass, has increased by 28% in the past 24 hours.

Open interest measures the number of active derivative contracts, such as futures or options, that are outstanding. Like FARTCOIN, when an asset’s open interest spikes during a bull run, it signals increased participation and new money flow into the market, reinforcing the strength of the uptrend.

FARTCOIN Price Prediction: Uptrend Could Push Token To All-Time Highs

Currently, FARTCOIN is trading at 1.01 USD. On the daily chart, its relative strength index (RSI), which measures overbought and oversold market conditions, is trending up to 59.11, confirming steady demand for Meme Coin This.

This RSI review shows that the FARTCOIN Token price continues to gain buying momentum and its investors are increasingly optimistic. This suggests that Meme Coin’s price may continue to rise, as there is still space for further growth without the risk of an immediate reversal. If this happens, FARTCOIN could recover to its all-time high of $1.29, previously reached on Christmas Day.

However, if Meme Coin sees an increase in sell orders as holders chase profits, this could cause a decline to $0.48, invalidating the bullish prediction above.