The prevailing sentiment in the cryptocurrency marketplace is greed given that Bitcoin hit $69,000 virtually sixteen months in the past.

Bitcoin’s Fear & Greed Index hit its highest score this yr, citing information from choice.me. This is a good signal that has not been noticed in the cryptocurrency neighborhood given that The #one cryptocurrency in the planet has passed the peak of USD 69,000 in November 2021.

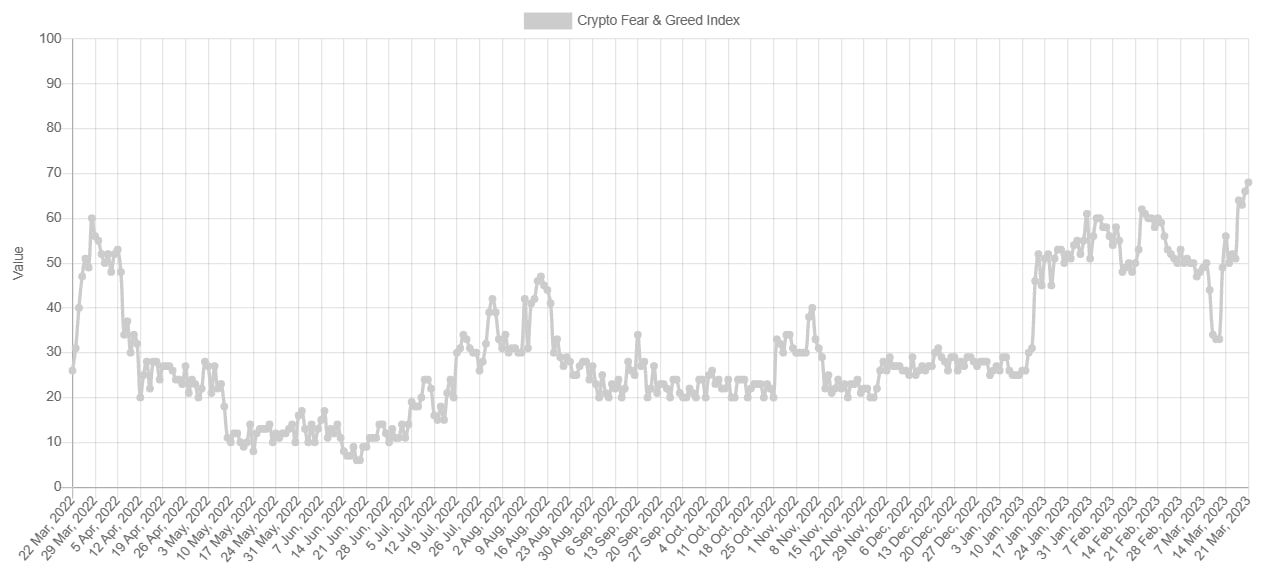

Fear & Greed Index is a record of investor dread and greed initially created by CNN Business for the stock marketplace, ahead of Alternative.me utilized to the crypto room. This indicator can be measured and statistically based mostly on a scale from to one hundred. In which, a score of signifies excessive dread, a score of one hundred represents excessive greed, and a score of 50 signifies that the marketplace is moving in neutral way.

According to the hottest update on March 21st, Fear & Greed Index is pivoting firmly in the direction of the “greedy” zone and has temporarily established ATH at 68. The final time this index recorded 66 factors was on November 16th, 2021. Therefore, the marketplace is bullish, traders are rushing to get, the typical sentiment is greed and FOMO.

As Coinlive reported, Bitcoin returned to $28,000 for the initially time given that early June 2022 late in the evening on March 19, temporarily reaching a large of $28,390. The king coin also closed the final trading week with an incredibly extraordinary development of 27.17%. BTC’s upward momentum is driven by macro uncertainties dealing with US and international monetary markets.

Synthetic currency68

Maybe you are interested: