Bitcoin (BTC) and Solana (SOL) have been two prominent names in the rise of the cryptocurrency market place on the morning of November two, when the Fed announced to preserve curiosity charges unchanged.

Fluctuations of the most important cryptocurrencies in the final 24 hrs, screenshot by Coin360 at 08:15 on October 24, 2023

Fluctuations of the most important cryptocurrencies in the final 24 hrs, screenshot by Coin360 at 08:15 on October 24, 2023

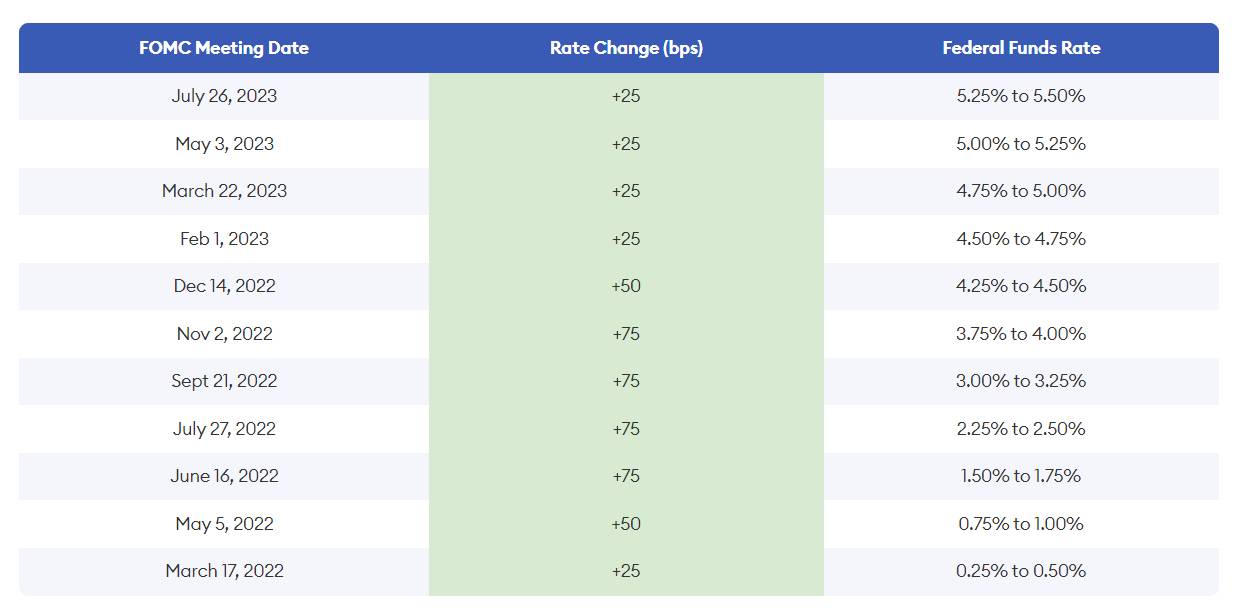

At the finish of the November FOMC meeting, the US Federal Reserve (Fed) declared that it will not change curiosity charges for the 2nd time in a row, continuing to preserve them at the degree five.25-five.five% like at the minute. Even so, this is nonetheless the highest curiosity price because the 2008 monetary crisis.

The Fed mentioned that information collected by this company exhibits that the US economic climate grew in the third quarter of 2023. Although the employment price has slowed, the unemployment price is nonetheless stored lower and inflation is no longer volatile as prior to.

Fed curiosity price changes in 2022-2023. Photo: Forbes

Fed curiosity price changes in 2022-2023. Photo: Forbes

Speaking later on, Fed Chair Jerome Powell mentioned the latest rise in U.S. Treasury yields could have some affect on monetary markets, but he nonetheless left open the likelihood of continuing to increase curiosity charges.

The Fed will make a additional curiosity price adjustment in mid-December, prior to coming into 2024, when numerous analysts count on the US Federal Reserve to commence minimizing curiosity charges.

The cryptocurrency market place reacted positively to the information. The world’s greatest cryptocurrency, Bitcoin (BTC), soon after a series of days of sideways motion about the USD 34,000 – 34,500 variety, regained its upward momentum following the Fed’s announcement to preserve curiosity charges unchanged.

Since the morning of November 2nd Bitcoin (BTC) it continued to rise to USD 35,650, setting a new peak in 2023 and also the highest value in the final yr and a half, because May 2022, when LUNA-UST collapsed.

1h chart of the BTC/USDT pair on Binance at 08:15 on November two, 2023

1h chart of the BTC/USDT pair on Binance at 08:15 on November two, 2023

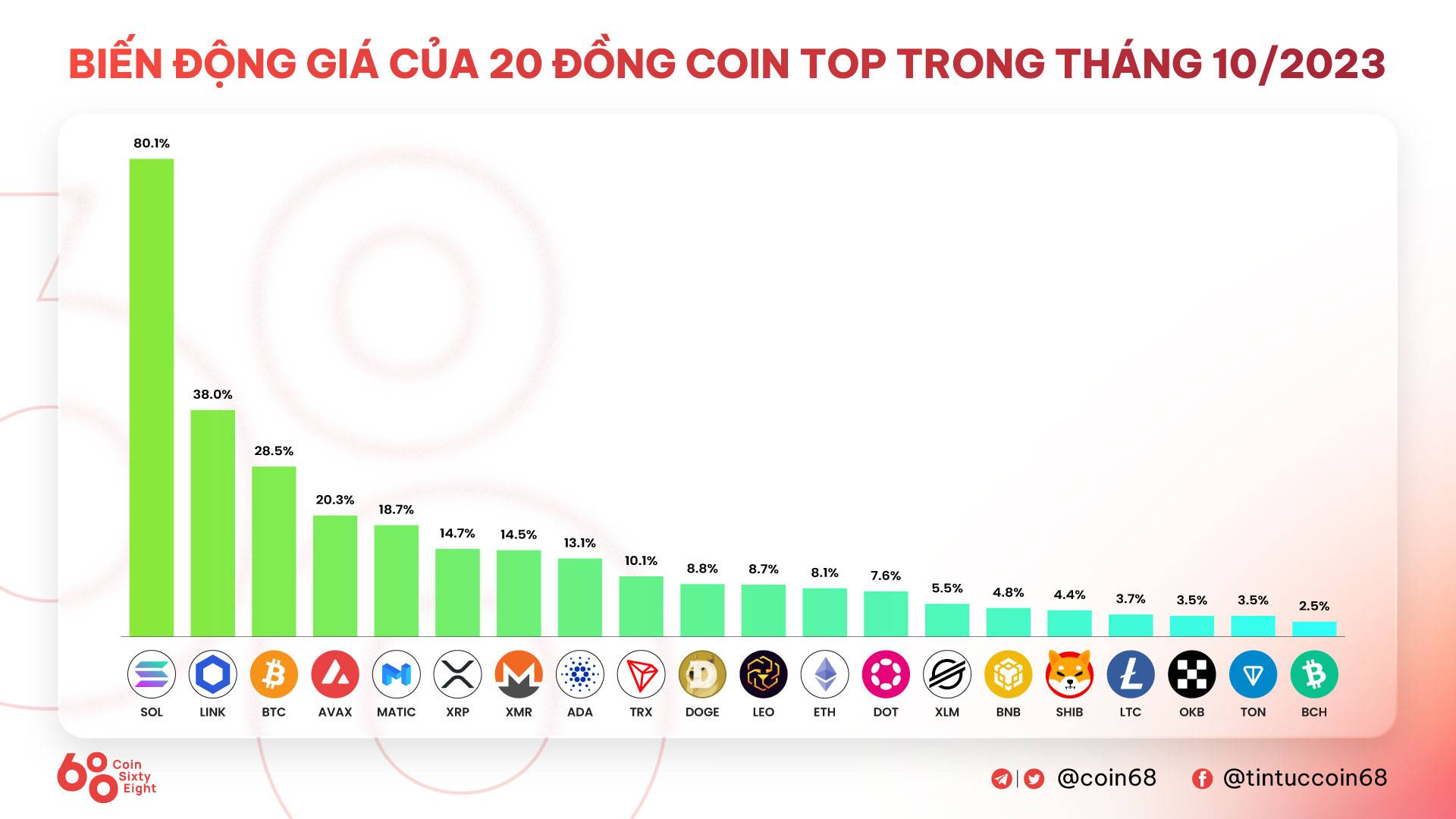

Last October, BTC surged 28.five% on momentum from the prospect of a Bitcoin ETF from Wall Street monetary giants.

Ethereum (ETH) it also caught the ascending wave and recovered up to USD one,857, but was unable to surpass the peak of USD one,865 on October 26.

four-hour chart of ETH/USDT pair on Binance as of 08:15 November two, 2023

four-hour chart of ETH/USDT pair on Binance as of 08:15 November two, 2023

Among the group of important altcoins, the most notable is Solana (SOL)in October the currency greater by 80% and from the evening of November 1st to the morning of November 2nd the SOL continued to rise till reaching USD 46.9, the highest worth threshold because August 2022.

1D chart of the SOL/USDT pair on Binance as of 08:15 on November two, 2023

1D chart of the SOL/USDT pair on Binance as of 08:15 on November two, 2023

Solana’s inspiration primarily comes from the Solana Breakpoint 2023 conference in Amsterdam (the Netherlands), with announcements of new developments, as properly as the optimistic sentiment of the local community. When the FTX exchange collapsed in November 2022, the Solana ecosystem was severely impacted, with the SOL value even plummeting from USD 33 to USD eight in just six weeks.

Solana Breakpoint proves that this blockchain nonetheless has fantastic likely and has a loyal local community of developers and end users, now that it has shaken off some of the affect of FTX.

Nonetheless, the court permitted the bankruptcy entity that took more than FTX in September to liquidate $three.four billion in cryptocurrencies more than time. FTX holds USD one.one billion of SOL (calculated at August 2023 rates), but there is a significant sum of SOL in locked kind and can not be liquidated instantly, as explained by Coinlive.

However, blockchain information exhibits that FTX on November one took out one.six million SOL, well worth just about $70 million, with the likelihood of getting ready to promote these coins.

Address: https://t.co/q0qjhcpPGc

—Lookonchain (@lookonchain) November 1, 2023

Data from Point on the chain exhibits that early in the morning of November two, wallets linked with FTX transferred USD 21.six million well worth of SOL and many other tokens to the exchange.

🚨🚨 [Updated] #FTX AND #Alameda The search transferred 9 assets well worth $46 million to #Kraken, #Binance & #Coinbase in the final seven hrs.

500K $SOL ($21.six million)

14M $MATIC ($9.three million)

two,784 $ETH ($five.15 million)

810K $MASK ($two.51 million)

two.one million $SUSHI ($two.37 million)

seven.67 million $BAT ($one.64 million)

71.six million $GALA ($one.four million)

650K… https://t.co/oMUhpyJsRE pic.twitter.com/FD3LdYoACl— Spot On Chain (@spotonchain) November 2, 2023

Many other altcoins also maintained a rise of eight-15% in contrast to 24 hrs in the past.

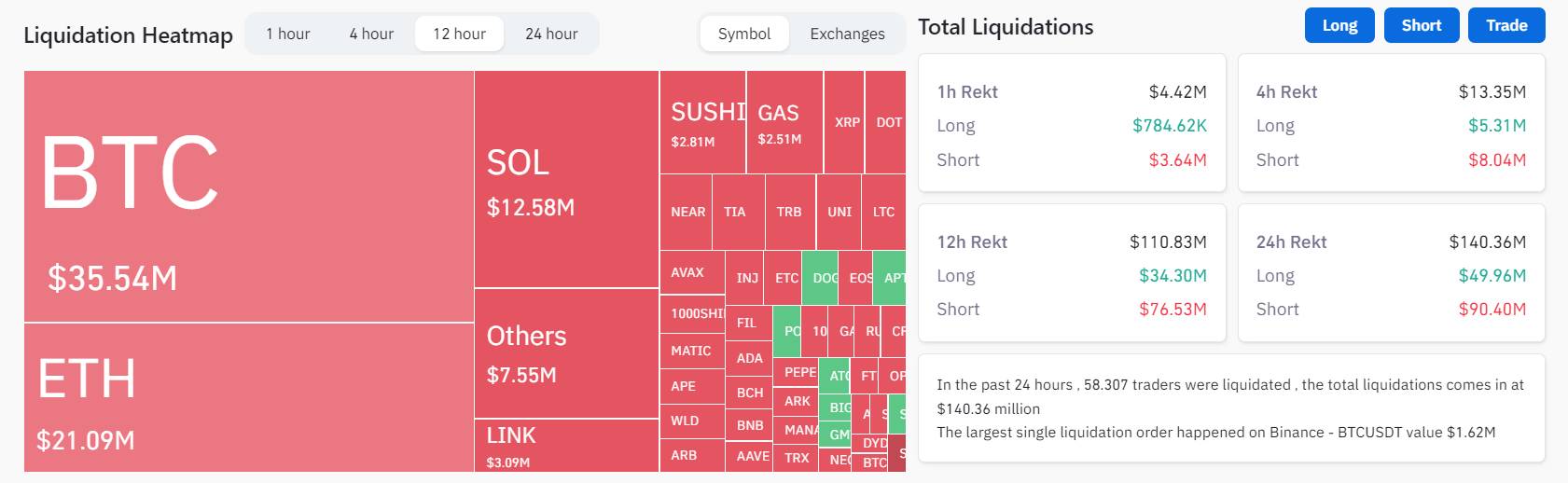

The sum of derivative orders liquidated in the final twelve hrs was more than $one hundred million, the vast majority of which are BTC, ETH and SOL. The percentage of quick orders burned was 58%, displaying that the prolonged side was not as well dominant in this cryptocurrency market place surge.

Long-quick buy settlement information on the cryptocurrency market place as of 08:15 on October 24, 2023. Photo: Coinglass

Long-quick buy settlement information on the cryptocurrency market place as of 08:15 on October 24, 2023. Photo: Coinglass

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!