FET prices have underperformed its nearest competitor over the past week, falling more than 8%. Despite being the second largest AI cryptocurrency by market capitalization, it still has difficulty keeping up with other major competitors in the same field.

While FET’s rivals have posted impressive growth, FET’s lagging behind has raised concerns about its ability to maintain its position. This recent decline is putting its position in the market in jeopardy, especially as other AI coins continue to show strong momentum.

Will FET Lag Behind Other AI Coins?

FET is currently the 2nd largest artificial intelligence cryptocurrency by market capitalization, behind TAO. It also ranks 2nd in weekly trading volume, just behind WLD. However, in terms of performance, FET has lagged behind its competitors over the past week, with prices falling 8.16%.

This price decrease is significantly lower than the impressive increases of competitors, such as RNDR with a 39.14% increase, and WLD with a 17.5% increase.

Recent numbers suggest that FET may be losing momentum in the AI cryptocurrency race, putting its position as the second largest AI coin in jeopardy.

If RNDR continues to increase by 15% and FET stays the same, their market capitalization will be equal, possibly leading to a change in ratings.

FET Whales Dropped Last Week

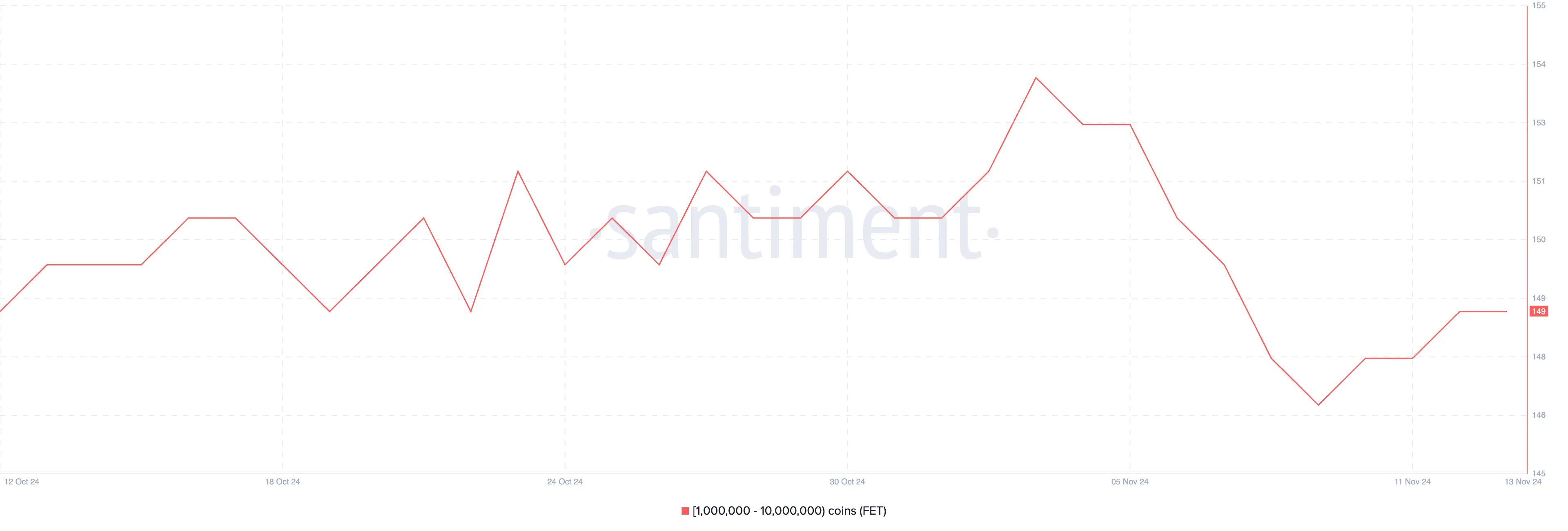

The number of addresses holding between 1 million and 10 million FET is currently 149, down from 153 on November 3. From that date to November 9, the number decreased steadily, bottoming at 147.

It is important to monitor the activity of these whale addresses, as they often have a large influence on price movements.

While the number of FET whales has recovered slightly from 147 to 149 over the past five days, it is still lower than levels seen in early November. This suggests that large investors may still be cautious, and that their confidence is still low. Full information has not been completely restored.

Despite the mild recovery, reduced whale activity may hint at lingering uncertainty or conservatism, which could impact price stability and future performance of FET in the short term.

FET Price Prediction: Likely 16% Adjustment

The FET price chart is showing signs of caution, with the EMAs indicating potential downside pressure. The short-term EMA has dropped significantly over the past few days and is almost crossing below the long-term EMA.

If this happens, it will form a “death cross”, a bearish signal that indicates a possible transition towards the downtrend.

If the “death cross” occurs, FET could challenge the nearest support at $1.18. If this level fails to hold, the price could drop to $1.08, representing a potential 16% correction.

However, if the momentum turns positive, FET price could challenge the resistance levels at $1.45 and $1.53. A break of these levels could see it rise to $1.64, offering 35% upside potential.