After BlackRock, one more Wall Street asset management company, Fidelity, announced that it will open a proposal to produce a spot ETF on Ethereum.

Fidelity has utilized to set up a spot ETF on Ethereum. Photo: Bloomberg

Fidelity has utilized to set up a spot ETF on Ethereum. Photo: Bloomberg

In the early morning hrs of November 18, American asset management group Fidelity Investments submitted paperwork to the SEC to register to produce a spot ETF on Ethereum.

Fidelity’s move came just days soon after Wall Street giant BlackRock produced a equivalent move.

Fidelity’s Ethereum spot ETF will be listed on an exchange owned by Cboe, but the custodian of the assets is unknown.

Update: @Fidelity joins the area #thereum ETF tender by filing a 19b-four with @CBOE https://t.co/rxNEzpzh3g pic.twitter.com/o96XspPDEP

—James Seyffart (@JSeyff) November 17, 2023

Fidelity’s filing argues that acquiring a spot Ethereum ETF would deliver traders with further safety when getting into the cryptocurrency marketplace, rather than holding an ETF straight and dealing with connected hazards. The corporation also cited Grayscale’s legal victory towards the SEC in August, saying that so far the U.S. Securities and Exchange Commission has not presented a compelling purpose to reject spot cryptocurrency ETFs.

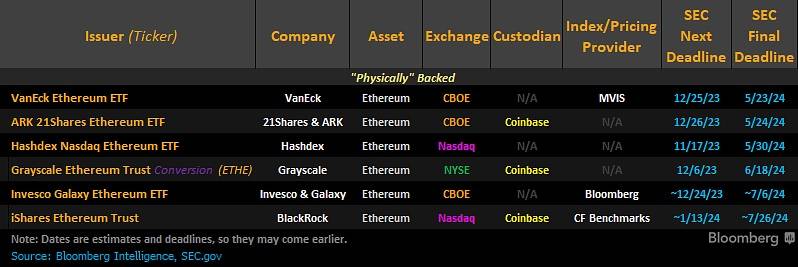

According to Bloomberg statistics, this is the seventh Ethereum spot ETF proposal submitted to the SEC not long ago, following VanEck, ARK Invest, Hashdex, Grayscale, Invesco and BlackRock.

Ethereum spot ETF proposals are awaiting SEC approval. Source: Bloomberg (18 November 2023)

However, all of these proposals will have to wait for the SEC to approve the series of spot Bitcoin ETFs staying viewed as by the company. The SEC has not accepted any spot cryptocurrency ETFs so far, claiming that the cryptocurrency marketplace is riddled with manipulation and fraud. Instead, the committee repeatedly delayed its selection to give it much more time to deliberate.

Similar to BlackRock, Fidelity in mid-2023 announced a proposal to open a spot Bitcoin ETF, but its overview was also delayed many occasions by the SEC.

ETH selling price did not react considerably to the information that Fidelity filed an Ethereum spot ETF application with the SEC.

1h chart of the ETH/USDT pair on Binance at 07:50 on November 18, 2023

1h chart of the ETH/USDT pair on Binance at 07:50 on November 18, 2023

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!