As the market grows, there are a lot more and a lot more versatile possibilities for consumers in conserving crypto assets. This post will enable consumers to uncover and see the simple variations among the top rated four crypto financial savings deposit platforms right now. FinbloxNexo, Celsius and BlockFi.

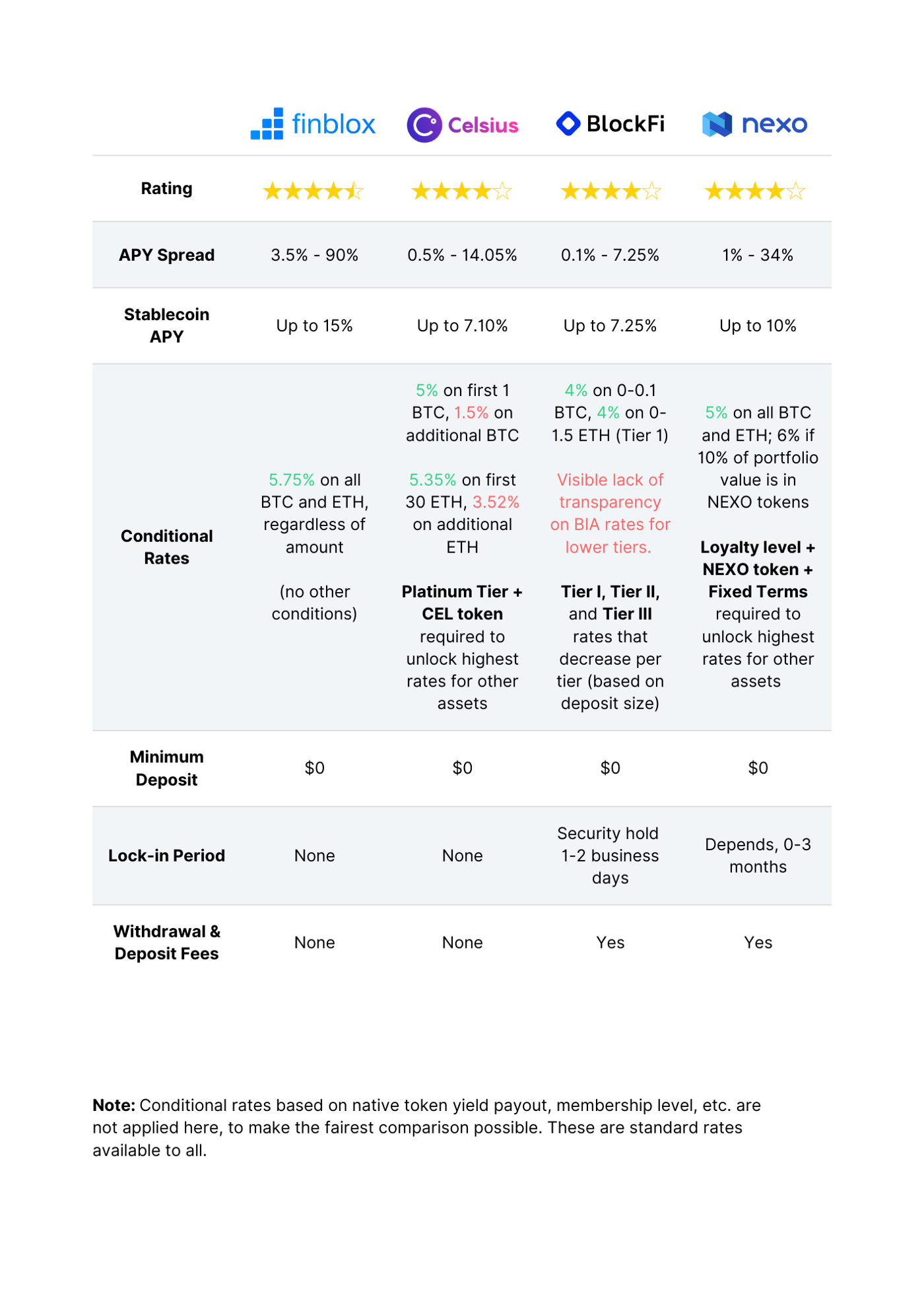

The table under is a speedy comparison among the four platforms:

Interest fee

Many folks will want to earn curiosity on the underlying tokens, for instance BTC, USDC …

Stablecoin

Finblox prospects the margin right here with 15% utilized to USDC and USDT and eight% on other stablecoins this kind of as XSGD (Singapore) and XIDR (Indonesia).

The common APY of Blockfi and Celsius on StableCoin is seven.ten% and NEXO all-around ten%, topic to the deposit sum, phrase and other accompanying problems.

Crypto

- For substantial cap coins: Celsius and Nexo supply returns of all-around five% for BTC and ETH. However, if a consumer deposits a lot more than one BTC or thirty ETH, the fee drops to one.five% for BTC and three.52% for ETH. On Finblox, there will generally be a fixed fee of five.75% for BTC and ETH.

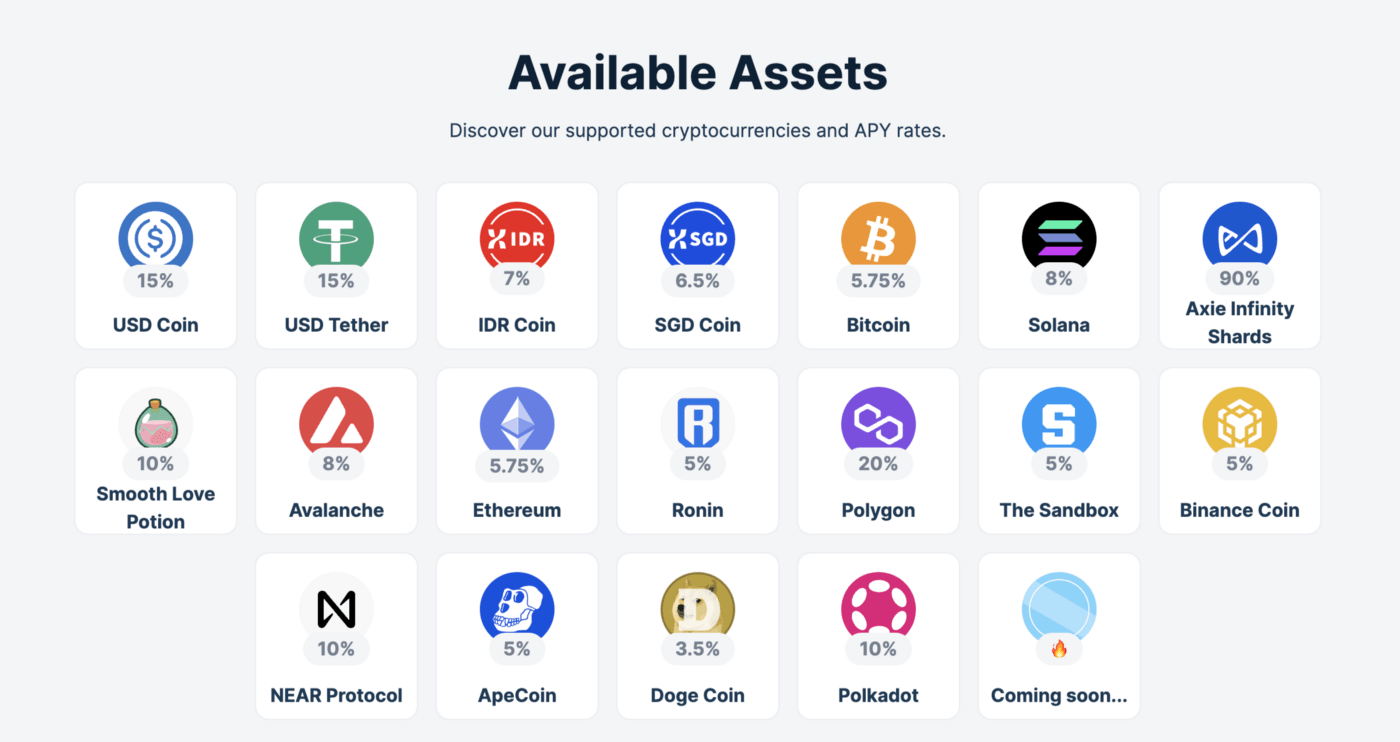

- For other cryptocurrencies: Rates will fluctuate, but now all of these platforms assistance a lot more than twenty protocols, and all of them record common tasks on Solana, Polygon, Avalanche, and Axie Infinity. With much less than twenty supported assets, Blockfi has a a lot more modest sum of cryptocurrencies out there on the platform.

One of the notable APY ranges is 90% for AXS and twenty% for Polygon on Finblox.

Withdrawal and Deposit Fees

Finblox and Celsius do not charge charges when customers have to deposit and withdraw cryptocurrencies from the platform. However, on Nexo and Blockfi, a various tariff table applies for every asset.

Supporter

Nexo is incubated by Credissimo, a Fintech group targeted on on line buyer lending and payment providers.

Finblox has the backing of Sequoia Capital (1 of the biggest venture capital money ever invested in Google, Paypal, Stripe and now managing in excess of $ 80 billion in assets), Saison Capital (a buyer finance business) US-Tokyo really worth $ thirty billion and is 1 of the biggest credit score card issuers in Japan), along with main blockchain money this kind of as Three Arrows Capital, Dragonfly Capital, Kyros Ventures and Coinfund.

Celsius attracted investment from Westcap and the Caisse de Dépôt et Place du Québec (CDPQ) (a international investment group).

BlockFi is supported by CoinBase Ventures, Galaxy Digital, Valar Ventures and Jump Capital.

Above are some of the variations among the top rated four crypto asset conserving platforms right now. Depending on their economic wants and abilities, consumers can take into account deciding on one of the four platforms over or flexibly mix all four platforms to realize the wanted passive finance.

About Finblox

Finblox is a startup task with employees from Vietnam, Russia, Indonesia, Hong Kong and Singapore. Finblox’s core item is a uncomplicated and safe application that will allow consumers to passively revenue from cryptocurrencies. The identify Finblox is inspired by the phrases “Financial” and “Blockchain”, reflecting the worth that the task needs to deliver to clients wanting for a steady supply of earnings from cryptocurrencies in a way, the easiest and safest. Finblox is now supported by numerous main organizations in the sector this kind of as Sequoia, Coinfund, MSA, Venturra, Saison …

More facts about Finblox: Website | Telegram | Twitter

Maybe you are interested:

Note: This is sponsored articles, Coinlive does not immediately endorse any facts from the over post and does not ensure the veracity of the post. Readers ought to perform their very own investigate in advance of creating selections that impact themselves or their enterprises and be ready to get duty for their very own possibilities. The over post is not to be viewed as investment information.