[ad_1]

What is dForce (DF)?

dForce is an open monetary protocol with 3 traits of integration, interoperability and extensibility.

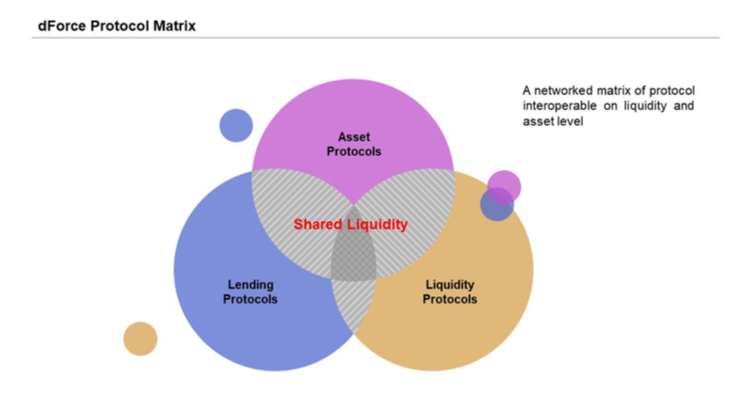

DForce’s imaginative and prescient is to construct core protocols inside every pillar group and in the end create a linked protocol matrix that may work together on the asset and liquidity stage, in addition to work together and combine with all three main sorts. protocol. The undertaking goals to construct a number of core protocols to enhance liquidity and intranet results, whereas remaining in a totally operational state for interoperability and integration with different protocols.

To implement the imaginative and prescient on dForce presents the dForce Protocol Matrix construction:

The dForce protocol matrix is designed to maximise the potential of a liquidity supply. The dForce protocol matrix consists of 3 protocols: Asset protocol (asset protocol), Lending protocol (mortgage protocol), Liquidity protocol (liquidity protocol).

What downside was born to resolve dForce?

DeFi protocols have generated robust momentum when it comes to each protocol supply and locked worth progress over the previous 12 months, nonetheless, not many are constructed to build up long-term worth. One Some DeFi protocols can function in a slim vertical vary, for instance Uniswap acts solely as AMM or trades stablecoins as Curve.Fi.

The essence of Defi is liquidity, if liquidity can transfer in 3 interconnected protocols, liquidity will likely be optimized to its potential. If liquidity is used solely vertically, there’s a threat of a liquidity loss.

How does dForce resolve the above issues?

The dForce protocol matrix minimizes liquidity losses and gives gravity to protect liquidity inside the protocol.

In the way forward for open finance or DeFi, there will likely be a number of massive clusters of protocol arrays nested by means of token protocols and several other protocol tremendous clusters that can kind a whole open core system and govern a lot of the world’s outflow of worth into the open monetary system.

Ultimately, it would kind a monetary infrastructure that can facilitate the circulate of information-like worth and combination liquidity and capital on a world scale, that is true finance. .

How does dForce work?

Asset patrimonial protocol

The Asset protocol has the operate of tokenizing on-chain and off-chain belongings. For instance, DAI is an asset protocol within the MakerDao system, folks can even deposit ETH within the protocol and different belongings within the system for the assure and minting of DAI. There are additionally efficiency tokens, comparable to cDAI or dDAI. Both tokens symbolize an interest-bearing instrument in a for-profit pool, the place customers can trade the unique token for a mortgage at a sure rate of interest.

Currently the dForce asset protocol consists of the stablecoin protocol – USDx protocol (dForce’s first steady artificial asset issuance protocol) and the yield token protocol -dToken (which is a fruiting token with steady constituent belongings).

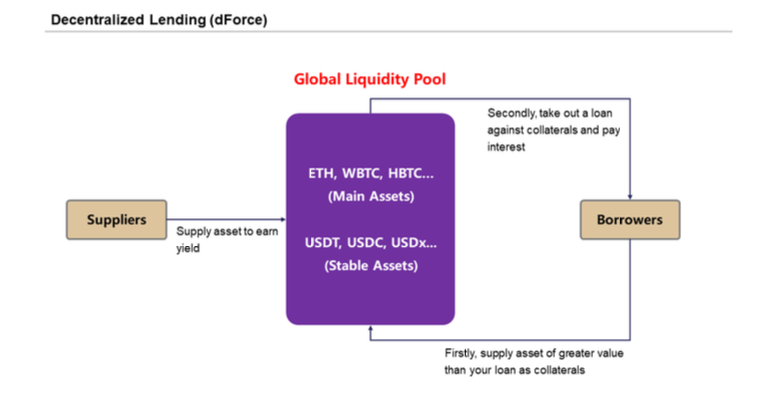

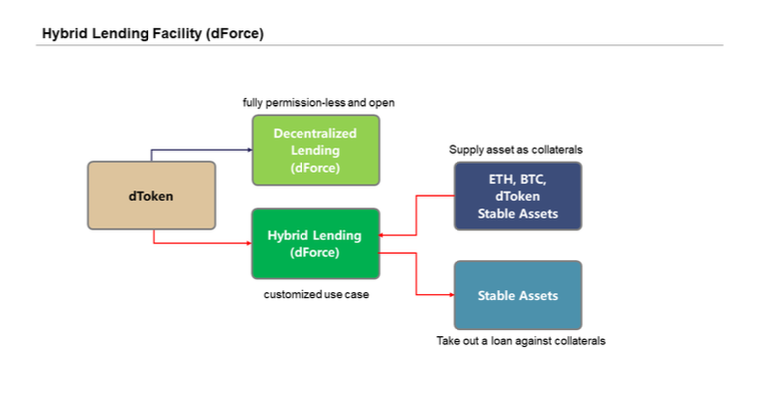

Loan protocol

Hybrid mannequin consists of dForce Lending protocol and Hybrid Lending Facility platform that create separate mortgage swimming pools that cater to customers with totally different wants and dangers, together with stablecoin mortgage swimming pools, commodities, collateral belongings, liquidity supplier shares , and so forth.

The hybrid mannequin permits dForce’s lending protocols to serve the broadest potential market whereas sustaining excessive flexibility, i.e. optimizing returns for the highest-yielding token pool from the Hybrid Lending Facility platform (with various threat tolerances and collateral) and on the identical time offering decrease financing prices for debtors utilizing the dForce mortgage protocol.

The dForce mortgage mannequin

Hybrid Lending Facility (dForce) Loan Model

Liquidity protocol

The undertaking will develop dForce Swap, Dex, trading protocols, spinoff protocols.

Currently the undertaking has developed dForce Trade and can proceed to launch different merchandise sooner or later.

Basic details about the DF token

- Name: dForce Token.

- Ticker: DF.

- Contract: 0x431ad2ff6a9c365805ebad47ee021148d6f7dbe0.

- Decimals: 18.

- Blockchain: Ethereum.

- Token customary: ERC-20.

- Token Type: Governance Token, Utility Token.

- Total provide: 999.950.547 DF.

- Current provide: 213.583.047 DF.

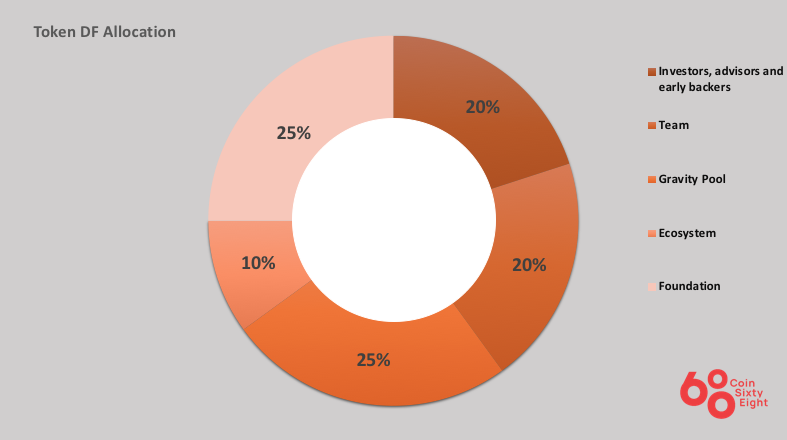

Token allocation

- 20% is allotted to traders, consultants and first traders within the undertaking

- 20% is assigned to the undertaking growth group

- 25% assigned to Gravity Pool

- 10% is dedicated to the event of the ecosystem

- 25% is used to maintain the corporate operating

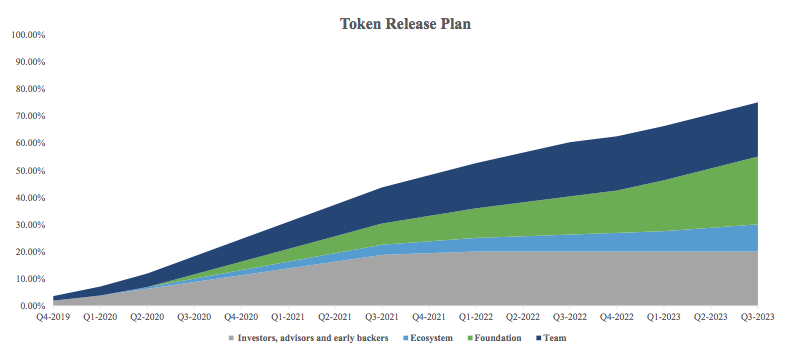

Token launch schedule

What is the DF token for?

- DF is the dForce governance token.

- DF tokens are used to pay transaction charges within the dForce ecosystem.

- DF tokens are used to keep up system stability.

- The DF token is used as a reward for customers after they take part within the money draw.

DF Token Storage Wallet

The DF token is an ERC20 token, so you should have many pockets choices to retailer this token. You can select from the next wallets:

- Floor pockets

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 pockets

- Cool wallets: Ledger, Trezor

How to earn and personal DF tokens

- Buy immediately on the ground.

- Participate in staking for rewards.

Where to purchase and promote DF tokens?

DF token is traded on many various exchanges with a complete each day trading quantity of roughly $ 6.5 million. Exchanges itemizing this token embrace: Uniswap, Binance, Huobi Global, MXC, BKEX, Hotbit, Gate.io …

What is the way forward for the dForce undertaking, ought to I spend money on DF tokens?

dForce This is a slightly attention-grabbing undertaking that goals to restrict the liquidity loss disadvantages of Defi protocols working vertically comparable to Uniswap or Curve Finance by providing a matrix mannequin to take full benefit of the liquidity in Defi. In the longer term dForce will launch extra Defi merchandise to finish the ecosystem and the unique imaginative and prescient of the undertaking. Through this text, it’s essential to have one way or the other grasped the fundamental details about the undertaking to make your funding choices. Coinlive just isn’t answerable for any of your funding choices. I want you success and earn rather a lot from this potential market.

.

[ad_2]