[ad_1]

The cryptocurrency market recently saw its first altcoin season in over 10 months. This short-lived rally saw many altcoins outperform Bitcoin. But now, the altcoin season index is down once again.

These shorting dynamics have worried investors, as the rapid decline in optimism raises questions about the sustainability of altcoin trends in the current market.

Is Altcoin Season Over?

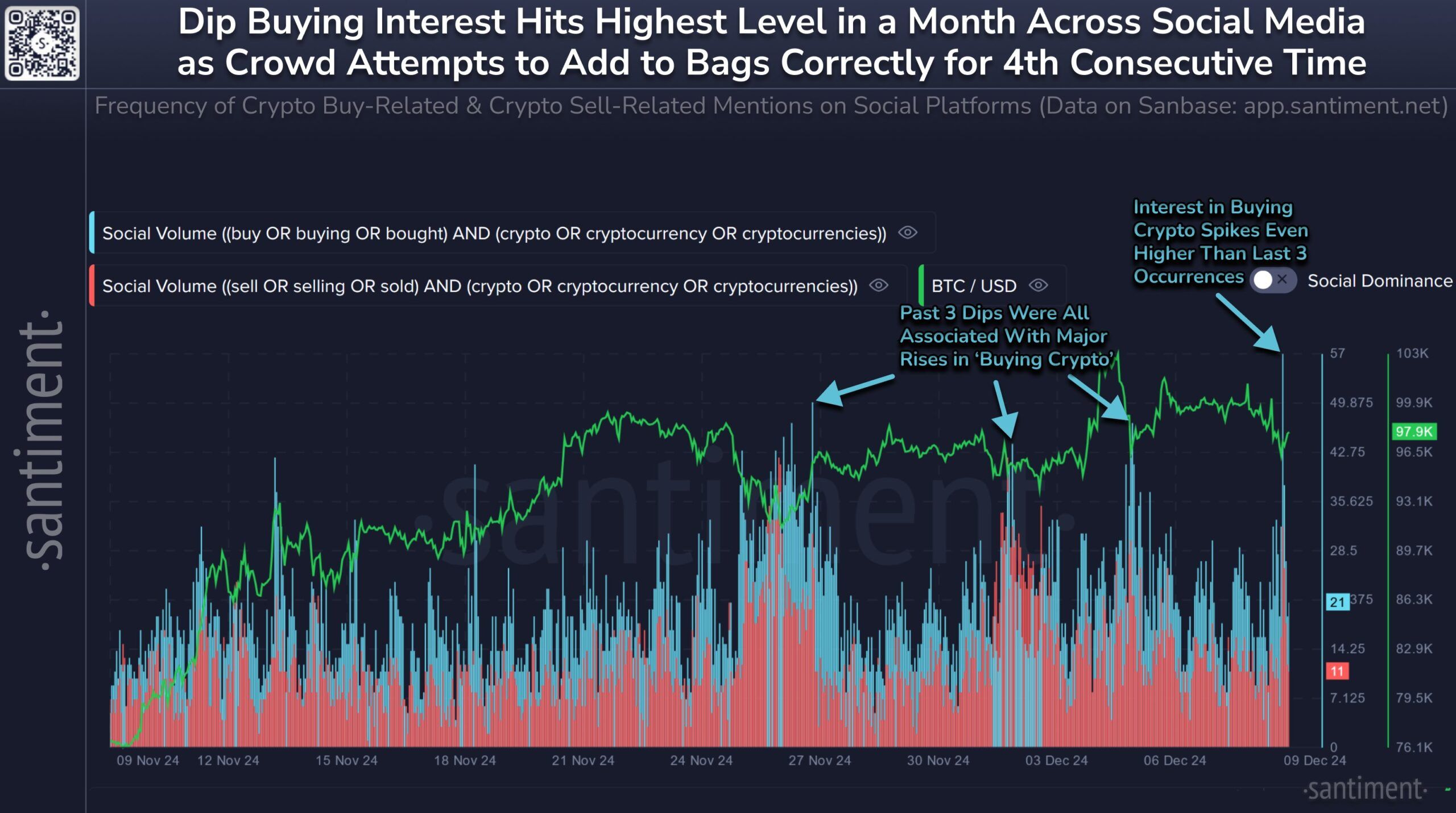

According to Santiment data, the altcoin’s recent price drop has triggered a surge in buying interest. This peak is the highest in weeks, even surpassing the level of interest when Bitcoin entered its growth phase.

Spikes often signal that crypto investor sentiment is driven by fear of missing out (FOMO), especially when altcoins show signs of short-term gains. This behavior often leads to increased market volatility as investors try to take advantage of opportunities that may only be fleeting.

Despite the increase in buying interest, the possible shortness of the altcoin season has left uncertainty in the market. FOMO buying can create unsustainable demand for altcoins, especially when broader market sentiment remains hesitant. The sudden drop in prices after the altcoin season suggests that many investors may have gone overboard, causing the market to quickly correct itself.

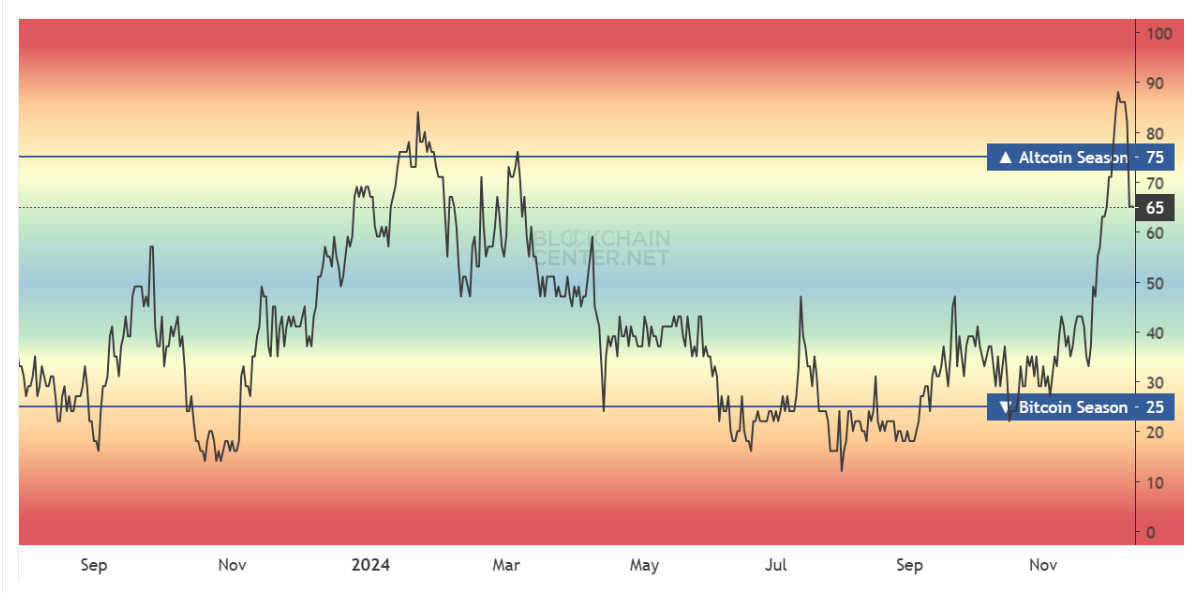

The overall dynamics of the altcoin market suggests an unsustainable lack of optimism. The Altcoin Season Index, which measures the performance of the top 50 altcoins against Bitcoin, has dropped significantly.

This decline is a clear sign that altcoins are losing ground against Bitcoin, which has reasserted its dominance in the market. When the Altcoin Season Index falls, the broader altcoin market tends to fade, as seen with the current altcoin season, which only lasts about a week.

The weak altcoin season highlights the challenges altcoins face in maintaining momentum as Bitcoin continues to appear strong. Market focus on Bitcoin often overshadows altcoin price rallies, leading to a rapid return to Bitcoin Dominance. This move suggests that, unless there is a significant shift in investor sentiment, altcoins may struggle to maintain strong momentum in the near future.

Altcoin Price Forecast: Support Coming

The total cryptocurrency market capitalization, excluding Bitcoin (TOTAL2), has experienced a sharp decline, losing $140 billion in the past 24 hours. This downturn in altcoin prices has severely affected the entire market. If altcoins continue to decline, TOTAL2 could face additional losses, leading to further market instability.

Currently, the cryptocurrency market capitalization is trying to retake the $1.57 trillion mark as support. This price level is important to maintain an optimistic short-term outlook. If market capitalization can hold this level, it could set the stage for a potential uptrend, stabilizing investor confidence.

However, a deeper altcoin correction could drag the market capitalization down to $1.22 trillion. This decline would significantly weaken the current bullish scenario, possibly triggering a more extended market correction. Failure to sustain key support levels could result in a prolonged downtrend.

General Bitcoin News

[ad_2]