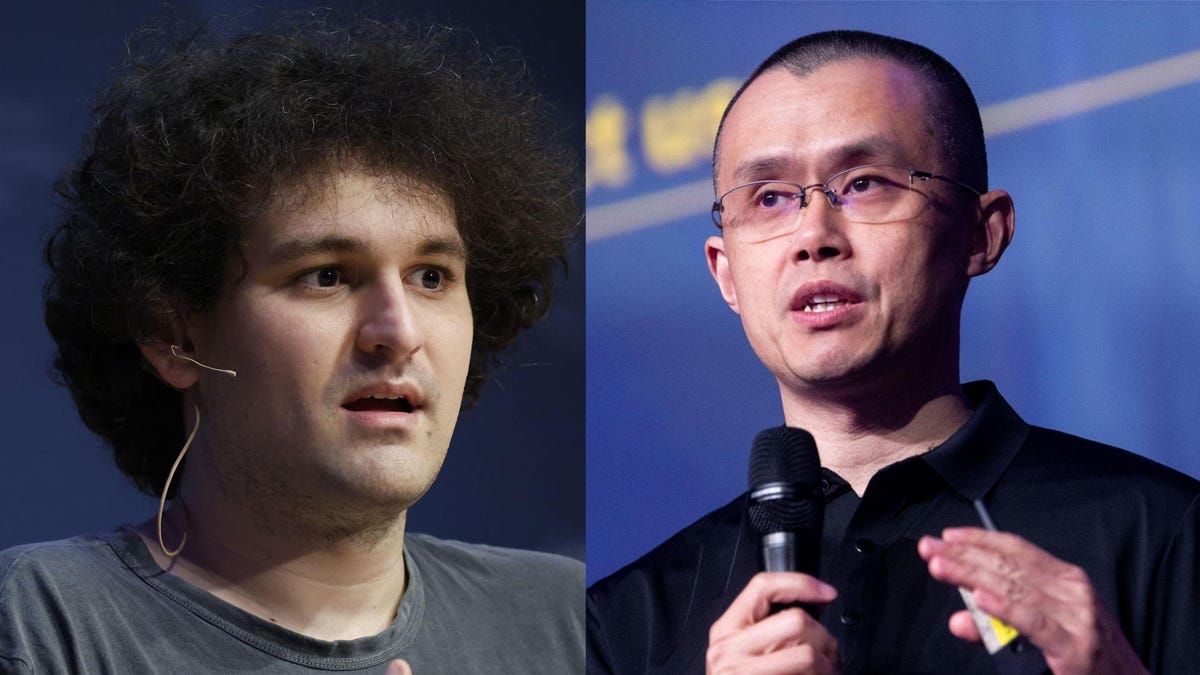

The cryptocurrency marketplace welcomes the new week with a drama of “extreme tension” in between Sam FTX and CZ Binance. But it seems to be like the win is in Binance’s favor.

FTX is dealing with withdrawal strain

After CZ publicly admitted that Binance is releasing FTT, the price tag of the FTX exchange token did five% low cost in the final 24 hrs.

However, Alameda Research CEO Caroline Ellison’s declare to “buy all FTTs for $ 22” is no “joke”, as FTT, despite the fact that volatility is down, even now sways this “difficult support. “.

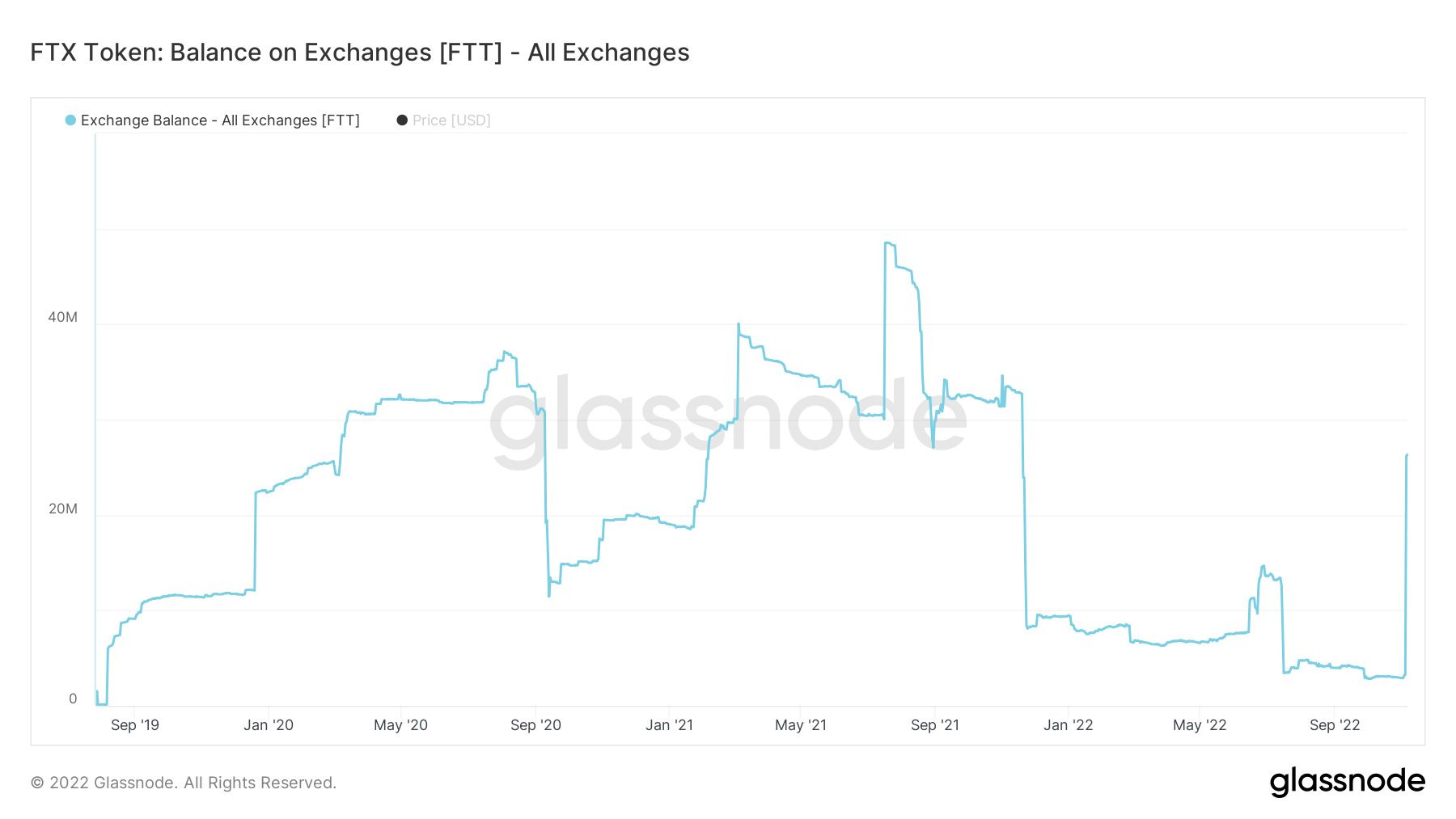

However, the information on the chain displays that the signal is not as well favourable. The amount of FTT tokens sent to the FTX exchange is seeing a sudden improve, demonstrating that traders are transferring coins to the exchange for a robust discharge.

Also, as reported by Coinlive, FTX is in a “bank run” state when customers massively withdraw income from FTX due to concern that the exchange lacks major liquidity. Over the weekend alone, there had been far more than 451 million bucks stablecoin withdrawn from the FTX exchange.

So exactly where does FTX get income to guarantee liquidity on the exchange and “hold the price” of FTT? The neighborhood has a conspiracy concept like this.

The “someone” conspiracy concept dumps SOL

Not just FTT, Solana-based mostly coins also noticed a steep drop. In the final 24 hrs, the price tag of SOL has 14% low costfluctuates all-around 31 USD.

Price of serum (SRM) as well download far more than seven% worth, is trading all-around .75 USD.

After Alameda Research’s “Portfolio” was unveiled with all the illiquid Solana tokens, the neighborhood was “worried” that Sam had offered all of these coins to get income to “save” FTT.

So is Alameda naturally downloading SOL absolutely to assistance the FTT price tag at 22?

– kamikaz TH (@kamikaz_ETH) November 7, 2022

And you, do you feel in this “conspiracy theory”?

Synthetic currency 68

Maybe you are interested: