Cryptocurrency exchange FTX has been unable to comprehensive a 45,000 BTC “raise” transaction really worth more than $ two billion considering that September ten.

The “mystery” of FTX’s 45,000 BTC transaction

On September 13, numerous Twitter consumers who specialize in analyzing Bitcoin’s blockchain information found suspicious spots surrounding a “huge” BTC transaction.

As a consequence, this transaction was very first recorded about 10pm on September ten, 2021 at Bitcoin block amount 699,915, with a worth of 45,504 BTC.

Whale alert! 🐋 Someone moved 45,504 BTC ($ two billion) to the 699,915 block https://t.co/Ru7u0pu0Nj

– Bitcoin Block Bot (@BtcBlockBot) September 10, 2021

Trading originates from FTX, the primary crypto derivatives exchange these days. With this kind of a substantial transfer worth, it is pretty very likely that this is a transaction that alterations the FTX wallet to make certain the security of the money on the exchange, which is frequently finished by other important exchanges.

However, an sudden level was immediately found. The aforementioned 45,000 BTC has considering that been routinely transferred from 1 wallet to an additional every single ten minutes, that means every single Bitcoin block mined considering that September ten has recorded it. The oddity does not cease there when following just about every transaction, 45k BTC will value a charge for the Bitcoin network and depart some BTC in the wallet that holds them.

From begin to now, which is practically four days, from the authentic 45,504 BTC, the FTX transaction is only 44,578 BTC at block amount 700,477, which signifies that it has been eroded by about one thousand BTC but does not appear to cease nonetheless.

Whale alert! 🐋 Someone moved 44,578 BTC ($ two billion) to the 700,477 block https://t.co/dlEBa76YqX

– Bitcoin Block Bot (@BtcBlockBot) September 14, 2021

Hypotheses posed

As quickly as they observed the dilemma, numerous persons spoke to verify that the FTX exchange was hacked, with losses amounting to more than $ two billion. If real, this would be the biggest cryptocurrency assault in background, far ahead of Poly Network’s record of $ 611 million in August.

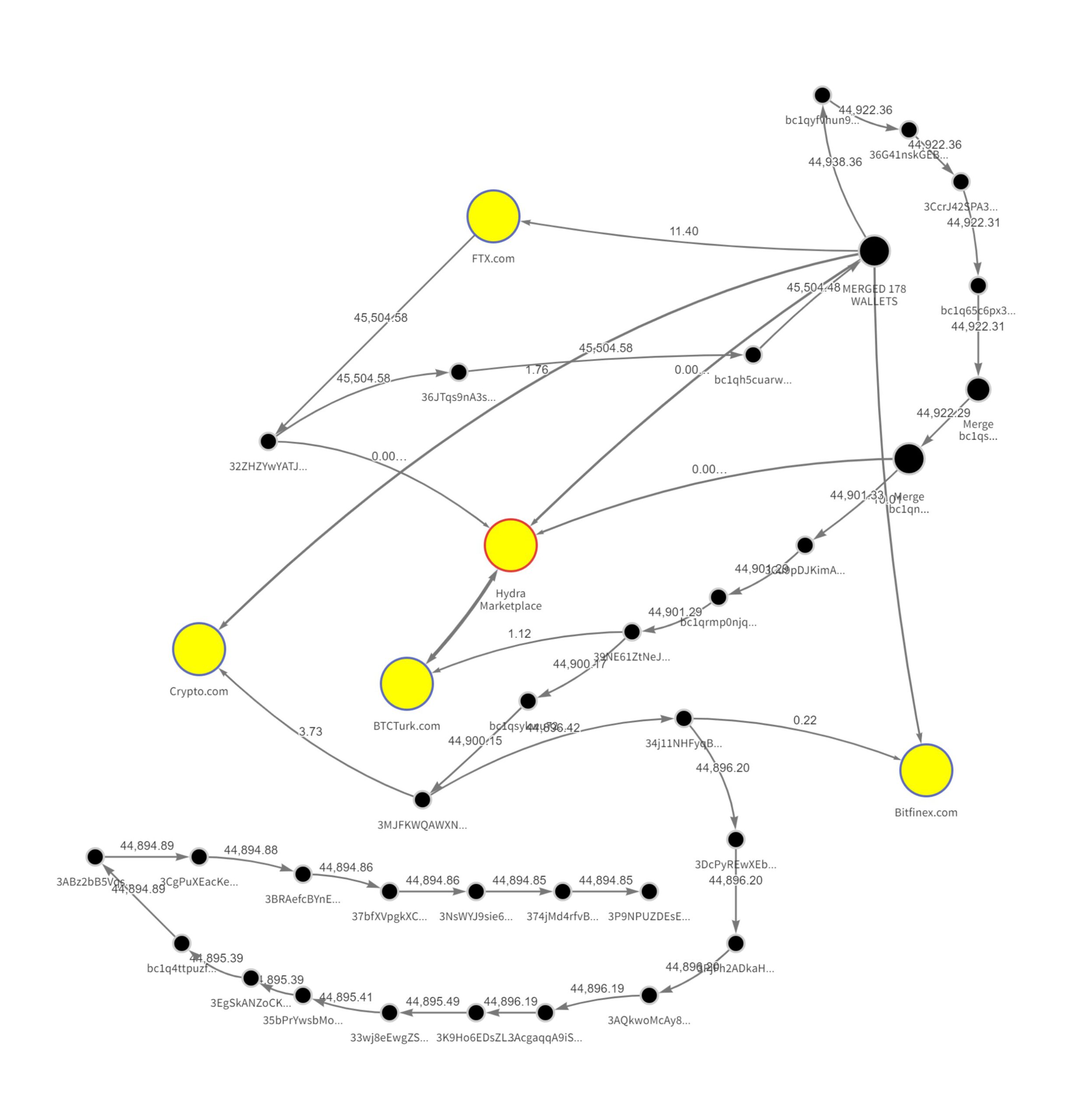

The purpose they came to this conclusion is that, following monitoring the funds movement, analysts uncovered that the 45k BTC was after transferred to a wallet linked to Hydra, a black marketplace for “forbidden assets” in the United kingdom. Russia.

Even so, this assumption is not reliable adequate since in addition to Hydra, money are also transferred to Crypto.com and Bitfinex wallets, so almost everything would seem to be random. Not to mention the reality that if FTX had basically been hacked, the attacker would have had to come across a way to split the dollars to disperse it as immediately as achievable, rather of leaving it as a giant, very easily traceable lump on the blockchain.

This prospects to the 2nd assumption, that the over transaction was basically executed by FTX, but the exchange has misplaced manage of this funds movement. It is achievable that FTX’s wallet exchange operation encountered some form of dilemma, resulting in 45,000 BTC becoming moved back and forth without the need of stopping. However, there is no proof to help this so far.

What does the FTX exchange say?

Before the neighborhood pleasure on the evening of September 13, FTX CEO Sam Bankman-Fried created a short announcement about the over transaction.

For people who will not know, processing Bitcoin withdrawals entails combining UTXOs from deposit addresses, and so on a couple of days in the past we consolidated some UTXOs in tackle to velocity up processing.

– SBF (@SBF_FTX) September 13, 2021

“For those of you who don’t know, Bitcoin withdrawal involves combining multiple UTXO data from deposit addresses, a few days ago we merged multiple UXTOs into one address to help with processing. Faster.”

* UTXO stands for Unspent Transaction Output, the phrase can be understood as the quantity of cryptocurrency that was not utilised in this transaction, so it can be utilised in subsequent transactions.

The FTX boss’s statement confirmed that the 45k BTC transaction was without a doubt created by the exchange, but he even now could not clarify why the dollars was even now moving.

On the morning of September 14, Sam Bankman-Fried went on to publish two much more tweets explaining:

(We create a new exchange tackle with just about every withdrawal)

– SBF (@SBF_FTX) September 14, 2021

“Note that cash flow will rotate when we make BTC withdrawals, so don’t be surprised if the aforementioned funds keep moving.”

“We will generate new addresses with each transaction.”

Sam’s newest posts will not make it substantially clearer. First, he did not mention when this transaction will cease, as very well as confirming that FTX even now has complete manage of the dollars and no matter whether BTC is even now safe and sound. Such back and forth transactions are eroding much more and much more dollars, does not FTX regret Bitcoin so substantially?

Secondly, Sam also claimed that the addresses containing the 45,000 BTC transaction have been designed by FTX, so why is there an tackle linked with Hydra?

The information offered at the time of creating is much more indicative of the 2nd hypothesis, that all through a substantial Bitcoin withdrawal transaction, the FTX staff ran into a dilemma someplace, resulting in 45,504 BTC crashing and going back and forth. following just about every new block of Bitcoin (every single ten minutes).

Until FTX releases much more affirmative data or fixes the dilemma quickly, this will carry on to be a “slow blast bomb” looming more than the cryptocurrency marketplace.

Synthetic Currency 68

Maybe you are interested: