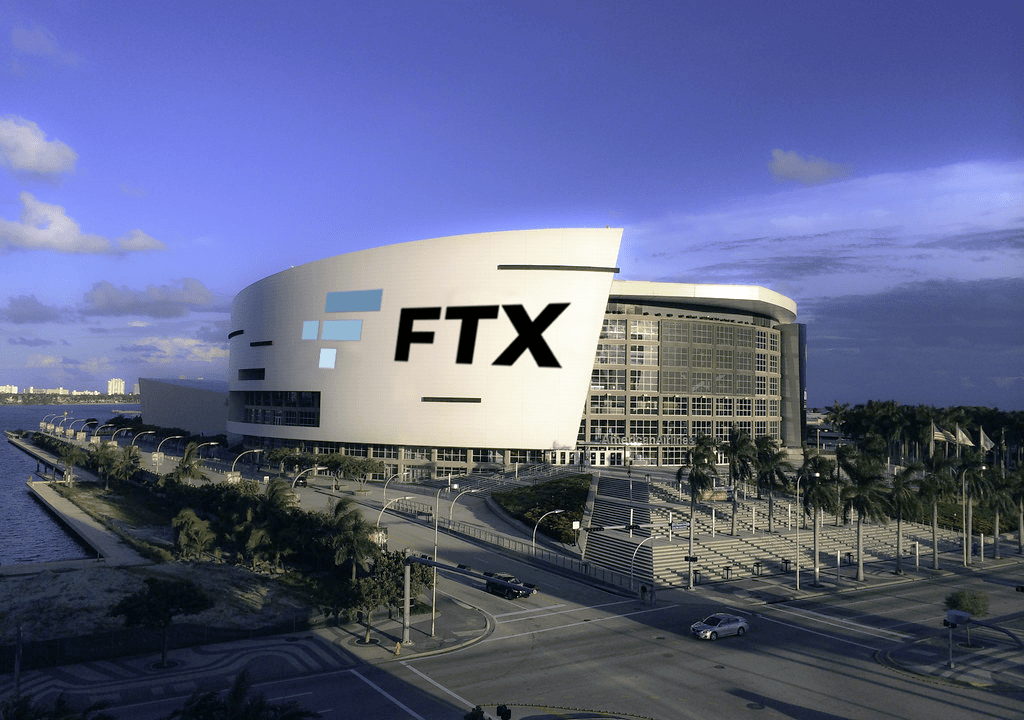

US-primarily based cryptocurrency exchange FTX announced it had accomplished a valuation of $ eight billion right after raising $ 400 million in its 1st round of funding from significant traders.

As Coinlive reported in early December, FTX’s US subsidiary FTX.US is getting ready a program to increase $ one.five billion at a $ eight billion valuation. As announced on January 25th, FTX.US has officially raised $ 400 million in a Series A round to fulfill the over ambition, producing it 1 of the most important corporations in the cryptocurrency industry.

A broad selection of regular crypto and institutional money participated in the round, which include Paradigm, Multicoin Capital, SoftBank, Lightspeed Venture Partners and Temasek. FTX.US President Brett Harrison shared:

“The event means a lot to us, officially putting FTX.US on the stage of the biggest competitors in the US cryptocurrency exchange space and signaling to the world that we will continue to expand very rapidly.”

Led by Brett Harrison, FTX.US is 1 of the most renowned corporations top the wave of cryptocurrencies in the United States. In its report for the third quarter of 2021, FTX.US posted record income, outperforming its direct competitor Coinbase, with a 75% drop in net revenue, resulting in a blow to COIN shares. , recorded in the identical time frame.

However, Coinbase nevertheless maintains a trading volume of all-around $ one hundred billion per month. Harrison hopes FTX.US will slowly catch up with Coinbase and maximize the industry share of the double-digit exchange by the finish of 2022.

He’s betting that the addition of stocks and diverse crypto items will fuel that development. Indeed, FTX.US acquired the US derivatives exchange LedgerX in buy to strengthen its legal place and express its curiosity in supplying crypto stock and possibility trading.

However, it can be mentioned that even at the starting of the 1st month of 2022, coupled with the rather damaging industry movements, it is nevertheless not probable to end the wave of capital mobilization, investments / acquisitions and deployment. significant boys to proceed exploiting probable possibilities with the cryptocurrency sector, which is nevertheless pretty younger.

Most notable are FTX exchanges ($ two billion), Animoca Brands ($ 359 million), Microsoft (acquired Activision Blizzard for $ 68.seven billion), NFT Autograph platform ($ 170 million), Secret Network ($ 400 million) , ICON ($ 200 million), Close to Protocol ($ 150 million) and Serum ($ 75 million).

Synthetic currency 68

Maybe you are interested: