[ad_1]

The Central Bank of China (PBoC) has convened a meeting with a group of commercial banks and mobile payment providers about freezing the accounts of crypto OTC trading users.

After the hashrate of Bitcoin miners in China continued to decrease as a result of the influence of Sichuan state, the crackdown on crypto-related activities continued in China.

Earlier this week, the Central Bank of China (PBoC) asked national commercial banks to freeze the accounts of people who are trading cryptocurrencies over the counter.

Specifically, on June 21, the PBoC convened a meeting with a range of domestic banks in addition to mobile payment providers. The parties for this meeting include:

- Agricultural Bank of China

- China Construction Bank

- Industrial and Commercial Bank of China

- China Postal Savings Bank

- Industrial Bank of China

- Alipay mobile payment program

According into the PBoC, speculation in addition to cryptocurrency trading has severely disrupted the equilibrium in the Chinese financial system. This risks creating illegal capital flows from the country’s borders in addition to money laundering.

The PBoC also asked the participants to enhance the internal monitoring algorithm to recognize cryptocurrency trades more accurately.

Also on June 21, the Agricultural Bank of China declared that:

The Agricultural Bank of China once again published the deleted webpage, and Alipay also issued a related announcement. https://t.co/TmV9TmSiuU https://t.co/WsQL9vvouC pic.twitter.com/2rGSmwfRa4

— Wu Blockchain (@WuBlockchain) June 21, 2021

“If any user is found to be trading cryptocurrencies, the bank will freeze the customer account and report the matter to the relevant authorities.”

However, this note was eliminated by the bank soon after.

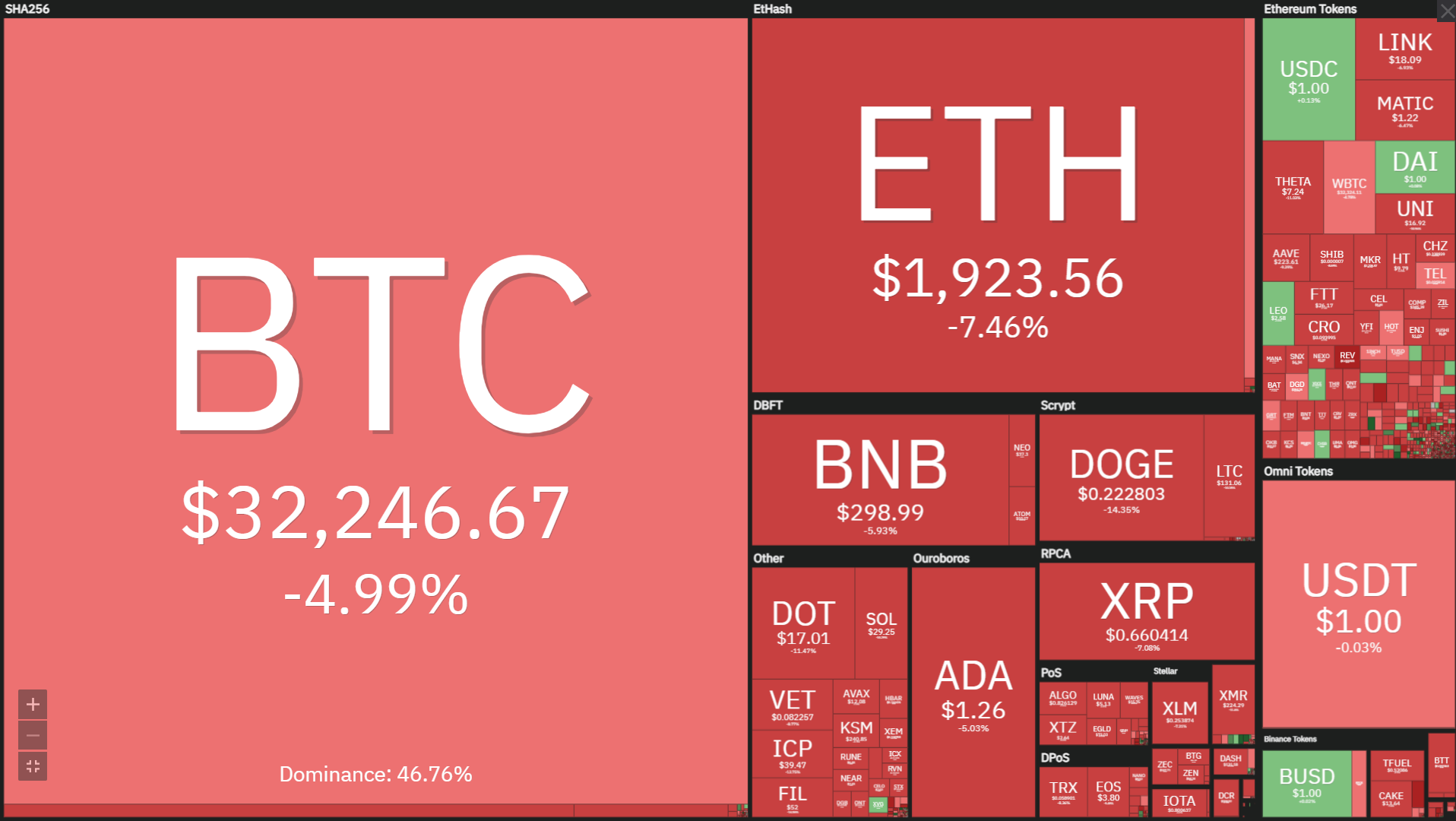

Although deleted, the Bitcoin price immediately dropped below $32,000down almost 10%. Not only Bitcoin but many different cryptocurrencies are also heavily influenced. May be mentioned as:

Ethereum (ETH) has dropped as low as $1,950, down -13.59% as of press time). Other cryptocurrencies have a poor situation when XRP -6.73%; ADA -4.46% and DOT -11.24%…

Synthetic

Maybe you’re interested:

.

[ad_2]