The approaching “huge” worth investment fund can serve as a “lifesaver” for the two Galaxy Digital and Genesis Trading.

According to the profile of the Securities and Exchange Commission (SEC) announced on August 29, the leading leaders of cryptocurrency investment giant Galaxy Digital and cryptocurrency lending company Genesis Trading are teaming up to increase $ 500 million to produce a new crypto fund known as DBA Crypto. Fund I LP.

The filing for DBA Crypto Fund I LP lists Michael Jordan of Galaxy Digital, Joshua Lim and Roshun Patel of Genesis Trading, and trader Shane Barratt as the company’s common partners.https://t.co/dWyT4n5PdB

– Axios Pro (@AxiosPro) August 29, 2022

The record of DBA Crypto Fund I LPs incorporates senior executives this kind of as Michael Jordan – co-investment manager of Galaxy Digital, Joshua Lim, head of derivatives at Genesis Trading, former Genesis Vice President Roshun Patel and the founder and CEO of Convex Trading, Shane Barratt.

Given the existing problem, the new fund targeted by Galaxy Digital and Genesis Trading could aim to help the two organizations following the hefty losses recorded in latest months. Galaxy Digital reported a reduction of extra than $ 554 million in the 2nd quarter of 2022, the primary explanation the corporation had to pull out of its $ one.two billion BitGo acquisition.

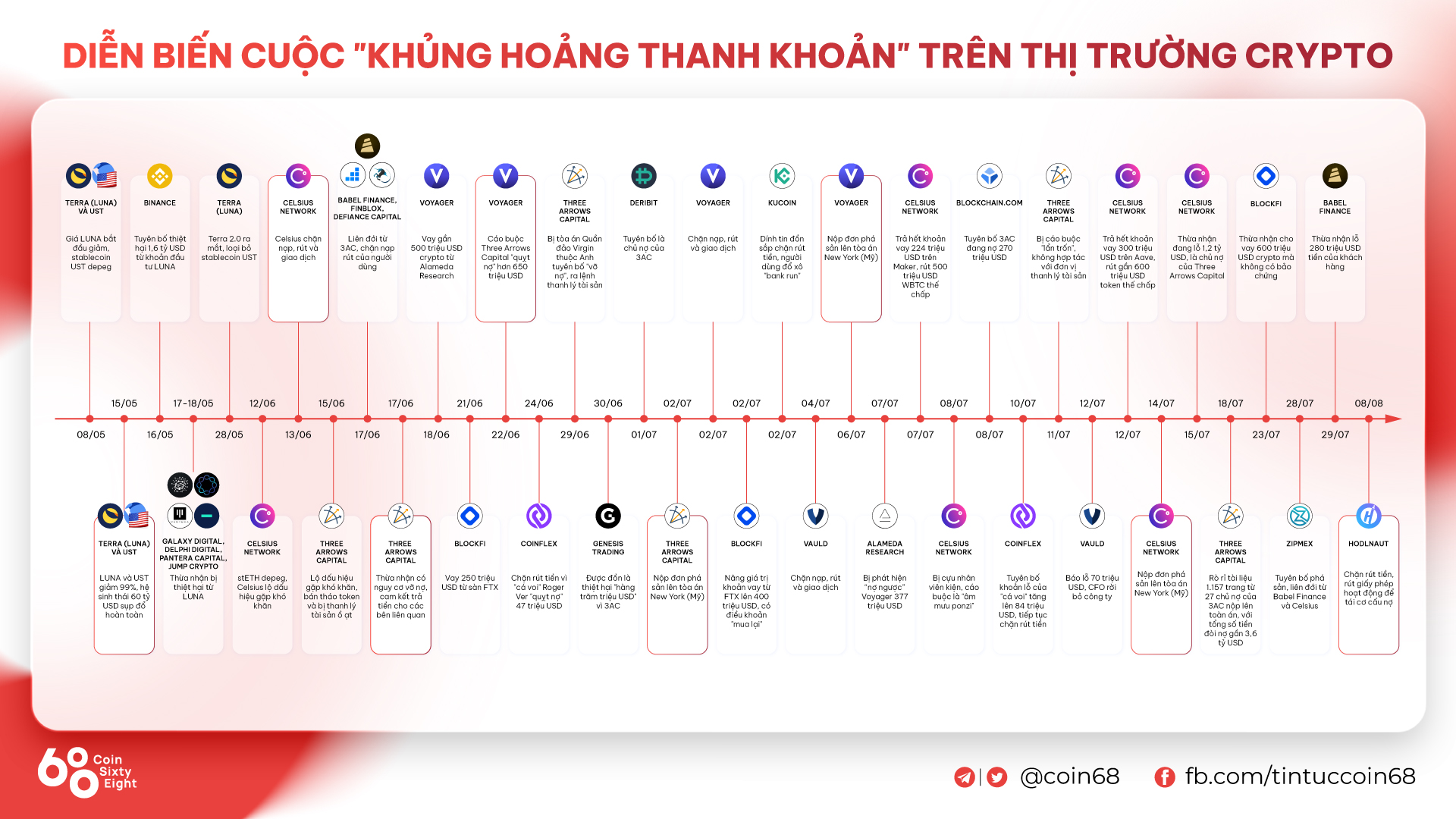

Meanwhile, Genesis Trading has unveiled up to $ two.36 billion of publicity to bankrupt hedge fund Three Arrows Capital (3AC). The corporation later on filed a lawsuit towards 3AC in the course of liquidation, but the reduction was mentioned to be irreparable extra aggressively. The aftermath of the crisis was that Genesis Trading fired twenty% of its personnel and CEO Michael Moro announced his resignation.

However, the hottest fundraising move by the two giants of “terrible” worth can be a good signal for the market place, primarily in this hard time period. More broadly, nevertheless, this is just a single of the number of extraordinary offers that have occurred in latest months, reflecting a expanding sense of caution in fundraising at the cryptocurrency market degree.

Synthetic currency 68

Maybe you are interested: