Galaxy Research just released its cryptocurrency market forecast for 2025. The report highlights important trends, including the possibility of Bitcoin reaching new historic highs and the continued expansion of the stablecoin market.

Other industry news also suggests an eventful year ahead, with countries continuing to adopt Bitcoin and Tether’s dominance in the stablecoin sector possibly waning.

Bitcoin and Ethereum reach new heights

Galaxy Research predicts that Bitcoin will reach a new historic high in 2025. The firm expects the leading cryptocurrency to surpass $150,000 in the first half of the year and climb to $185,000 by the fourth quarter.

This boom will be driven by growing adoption from large corporations and nation-states. The report predicts that five companies in the Nasdaq 100 and five countries will add Bitcoin to their balance sheets, thanks to their diversification strategies and demand for transaction settlements.

“Competition among states, especially non-aligned states, those with large sovereign wealth funds, or even those rivaling the United States, will drive strategies of exploitation or Buy Bitcoin,” Galaxy Research stated.

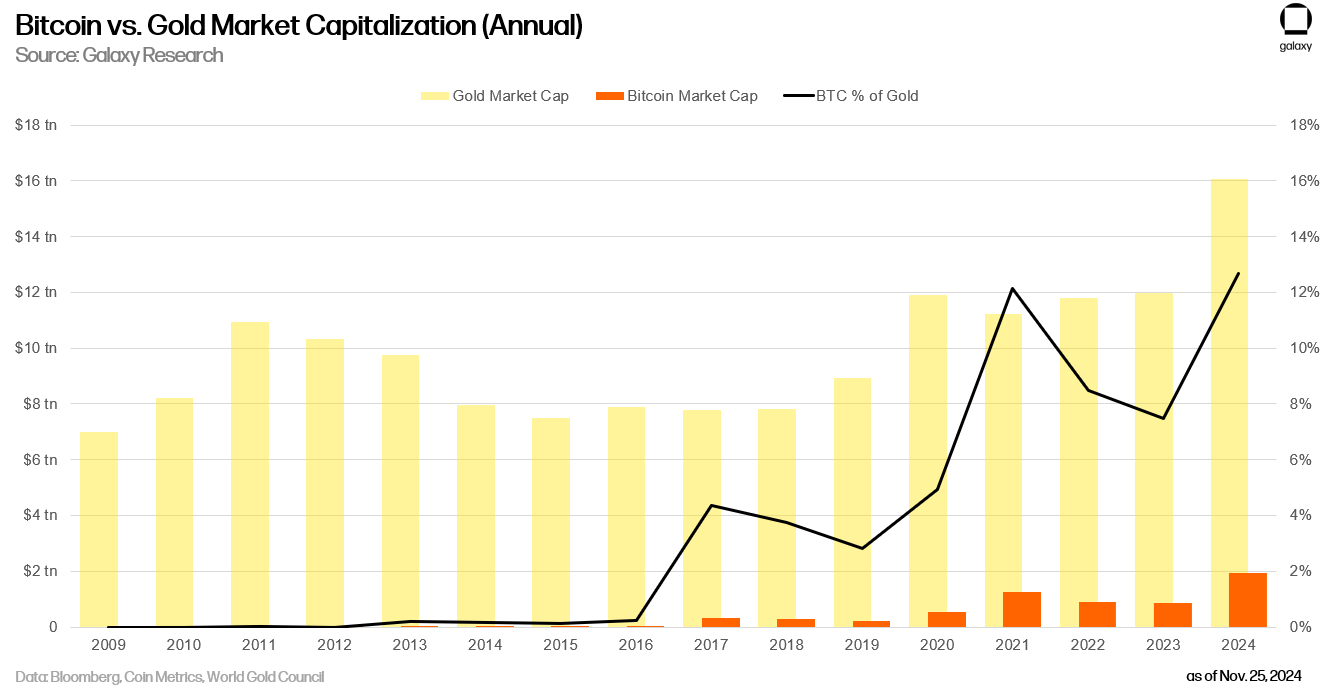

Bitcoin is also predicted to continue to gain momentum in investment markets. Spot Bitcoin ETFs can manage over $250 billion in total assets, cementing BTC’s role as a leading alternative asset class. By 2025, its market capitalization could rival gold’s value by 20%, cementing its status as a top investment.

Ethereum, the 2nd largest cryptocurrency, is also heading for strong growth. The report estimates Ethereum could trade at $5,500 in 2025, with DeFi and staking serving as the main growth drivers. Regulatory improvements are likely to create favorable conditions, pushing Ethereum’s staking participation rate above 50% and enhancing its network activity.

The company also predicts that Dogecoin will reach the $1 milestone and a $100 billion market capitalization, thanks to sustained community support and utility expansion.

Stablecoin market develops further

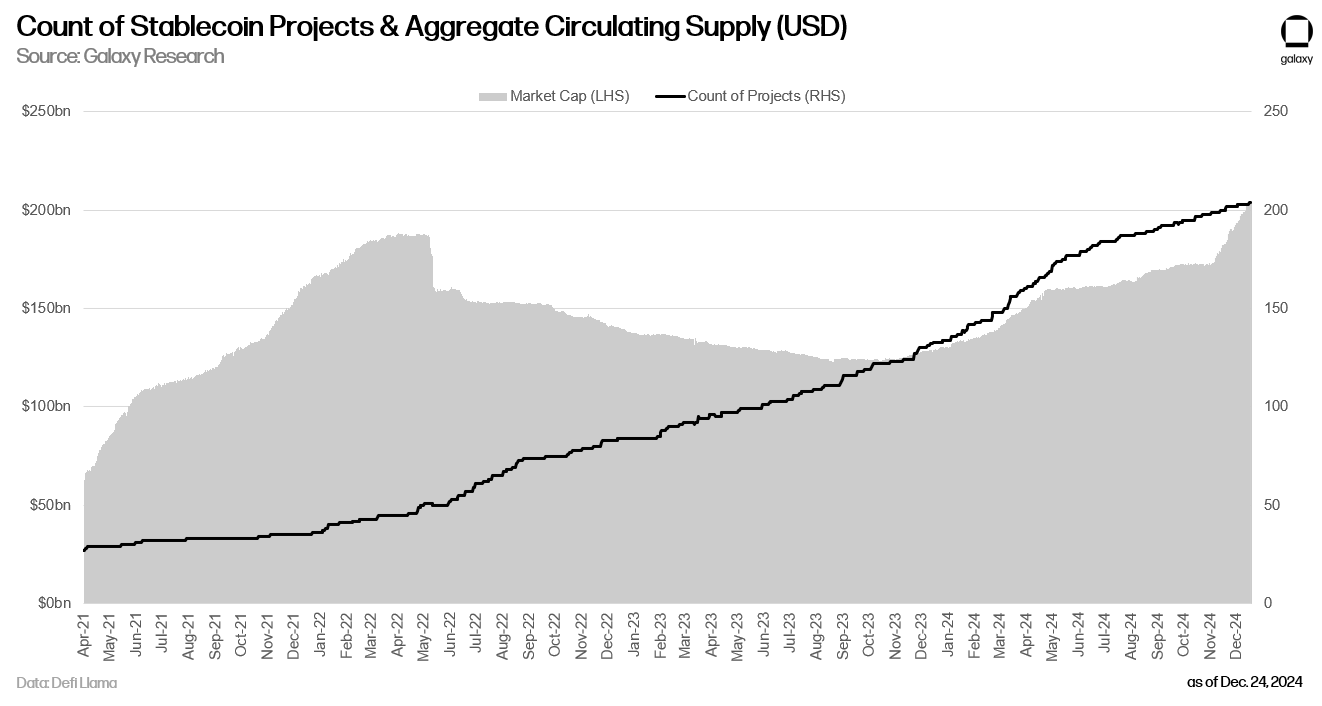

Galaxy Research predicts dynamic change in the stablecoin sector. The report expects total stablecoin supply to surpass $400 billion by 2025, with at least ten new stablecoin projects backed by traditional financial partnerships entering the market. These developments will expand the use of stablecoins for payments, remittances and payments.

“Further regulatory clarity for both existing stablecoin issuers and traditional banks, credit unions, and treasuries will lead to an explosion in stablecoin supply in 2025,” Galaxy said.

However, Tether’s dominance is predicted to fall below 50% as new competitors offer yielding alternatives. Competitors were able to attract users by sharing revenue from reserve yields, forcing Tether to adjust its strategy. The company suggested that Tether could introduce a delta-neutral stablecoin to remain competitive.

USDC has the potential to increase momentum further, supported by reward programs integrated into leading platforms such as Coinbase. This strategy could significantly improve user adoption and boost the DeFi ecosystem, demonstrating the growing convergence between cryptocurrencies and traditional financial services.

Policy and market structure are the highlights

Legally, the US government probably won’t buy Bitcoin publicly but could consolidate its current holdings. Discussions on Bitcoin reserve policy are likely to take place, although significant steps may not take place immediately.

“There will be some moves within departments and agencies to consider an expanded Bitcoin reserve policy,” the company stated.

Galaxy Research also predicts that there will be bipartisan legislation establishing stablecoin regulations in the United States. The move could create a regulatory framework for closer oversight and encourage widespread adoption of dollar-backed digital currencies.

The firm continues that while clarification on stablecoins may be moving forward, delays in comprehensive regulatory reforms for the broader cryptocurrency market will leave some uncertainty in the space.