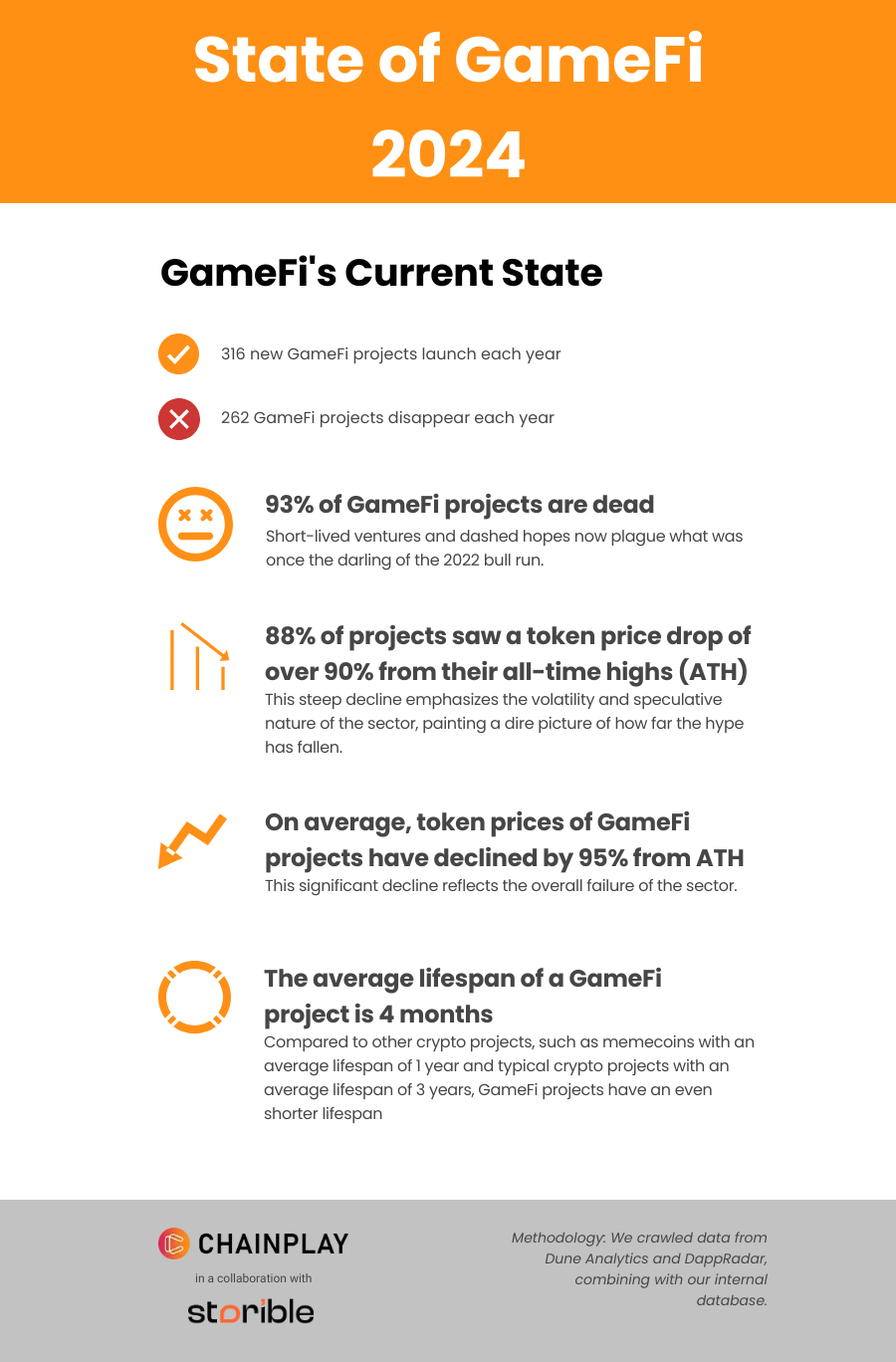

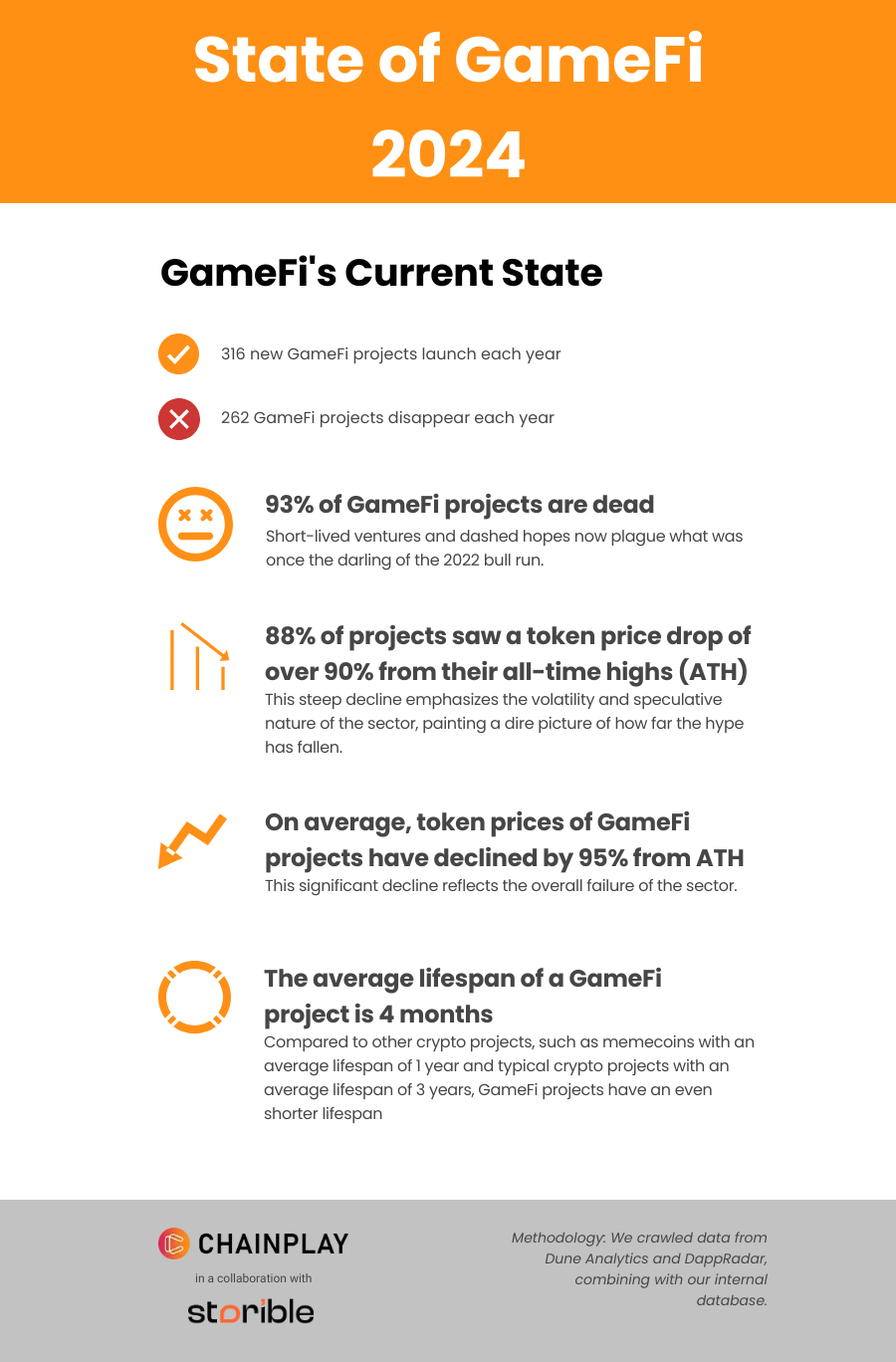

According to a new report from ChainPlay, 93% of Web3’s GameFi projects have shut down. The company analyzed 3,279 projects and determined that the average value per application has dropped 95% from its peak.

No segment of the industry has escaped this downward pressure, but some venture capital (VC) firms have managed to make profitable investments.

GameFi Is Collapse

ChainPlay published this gloomy analysis of the GameFi industry above blog mine this week. Essentially, the peak in funding and enthusiasm for GameFi was in 2022, but much of the business has proved completely unsustainable. Even this year’s prominent airdrops could not prevent this harsh decline.

These numbers are so disappointing that the report makes no claim that any region delivered better returns.

For example, some industry commentary has suggested that Tap-to-Earn gaming is the future of GameFi investing. Cloud gaming is also growing, and Aethir recently created a $100 million fund for its growth. However, none of this contradicts the downward trend.

However, ChainPlay is very clear that there are still profits that can be made. The average retail investor saw returns of 15%, and the report states that “the ambition of achieving financial success with GameFi has turned into a scary reality” for these retail users. However, institutional investors achieve much higher returns.

“For venture capitalists (VCs), returns are much more polarized. The average VC return stands at 66%, showing that strategic bets can deliver value despite broader market struggles. The top performers are also the leaders in the cryptocurrency market. This shows that prudent VC investments can still generate profits,” ChainPlay stated.

However, the best performing VC firm was Alameda Research, a subsidiary of FTX, which saw a 713.15% return on its investment. Given the massive fraud Alameda was involved in, its GameFi strategies are unlikely to be a replicable model.

In total, GameFi investment in 2024 is down more than 84% from its 2022 peak. Venture capital firms are still making strategic bets on certain projects, and these could create generate significant profits. However, for individual users, “the volatility that once promised huge growth potential has now proven to be a double-edged sword,” and profit results are lackluster.

General Bitcoin News

According to a new report from ChainPlay, 93% of Web3’s GameFi projects have shut down. The company analyzed 3,279 projects and determined that the average value per application has dropped 95% from its peak.

No segment of the industry has escaped this downward pressure, but some venture capital (VC) firms have managed to make profitable investments.

GameFi Is Collapse

ChainPlay published this gloomy analysis of the GameFi industry above blog mine this week. Essentially, the peak in funding and enthusiasm for GameFi was in 2022, but much of the business has proved completely unsustainable. Even this year’s prominent airdrops could not prevent this harsh decline.

These numbers are so disappointing that the report makes no claim that any region delivered better returns.

For example, some industry commentary has suggested that Tap-to-Earn gaming is the future of GameFi investing. Cloud gaming is also growing, and Aethir recently created a $100 million fund for its growth. However, none of this contradicts the downward trend.

However, ChainPlay is very clear that there are still profits that can be made. The average retail investor saw returns of 15%, and the report states that “the ambition of achieving financial success with GameFi has turned into a scary reality” for these retail users. However, institutional investors achieve much higher returns.

“For venture capitalists (VCs), returns are much more polarized. The average VC return stands at 66%, showing that strategic bets can deliver value despite broader market struggles. The top performers are also the leaders in the cryptocurrency market. This shows that prudent VC investments can still generate profits,” ChainPlay stated.

However, the best performing VC firm was Alameda Research, a subsidiary of FTX, which saw a 713.15% return on its investment. Given the massive fraud Alameda was involved in, its GameFi strategies are unlikely to be a replicable model.

In total, GameFi investment in 2024 is down more than 84% from its 2022 peak. Venture capital firms are still making strategic bets on certain projects, and these could create generate significant profits. However, for individual users, “the volatility that once promised huge growth potential has now proven to be a double-edged sword,” and profit results are lackluster.