In the Arbitrum Odyssey series of occasions, a fantastic deal of sources are drawn to this degree two ecosystem. However, accompanying this pleasure are structural limitations, the most obvious getting the fuel tariff.

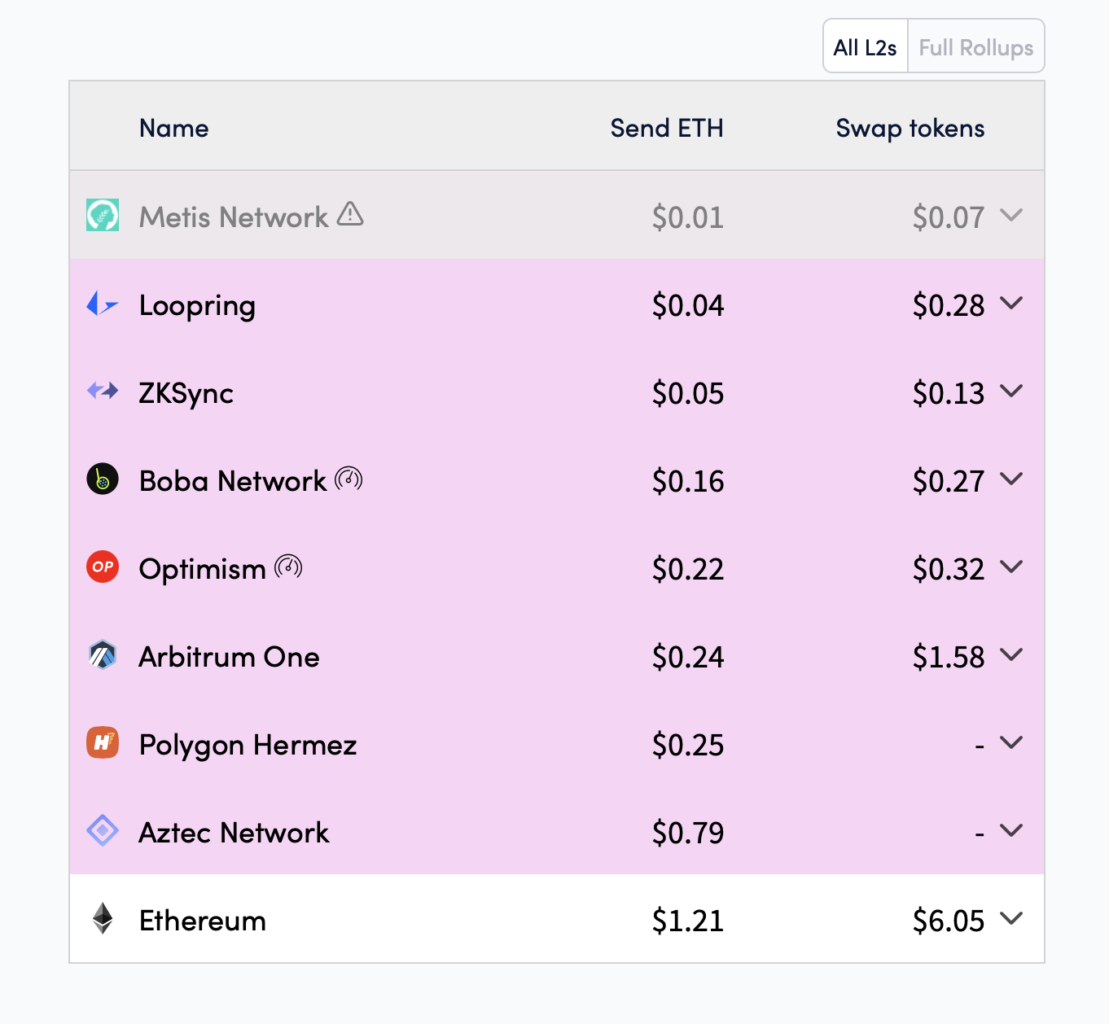

According to numerous data of the day, there are instances when the transaction charges on Arbitrum are even increased than people of Layer-one (the primary Ethereum network).

Currently, the fuel charges on Arbitrum, which is a layer two on Ethereum, are also substantial in contrast to the primary Ethereum network itself.

While it expenditures $ three.9 for an exchange on the primary network. The very same transaction expenditures $ four.five on Arbitrum.

What is your viewpoint on this subject? pic.twitter.com/ODXBjoo3Sx

– Official Airdrop🍥 (@its_airdrop) June 29, 2022

At the time of creating, the transaction charge on Arbitrum has temporarily cooled and returned to one-two USD per trade.

However, this move can be regarded brief-phrase, as Arbitrum is launching the Odyssey plan, a series of actions every week the place end users will have to have to complete particular actions to get rewards from Arbitrum.

Arbitrum has also set a record in intraday trading and this milestone may perhaps also carry on to be shattered as the Odyssey incentive plan enters its 2nd week.

Daily transactions on Arbitrum at all-time highs pic.twitter.com/nbIVw89szm

– Nansen Alpha (@nansen_alpha) June 26, 2022

Parallel to the explanation for the skyrocketing demand, in terms of infrastructure supplied, Arbitrum even now faces some bottlenecks in the Batch (packaging) phase of transactions, generating the transaction processing capability not nevertheless optimized.

With optimistic rollups like Arbitrum, there are also bottlenecks in information availability. Readers can click on the hyperlink beneath to master much more about the availability of information.

> See also: Data Availability – Ethereum Rollup Bottleneck

In addition to the historical past of transaction charges, end users also experience liquidity-associated stories when transferring ETH from other ecosystems to Arbitrum.

Hop Protocol – the winning alternative for the very first week (Bridge Week) of the Odyssey plan – ran into liquidity complications, creating quite a few ETH transfers from other chains to be delayed.

27 hrs have passed and even now no ETH polygon for Ethereum away @HopProtocol – it truly is standard??

What am I executing incorrect?

– Alex Svanevik🐧 (@ASvanevik) June 28, 2022

Regarding the task, Hop Protocol mentioned it is processing backlog transactions and expects liquidity in the close to potential to quickly attain the trading volume and demand for the transfer of ETH to Arbitrum when Bridge Week has just ended.

Synthetic currency 68

Maybe you are interested: