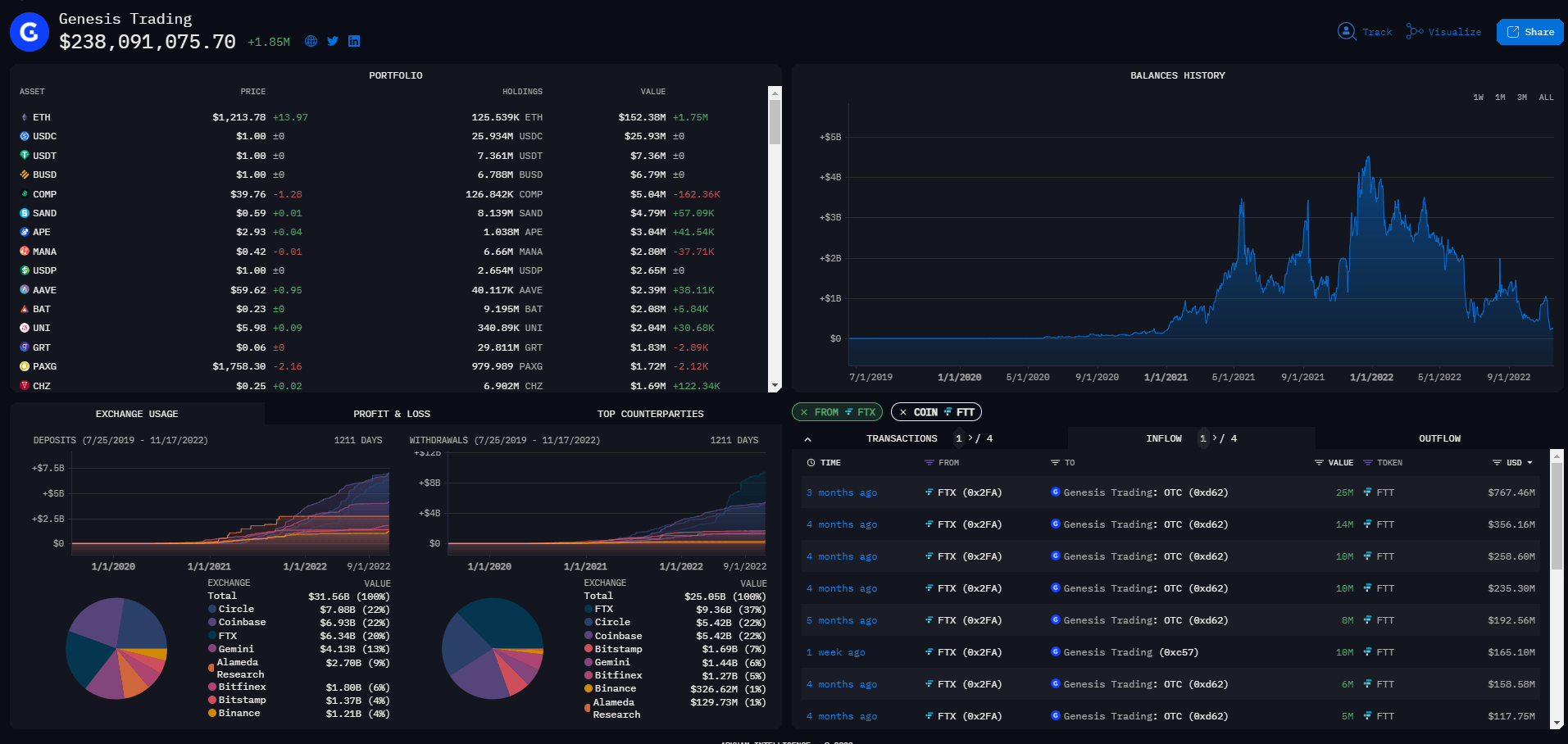

An examination of the Arkham Intelligence CryptoSlate Research dashboard exhibits that preferred crypto loan provider Genesis has obtained billions of bucks in FTT from bankrupt crypto corporations Alameda Research and FTX above the previous 12 months.

For context, Genesis obtained $932.56 million really worth of FTT tokens from FTX inside of the previous 3 months, even though it obtained $141.one million really worth of struggling tokens from FTX. Alameda Research for the duration of the identical time period.

The crypto loan provider not too long ago halted all purchaser withdrawals due to the collapse of FTX. Genesis claims that the incident resulted in “unusual withdrawal requests” that exceeded its liquidity.

Meanwhile, reviews uncovered that the loan provider had not obtained a $one billion emergency loan from traders following the collapse.

Meanwhile, the extent of FTX’s fall to the Genesis company is telling when one particular considers the worth of the trading assets it owns.

At its peak, Genesis’ trading assets have been near to $five billion. As of press time, the company’s trading assets are really worth about $238 million, in accordance to the Arkham Intelligence dashboard.

Genesis is processing a significant quantity of acquisitions

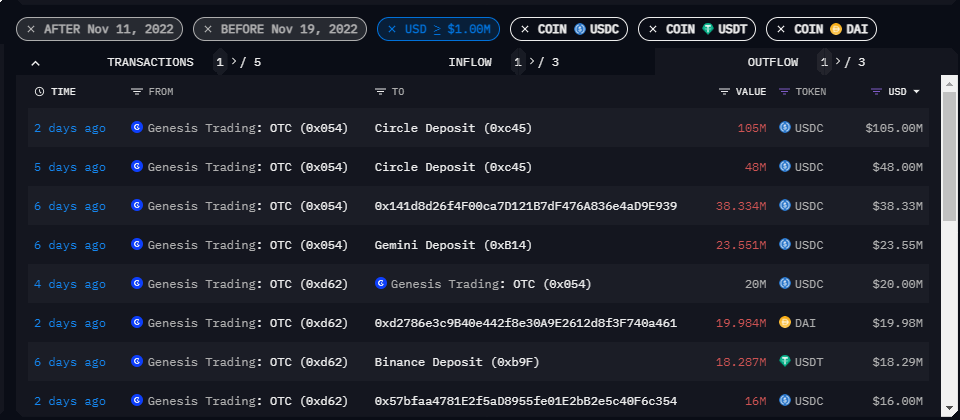

On November sixteen, an deal with labeled Genesis processed its biggest transactions. Arkham Intelligence tweeted on November 18, above $a hundred million USDCoin (USDC) was transferred to Genesis OTC deal with, and that deal with subsequently deposited $105 million USDC into Circle.

Arkham stated this could be a significant purchaser who withdrew from the Genesis OTC platform.

CryptoSlate Research’s examine of the Genesis trading console on the Arkham Intelligence platform exhibits that significant trades are not one particular-off. Instead, it was one particular of several this kind of acquisitions that the loan provider has dealt with not too long ago

According to the dashboard, Genesis OTC processed a 250.9 million USDC buyback inside of the previous 7 days. During the identical time period, the OTC also processed $18.three million in USDT and $twenty million in DAI.

In complete, the OTC processed about $290 million in stablecoin buybacks in 7 days.

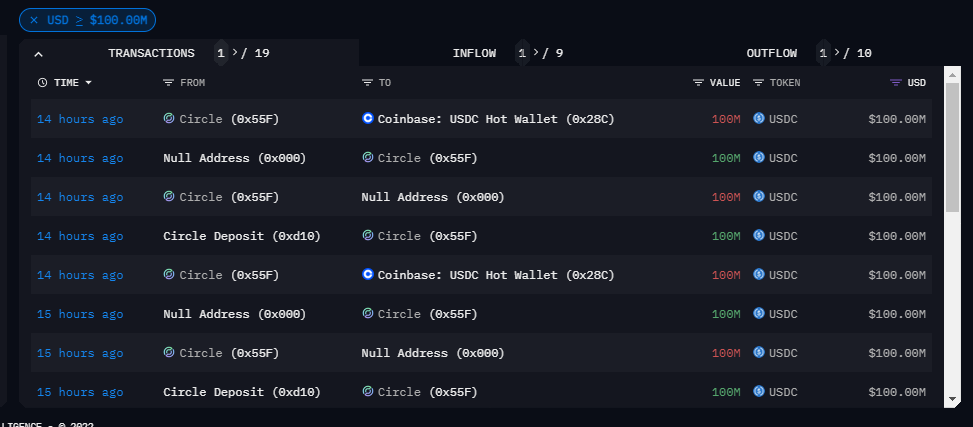

Meanwhile, Circle is also seeing a significant volume of USDC converting to fiat as it has burned hundreds of thousands of USDC.

Arkham Intelligence says USDC is burned when USD is converted into fiat currency. The dashboard exhibits that the stablecoin issuer has burned $a hundred million twice in the final 24 hrs.