In the midst of the crisis, loan provider unit Genesis Trading continued to minimize a further thirty% of its employees as the January eight deadline approached.

Follow CoinDeskstruggling credit score unit, Genesis Trading, has determined to lay off thirty% of its staff, bringing the quantity of staff back to 145 folks. The most impacted divisions are enterprise and BD.

A representative from Genesis mentioned:

“Faced with challenging difficulties, Genesis was forced to make the tough determination to downsize its international headcount. These are the actions that will need to be taken to move the enterprise forward. We enjoy the really hard perform of our talented and committed group and will carry on to perform in direction of discovering the very best resolution for Genesis, consumers and staff for the lengthy phrase.

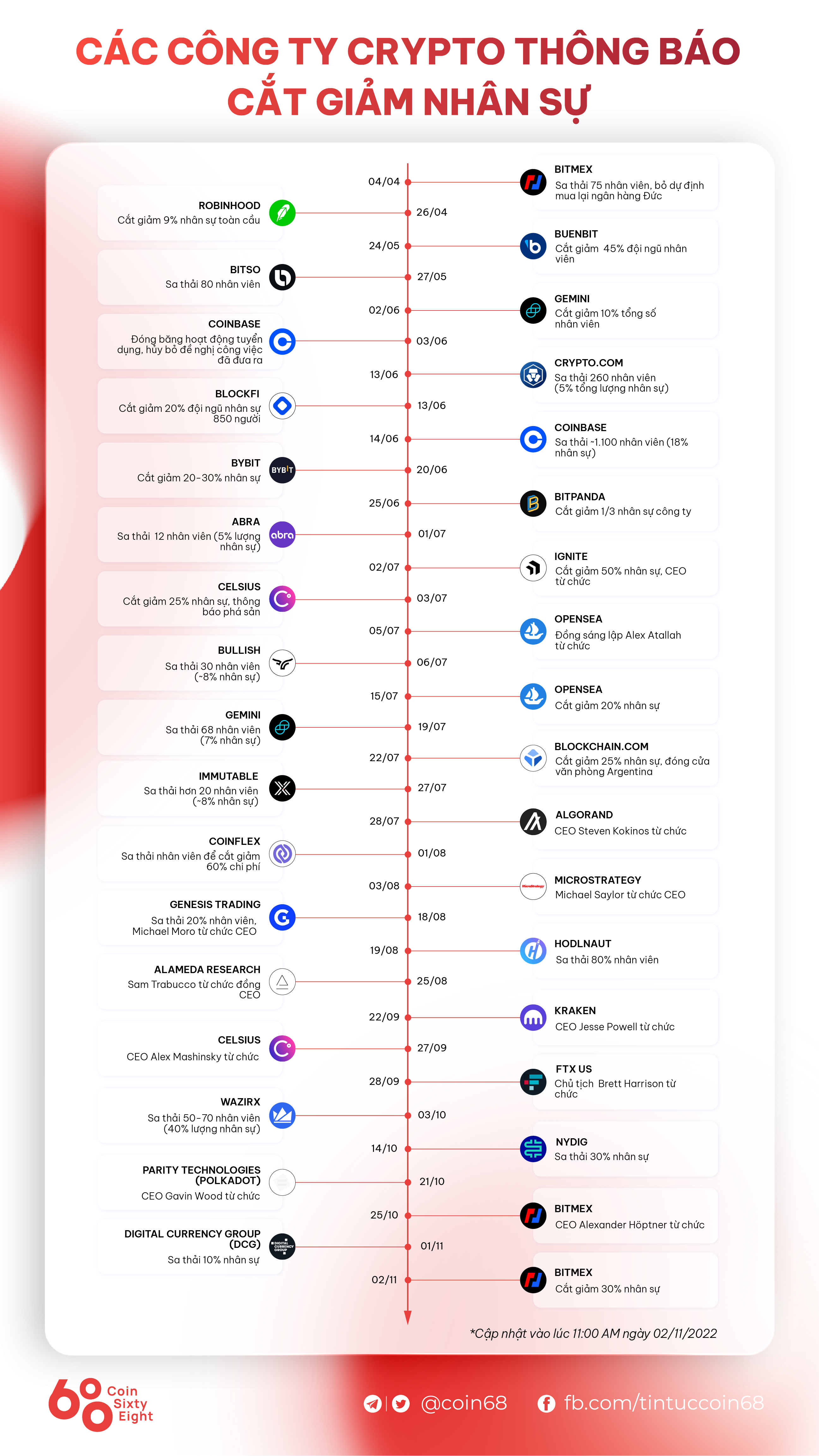

Genesis in August 2022 also mentioned goodbye to twenty% of the complete quantity of staff in the wave of layoffs of the cryptocurrency industry at the time.

These are the hottest developments from Genesis just after this lending unit was mentioned to be insolvent when it stopped withdrawals from mid-November 2022, just days just after FTX went bankrupt.

Not only that, Genesis’ mother or father business, Digital Currency Group (DCG), was also embroiled in a spiral of crisis due to unclear inner transactions, but it created this business insolvent.

After currently being accused of deliberately “buying time” to discover an extremely hard way out, Genesis acquired an “ultimatum” from a $900 million creditor, the Gemini exchange, demanding that a resolution be uncovered by eight/ 08.01.

In response, the Genesis CEO in a Jan. four letter to traders mentioned “more time is needed” to handle the crisis.

Synthetic currency68

Maybe you are interested: