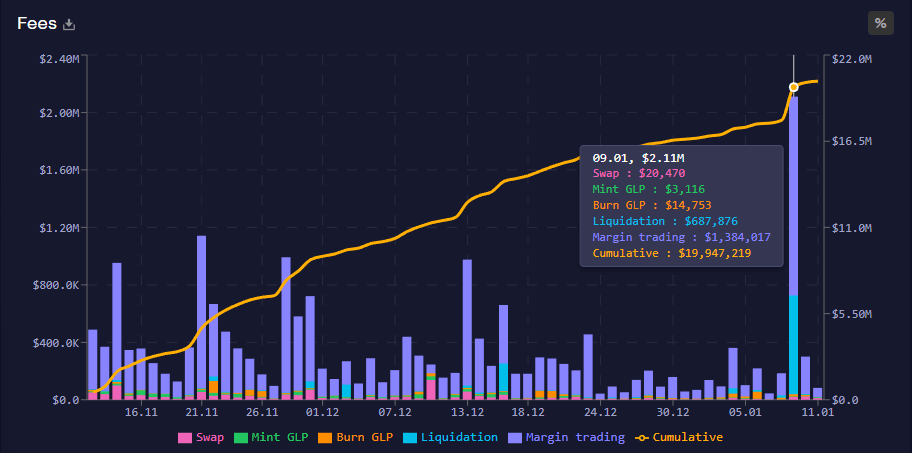

GMX — the native token of the decentralized exchange (DEX) GMX — day-to-day costs hit $two.eleven million on Jan. 9 due to margin trading volume on Avalanche and arbitration.

The huge raise in charge volume — 2nd only to Ethereum on the day — comes just 5 days following the GMX whale wallet was hacked on January four with $three.four million.

About thirty% of the produced costs are swapped into ETH or AVAX and then distributed to GMX token stakers, in accordance to the GMX white paper.

Of the thirty%, about one% is employed to cover the network expenditures of GMX “Keepers” — leaving about 29% of the $two.eleven million — or about $611,900 — for distribution to tokens. GMX bet that.

The GMX token is priced at $44.54 at press time — up one.five% in excess of the previous 24 hrs — and has a marketplace cap of $372.eight million.

CryptoSlate’s exploration exhibits that GMX is one particular of the most effective performers in the 2022 bear marketplace so far.

General Bitcoin News