The price of Goatseus Maximus (GOAT) has skyrocketed 34.19% over the past week, recently reaching the $1 billion market capitalization milestone. However, technical indicators show that the uptrend is losing momentum, with ADX and RSI indicating that momentum is gradually weakening.

Although the EMAs remain bullish, the short-term trends are starting to decline, signaling a possible change in market sentiment. Currently, GOAT is at a crucial point where it could test the resistance at $1.36 or face a deeper correction towards key support zones.

Current Trends Are Losing Momentum

GOAT’s ADX has dropped to 29.77 from 38 over the past few days, indicating a weakening in trend strength. While this value still shows that the asset is in an uptrend, this decline shows that the momentum behind the current trend is gradually fading away.

ADX, or average directional index, measures the strength of a trend on a scale of 0 to 100. Values above 25 indicate a strong trend, while values below 20 indicate a weak or absent market certain direction.

As GOAT’s ADX falls near the lower threshold, it suggests that the current uptrend is losing momentum. If ADX continues to fall further, traders should pay attention to signs of a potential downtrend or sideways movement as the market corrects.

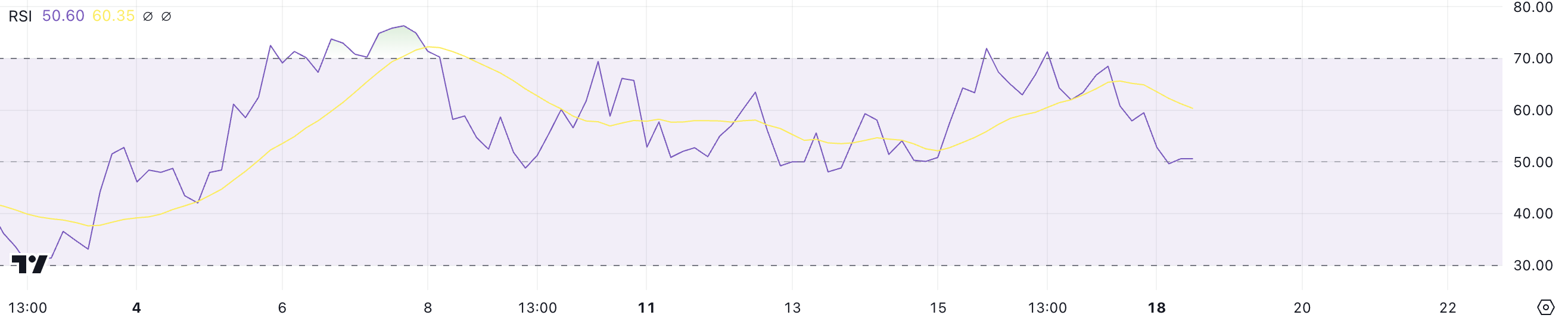

GOAT RSI Shows Neutral Zone

Today, GOAT is the largest coin ever released on Pumpfun, Solana’s largest coin launchpad. GOAT’s RSI has dropped to 50.60 from over 70 a few days ago, reflecting a weakening in bullish momentum. Previously, with RSI above 70, this asset encountered strong upward pressure.

However, the decline to neutral levels suggests buying activity is slowing, indicating that the recent rally has lost momentum and the market is correcting.

RSI, or relative strength index, evaluates the speed and magnitude of price changes to determine whether an asset is overbought or oversold. Values above 70 indicate overbought conditions and a possible recovery, while values below 30 warn of oversold conditions and a possible recovery.

With GOAT’s RSI currently at 50.60, it is neutral, which means the price lacks strong momentum in either direction.

GOAT Price Prediction: 63% Chance of Correction

GOAT’s EMAs are still maintaining an uptrend, but the short-term ones are starting to decline, signaling a loss of momentum in the uptrend. This is consistent with RSI and ADX, both of which show that the uptrend is losing strength.

If the uptrend regains momentum, GOAT price could target resistance at $1.36, signaling the potential for further gains. However, if bearish pressure increases, support levels could be tested at $0.80 and $0.69.

A failure in these zones could lead to a deeper correction, potentially to $0.41, which would mark a significant decline of 63% from current levels and could eliminate remove GOAT from the list of 10 largest Meme Coin coins.