- Plunge in gold and silver prices due to market shifts.

- Gold dropped 11.4% amidst market volatility.

- Fed nominee’s impact on investor sentiment.

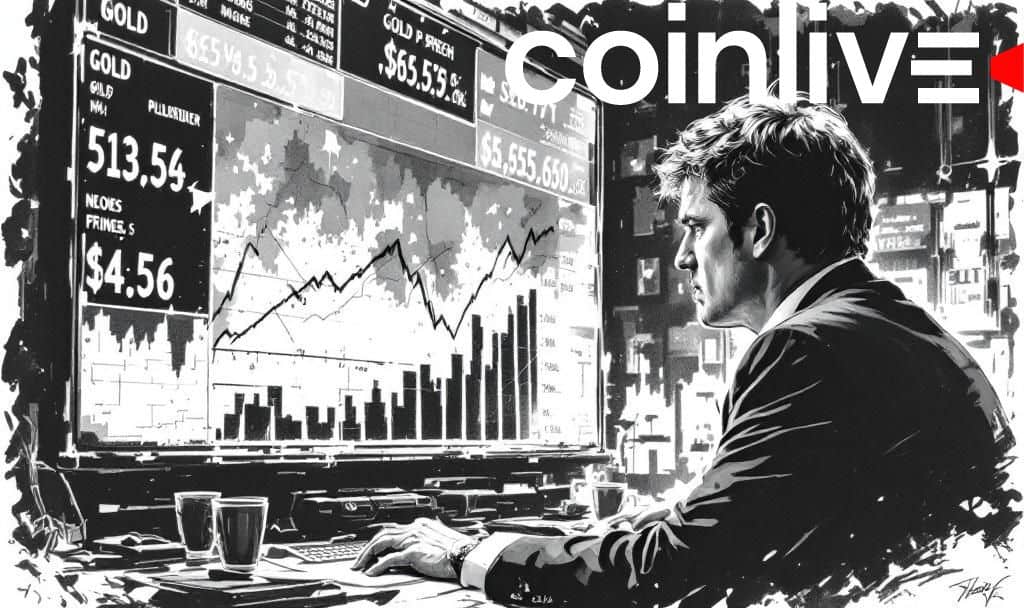

On January 30, precious metals saw significant declines with gold dropping by 11.4% to $4,745.10 per ounce and silver decreasing by 31.4%.

The plunge in metal prices reflects broader market volatility amid economic uncertainties and monetary policy shifts, impacting investor confidence.

Gold and silver prices experienced a significant drop with gold falling 11.4% to $4,745.10 per ounce. This decline was part of a broader market shift on January 30, linked to changes in U.S. economic policies.

The appointment of Kevin Warsh as a nominee for the Federal Reserve contributed to the volatility. Investors reacted to Warsh’s alignment with former President Trump’s monetary policy, leading to fluctuations in metal prices. Thierry Wizman, Strategist at Macquarie Group, commented, “Indeed, Warsh is not the Fed’s guy, he is Trump’s guy, and has shadowed Trump on monetary policy almost every step of the way since 2009.”

The market response was immediate, affecting both precious metals and associated mining stocks. Companies like Newmont and Freeport-McMoRan saw declines of 11.5% and 7.5% respectively, reflecting a broader industry impact.

The U.S. stock market experienced downturns in indices including the S&P 500 which fell 0.4%, signaling economic concerns tied to potential shifts in Federal Reserve strategies.

The volatility could influence global investor behavior, particularly in sectors closely tied to commodities. Understanding these patterns is essential for anticipating future market movements.

The recent developments may lead to greater scrutiny of Federal Reserve appointments and their impact on markets. Historical trends suggest volatile market responses to Fed policy shifts, emphasizing the importance of strategic economic planning.