- Gold exceeds $4,250, driven by macroeconomic factors and expert forecasts.

- Analysts predict gold may hit $5,000 by 2026.

- Mixed investor sentiment with significant skepticism.

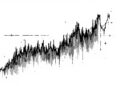

Gold prices have surged past $4,250, influenced by macroeconomic conditions, according to Rashad Hajiyev’s analysis, suggesting a parabolic rally in the precious metals market.

This significant movement marks a potential rally towards $5,000 by early 2026, impacting traditional markets while analysts like Hajiyev and Widmer project continued strong demand.

Gold has surpassed $4,250, signaling a continuation of its bull run. This rise is largely attributed to macroeconomic factors influencing markets.

Financial analyst Rashad Hajiyev projects gold reaching $5,000 by early 2026. His forecasts highlight the evolving dynamics of precious metals.

Precious metals markets

see increased action, with likely effects on silver. Cryptocurrencies show indirect sentiment impacts but no direct fluctuations. The financial outlook includes projections of gold’s continued ascent. Bank of America strategists foresee a potential rise to $5,000 due to sustained demand, stating:

“Gold could reach $5,000/oz in 2026, arguing that forces behind its recent surge will continue.”

Historical data reveals consistent cycles in gold price movements. Past patterns suggest this could lead to new highs. Rashad Hajiyev’s insights speculate a final parabolic run for precious metals.

Regulatory changes remain unreported, but market strategies are adapting.