On November 1, Dogwifhat’s (WIF) 50-day Simple Moving Average (SMA) crossed above its 200-day SMA, forming a golden cross — a bullish indicator that indicates the possibility of upward momentum. Following this technical event, WIF’s price skyrocketed 37%, reaching a five-month high of $3.

With this bullish indicator in effect, the key question is whether WIF can maintain its upward momentum and hold support above $3.

Dogwifhat Forms Golden Cross

On November 1, WIF’s 50-day SMA (blue line) crossed above its 200-day SMA (yellow line).

The 50-day SMA tracks the average price of an asset over the last 50 days, highlighting short- and medium-term trends. In contrast, the 200-day SMA reflects the average price over 200 days, serving as a gauge for long-term trends. Typically, when the price of an asset crosses the 200-day SMA, this suggests a sustained uptrend.

A “Golden Cross” occurs when the 50-day SMA crosses above the 200-day SMA, indicating that recent momentum is surpassing the long-term trend. This crossover signals a transition from a downtrend to an uptrend, often causing traders to consider long positions in anticipation of further price increases.

This is true for WIF, whose price has increased nearly 40% since the formation of the Golden Cross pattern.

WIF Sees Soaring Demand

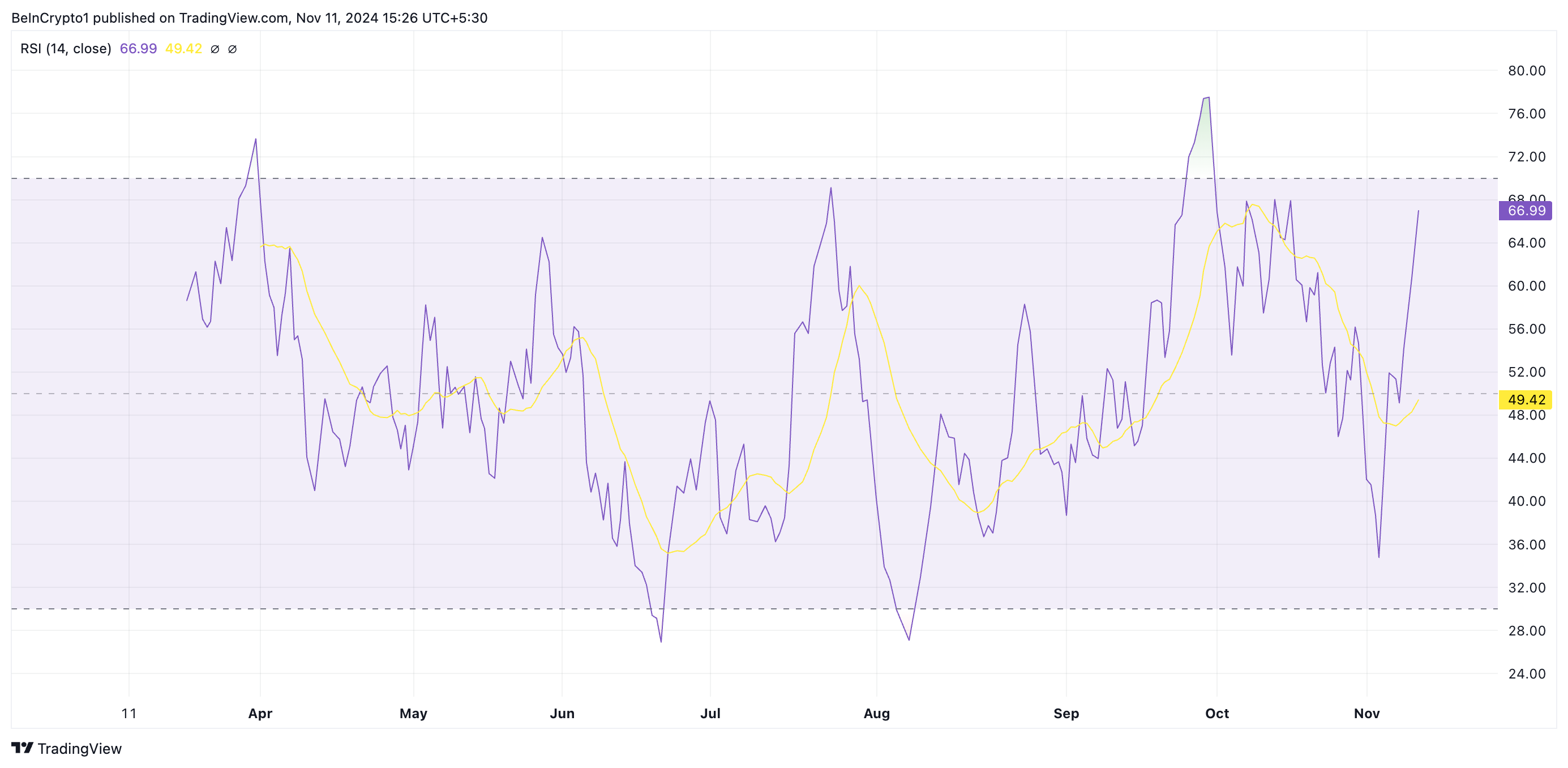

Over the past seven days, the value of the coin tied to dogs has increased 48%, and TinTucBitcoin’s assessment of the technical setup suggests it could extend these gains. For example, the rising Relative Strength Index (RSI) indicates an increase in demand for the coin. At the time of writing, the value of this indicator is 66.99.

The RSI indicator measures overbought and oversold market conditions of an asset. It ranges from 0 to 100, with values above 70 indicating the asset is overbought and may need a correction. Conversely, values below 30 indicate the asset is oversold and could witness a pullback.

An RSI reading at 66.99 shows that the asset is approaching overbought territory but has not crossed the overbought threshold at 70. This suggests that buying momentum remains quite strong and could continue in the short term. term.

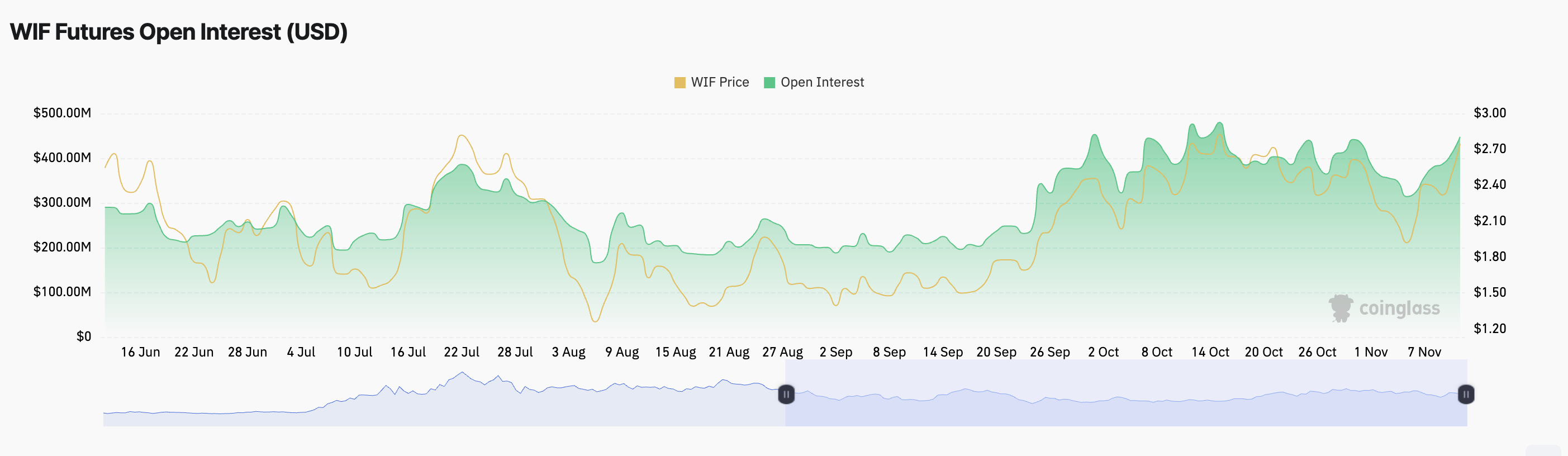

Furthermore, the WIF rally was accompanied by a corresponding increase in open interest. Currently, this figure stands at a monthly high of 448 million USD.

Open interest refers to the total number of contracts that have not been settled or closed. As with WIF, when open interest increases along with the price, this usually indicates that there is new money flowing into the market, and the current price movement is supported by an increase in trading activity. This is a bullish signal that hints at a continued bullish expectation.

WIF Price Forecast: $3 Price Is Key

Currently, Dogwifhat (WIF) is trading at $3.00, slightly above long-term resistance at $2.99. If buying pressure continues, this level could turn into a base of support, potentially pushing WIF up to $3.41. A break above this level could pave the way for a rally to $3.96, which is the final hurdle before WIF targets its year-to-date high of $4.86.

However, this optimistic scenario could be reversed if market sentiment becomes negative. A decline in demand could push the price of WIF down to $2.51.