On November 8, the price of GRASS, the native token of the Decentralized Physical Infrastructure Networks (DePIN) project on the Solana platform, reached a historic peak at $3.95. However, with a decline in optimism and an increase in profit-taking, the token’s value has dropped 27% since then.

This analysis explores the reasons why GRASS’s crypto price could continue to fall further from current levels.

GRASS trader dumps assets

The DePIN GRASS token is trading at $2.78 at this time, recording a 13% price drop over the past 24 hours. TinTucBitcoin’s review of the 4-hour chart of the GRASS/USD pair confirms an increase in selling pressure.

For instance, indicators from the Relative Strength Index (RSI) show that investors have been selling more GRASS tokens than buying new ones over the past few days. At the moment, this index is in a downtrend, at 44.80.

The RSI measures overbought and oversold market conditions of an asset. It ranges from 0 to 100, with values above 70 indicating the asset is overbought and is likely to correct. Conversely, a value below 30 indicates the asset is oversold and could recover.

GRASS’s RSI at 44.80 shows that selling pressure is increasing as Token Holders begin to sell to take profits.

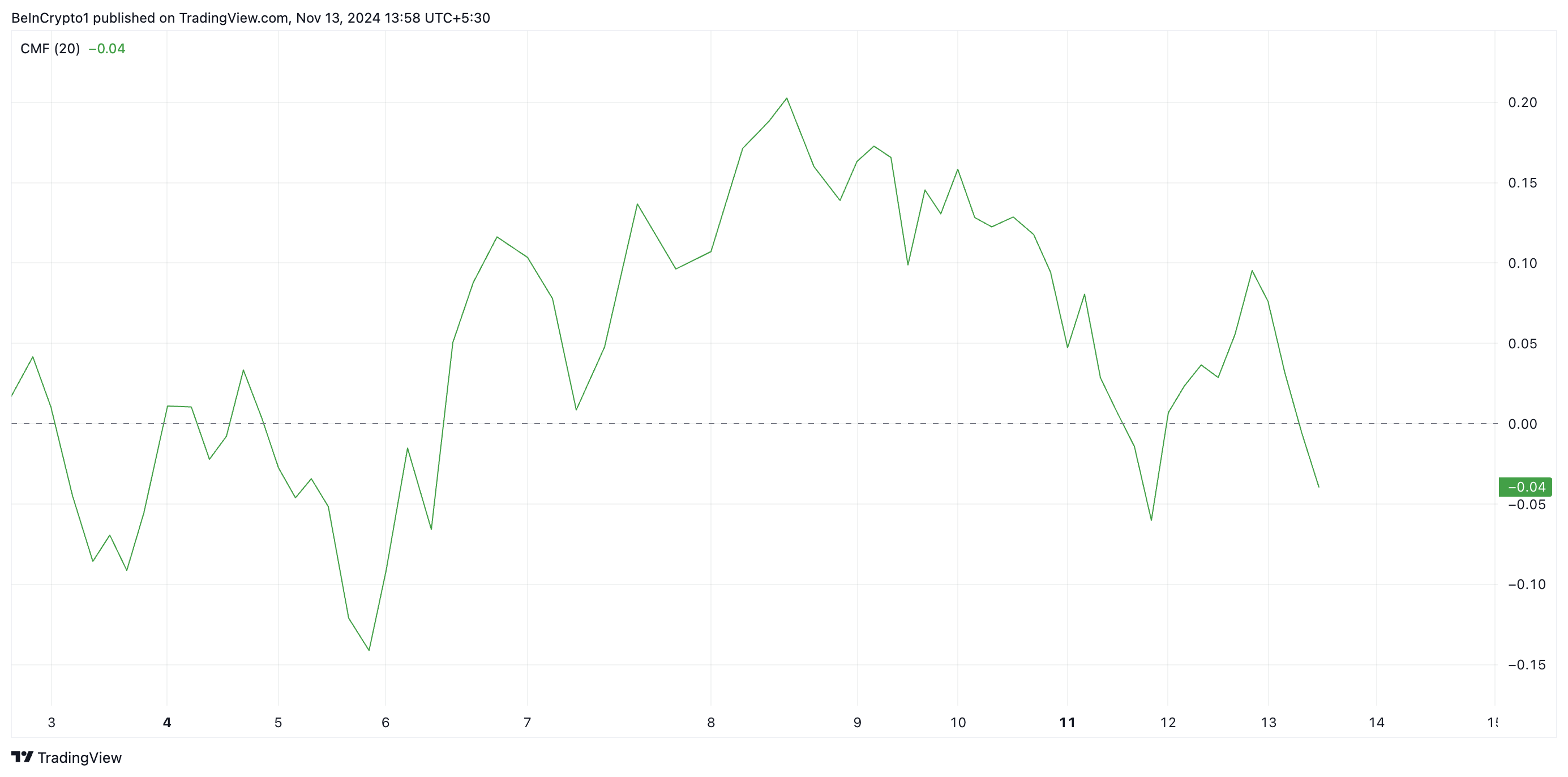

Additionally, the Token’s negative Chaikin Money Flow (CMF) confirms this negative view. At the moment, the index, which measures the inflow and outflow of an asset, is below zero, at -0.04.

CMF below zero typically symbolizes a preponderance of sellers over buyers, often signaling bearish price momentum. The farther away from zero, the stronger the selling pressure.

Futures trader GRASS remains hopeful

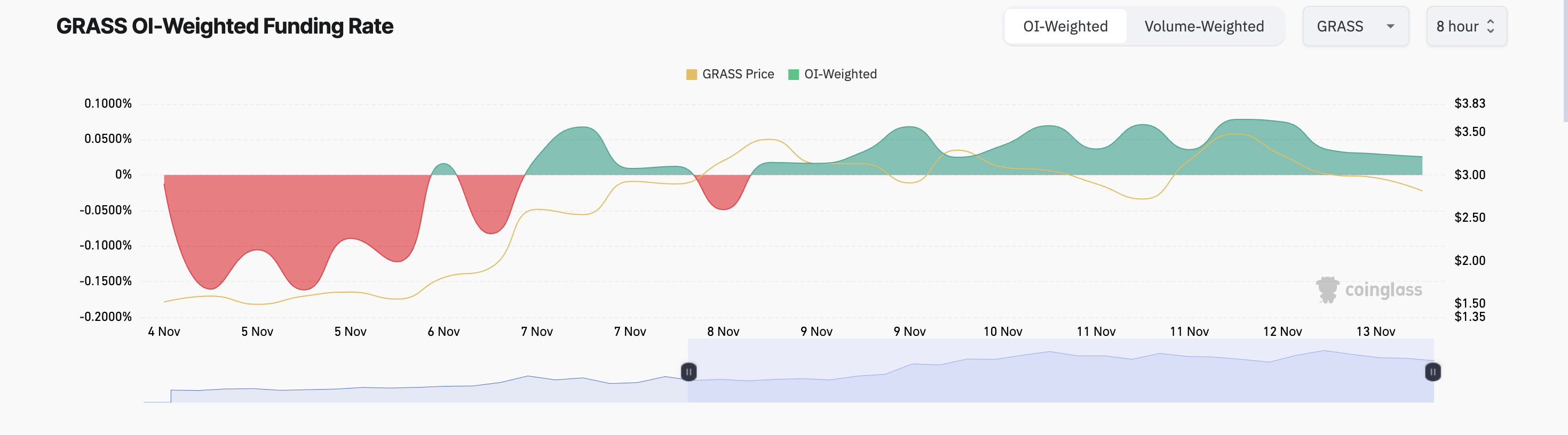

Interestingly, even though the GRASS Token price is falling, its futures traders continue to bet on a price recovery. This is reflected in the Token’s funding rate, which has remained positive since November 8. At the moment, the figure is 0.025%, according to data from Coinglass.

In futures trading, the funding rate is the forward fee paid between traders holding long and short positions, encouraging a balance between the two. When the ratio is positive, it means the demand for long positions is greater.

This indicates that even though the GRASS Token price has maintained a downtrend over the past few days, there are still more traders opening new positions expecting a price recovery than those hoping for a decline. continue.

GRASS price prediction: Likely to fall below 2 USD

At this time, GRASS is trading at $2.78, slightly above the support threshold of $2.65. Increasingly strong selling pressure hints at the possibility of a break below this level.

If this happens, the Token will attempt to find support at $2.26. The failure of bullish investors to defend this mark would cause GRASS price to fall below $2 to trade at $1.86.

However, if this altcoin experiences a positive change in market sentiment and demand recovers, its price could surge through resistance at $3.22 and retest its historical peak of 3 $.95.