Most traders have offered their optimistic assistance as to why the SEC ought to approve the conversion of the Grayscale Bitcoin Trust (GBTC) fund into a Bitcoin spot ETF.

The United States Securities and Exchange Commission (SEC) has permitted traders to comment and deliver suggestions on Grayscale’s proposal to open a Bitcoin ETF. As quickly as the announcement was created, the listing was straight away extended to the vast majority of folks who agreed.

On February 15, Bloomberg veteran analyst Eric Balchunas reviewed a quantity of current feedback demonstrating a 95% approval price for the SEC’s proposal.

I’m just checking out the quite a few feedback from ppl to the SEC that is converting $ GBTC to an ETF and 95% are in favor and most use serious names and stage to the remarkable reality that ETF futures are fine but will not. for instance: pic.twitter.com/j15iNYnh8R

– Eric Balchunas (@EricBalchunas) February 14, 2022

Many traders responded to the SEC’s proposal by claiming that the regulator has accepted ETF merchandise primarily based on Bitcoin futures, such as ProShares Bitcoin Strategy ETF (BITO), The Valkyrie Bitcoin Strategy ETF (BTF), and VanEck’s Bitcoin Strategy ETF (XBTF). , so a industrial product or service ought to also be out there. While other people argue that the US hazards falling behind other nations this kind of as Canada if they will not distribute the product or service promptly.

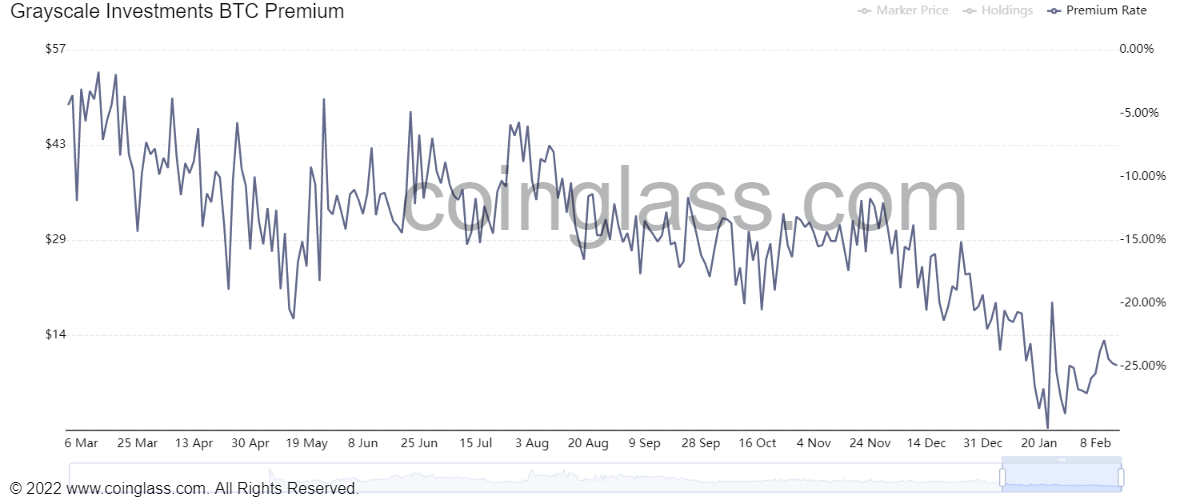

However, there have been conflicting views on no matter if the fund developed arbitrage possibilities to get total benefit of the retail trader’s loophole. GBTC Premium’s latest framework has offered experienced traders an edge in excess of typical ground.

Grayscale Bitcoin Trust traded at the worst GBTC premium in current months. At the time of creating, GBTC Premium hovers all over 25%. This signifies that when BTC is at present priced at all over $ 43,600, the GBTC share cost will only be well worth all over $ 32,500.

Grayscale officially utilized for a spot ETF on Bitcoin in October. On February four, the SEC delayed the determination citing the similar loved ones issues pertaining to manipulation, liquidity and transparency, regardless of requests from US lawmakers for prior approval. As of February 15, Grayscale Bitcoin Trust stays the greatest BTC fund in the planet with a complete worth of $ 27 billion underneath management.

ANNOUNCEMENT: As our product or service loved ones continues to increase, we have developed a new resource for our fund info, up to date everyday, so there is no require to wait for our everyday snapshot. We will carry on to tweet a reminder each week: https://t.co/ivV82Q4bBo pic.twitter.com/Gg6ePrhx47

– Grayscale (@ Grayscale) February 14, 2022

Synthetic currency 68

Maybe you are interested: