Grayscale Research has published a new report today, revealing their predictions for the top Cryptocurrency sectors for the first quarter of 2025. The latter part of 2024 has seen strong success, contributing to the competition and vitality in this space.

The company’s report concludes that smart contracts have more potential and momentum than any other factor. However, a few big names like crypto and DePin have also attracted interest from Grayscale Research.

Grayscale Report Highlights Strong Competition in the Smart Contract Market

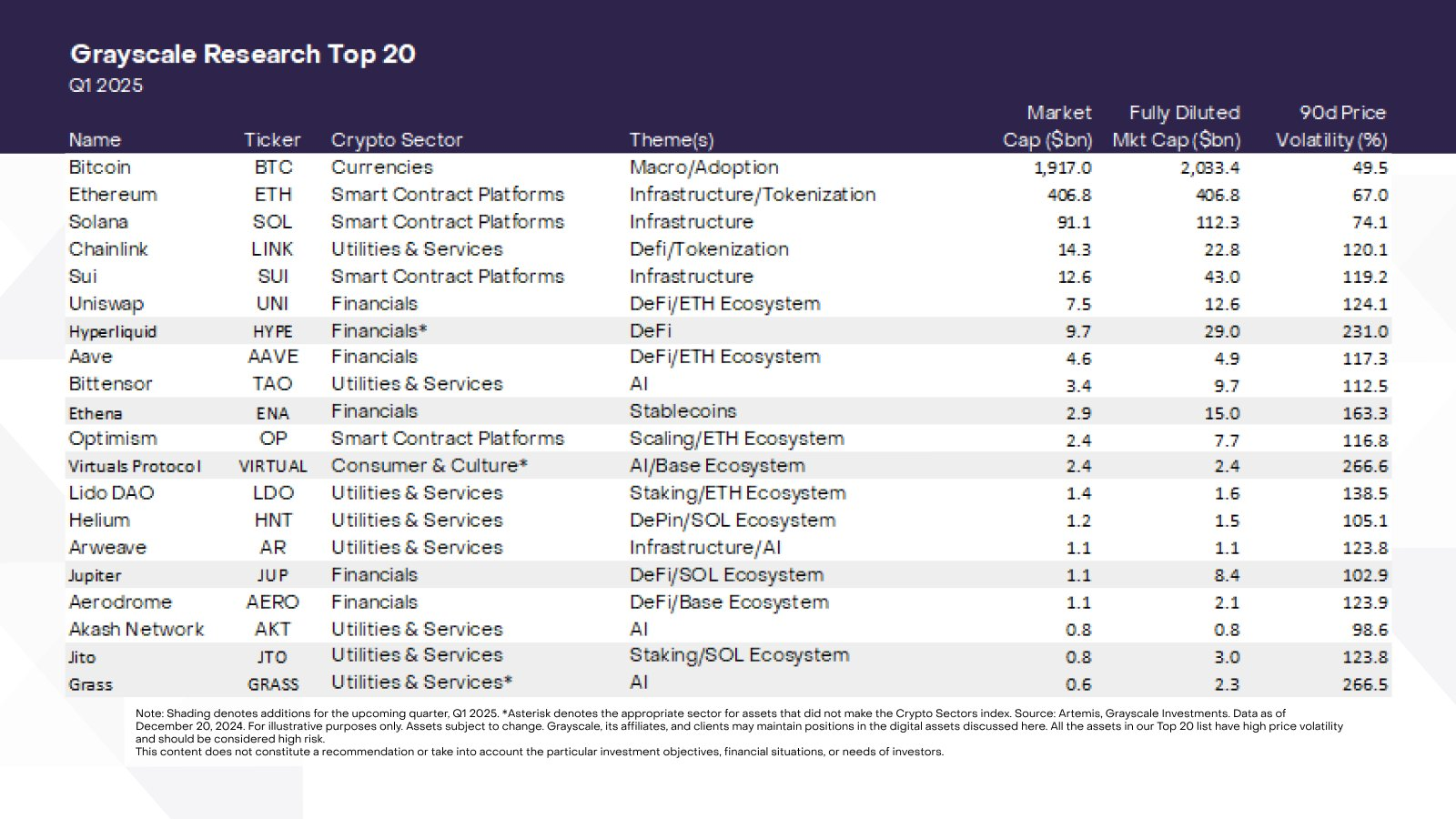

Grayscale, one of the leading Bitcoin ETF issuers, has announced report this with many commenting on their main prediction. The company concluded that the Cryptocurrency market grew sharply in the fourth quarter of 2024 and that fierce competition among smart contract platforms was a key growth driver. It also provides a “Top 20” list of the highest performing DeFi/Web3/crypto investment options.

The company calls smart contracts “the most competitive market segment in the digital asset industry,” noting that Ethereum has underperformed despite notable successes like ETFs and significant software upgrades. . Instead, competitors like Solana, Sui, and TON have taken their share of the market, highlighting the sector’s dynamic energy.

Grayscale has the highest expectations for smart contracts. However, only a few of its Top 20 assets fall into this category, and that doesn’t even include the leader. Other areas of interest include scaling, encryption, and DePin solutions.

“Regardless of design choices and network advantages or disadvantages, one way smart contract platforms create value is through their ability to generate revenue from network fees. The greater the ability to generate revenue from network fees, the greater the ability to transmit value to the network in the form of Token burns or staking rewards. This quarter, Grayscale Research’s Top 20 featured the following smart contract platforms: ETH, SOL, SUI, and OP,” the report noted.

This company is a subsidiary of Digital Currency Group (DCG) and has a long history in the field of Cryptocurrency. Grayscale led the regulatory effort for a Bitcoin ETF, which was successful in January 2024, though the company quickly lost ground in this new market.

Despite this setback, the company was a pioneer in achieving SEC approval for the Ethereum ETF and new ETF trading options. Ultimately, the ability to successfully sell an ETF has little bearing on a company’s ability to assess its market potential.

To be honest, Grayscale Research’s report for Q1 2025 barely mentioned the ETF space, perhaps because they view it as indirectly related to key fundamentals. Regardless, Grayscale still shows considerable optimism about the future of Cryptocurrencies.