[ad_1]

Grayscale Investments has filed an updated draft for its Bitcoin Options ETF (exchange-traded fund).

This shows quick action after the Commodity Futures Trading Commission (CFTC) approved the listing of Bitcoin ETF spot options.

Grayscale Pursuit Bitcoin Options ETF

This fund, which provides exposure to Bitcoin and the Grayscale Bitcoin Trust (GBTC), aims to generate income through actively managed call and put options on the Bitcoin exchange-traded product (ETP). The draft is available initial submission to the US Securities and Exchange Commission (SEC) in January 2024.

According to the filing, this ETF will achieve its objective by providing exposure to GBTC. In addition, it will also apply the insurance options strategy. This means it will sell call options to generate income while holding Bitcoin or GBTC as collateral.

“The fund seeks to achieve its investment objective primarily through proactive exposure to the Grayscale Bitcoin Trust (GBTC) and the purchase and sale of a combination of call and put contracts using GBTC as collateral. reference,” the January filing declared.

James Seyffart, an ETF analyst at Bloomberg Intelligence, commented on this development. According to him, Grayscale is taking advantage of the approval for the Bitcoin ETF option.

“Grayscale wasted no time after approving the BTC ETF option. They have filed an updated draft for their Bitcoin Options ETF (no trading ticker yet). The fund will provide exposure to GBTC and BTC while writing and/or buying options contracts on the Bitcoin ETP to generate income,” Seyffart comment.

This comes after the US Securities and Exchange Commission (SEC) approved options trading for spot Bitcoin ETFs. This regulatory milestone, announced last month, allows ETF issuers to integrate options strategies into their Bitcoin-focused funds. Among other benefits, this opens up new investment avenues.

The Office of the Comptroller of the Currency (OCC) is also preparing to launch options trading on the Bitcoin ETF. Eric Balchunas, another ETF industry expert, emphasized the importance of the CFTC’s decision. He said this paved the way for more complex Bitcoin investment products.

With options now available, funds like Grayscale’s Options ETF can serve investors seeking yield in a volatile asset class.

ETF Strategy by Grayscale in Vast Background

Grayscale’s filing for the Options ETF is part of its larger effort to position itself as a leader in Cryptocurrency ETFs. In October, the SEC admitted Grayscale’s application to convert its Digital Asset Hedge Fund into an ETF, signaling the company’s commitment to diversifying its products.

Additionally, Grayscale has partnered with NYSE Arca to secure approvals to list a series of ETFs, including those focused on digital assets beyond Bitcoin. These efforts reflect the company’s strategy to bring qualified financial products to the Cryptocurrency market.

The ability to integrate options trading into Bitcoin ETFs could mark a turning point for the crypto industry. The covered options strategy, which involves selling options on held assets, allows the fund to generate steady income — a feature that could attract a broader range of investors.

Grayscale’s swift response to these developments and push for a Bitcoin Options ETF reflects its deftness in navigating an increasingly complex regulatory environment. By filing an updated draft for the Bitcoin Options ETF, the company positions itself to capitalize on the growing interest in options-based investments in Cryptocurrencies.

If approved, the Bitcoin Options ETF could pave the way for a new generation of investment products that combine traditional financial strategies with novel digital assets. With regulatory frameworks starting to adapt to such innovations, the crypto investment space is gearing up for significant growth.

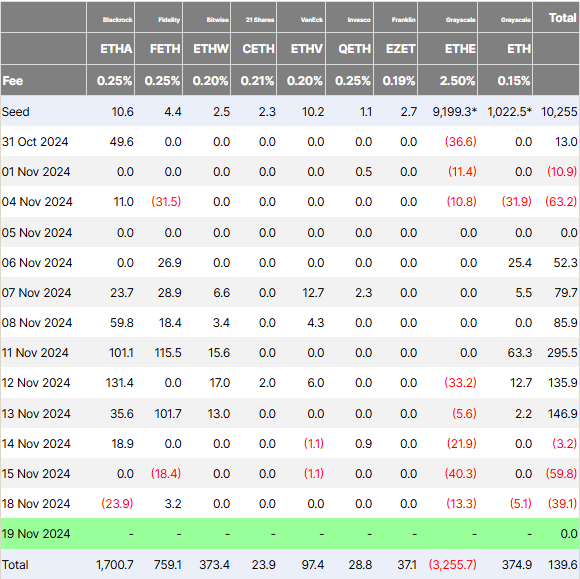

However, the company’s Ethereum ETF is still affected by withdrawals, seeing five consecutive days of withdrawals since November 12.

General Bitcoin News

[ad_2]