Grayscale file request for the new Ethereum futures ETF, in accordance to data reported by Wall Street Journal on September 19th.

Grayscale would like to open extra Ethereum ETF futures

Grayscale would like to open extra Ethereum ETF futures

Grayscale utilized for an Ethereum futures ETF based mostly on the Securities Act of 1933, rather than the Investment Company Act of 1940, which the organization previously requested.

It is acknowledged that the US Securities and Exchange Commission (SEC) has previously accredited a amount of Bitcoin futures ETFs underneath the laws of 1933 and 1940. While the paperwork filed for Bitcoin spot ETFs, which have not nevertheless been accredited, they are based mostly on the law. Law of 1933.

The ETF wave has rekindled in latest weeks, with a amount of names confirming their participation in the rush. Volatility Shares, Direxion, Bitwise, ProfessionalShares, VanEck, Roundhill and Valkyrie have all utilized to the SEC to open an Ethereum futures ETF. The amount of candidates submitted to the US Securities and Exchange Commission has reached twelve.

Indeed, the SEC has agreed to license a amount of Bitcoin futures ETFs considering that October 2021, but continues to say no to spot fund items, arguing that this market place is rife with dangers of manipulation and fraud. Bigwig BlackRock was the initial to spark the ETF spot move. Closely followed by Fidelity, WisdomTree, Valkyrie, Invesco…

On the other hand, Grayscale’s latest victory prior to the SEC concerning its ETF conversion proposal has place the commission in the place of getting forced to assessment the registration application, but with the appropriate to reject or not approve it.

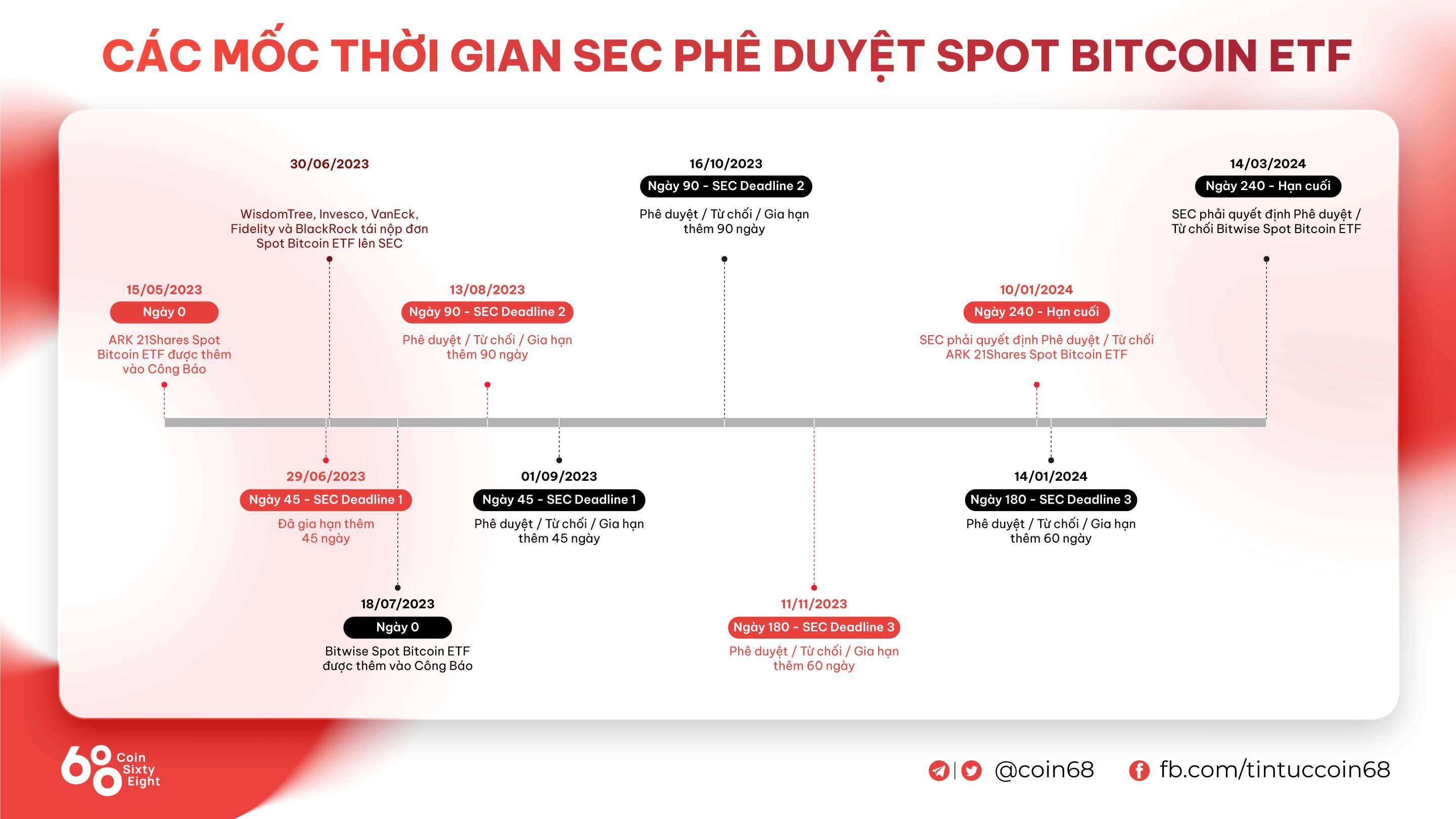

The time restrict inside of which the U.S. Securities Commission can make a last choice on every single ETF application is 240 days. According to the newest estimates by Bloomberg, the possibility that the SEC will give its approval to the spot ETF is 75%. Appearing prior to the Senate Banking Committee on September twelve, SEC Chairman Gary Gensler explained that he was even now reviewing the court’s ruling in the Grasycale situation and that he essential extra time to assess other Bitcoin ETF applications.

SEC Bitcoin ETF Approval/Rejection Timelines

SEC Bitcoin ETF Approval/Rejection Timelines

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!