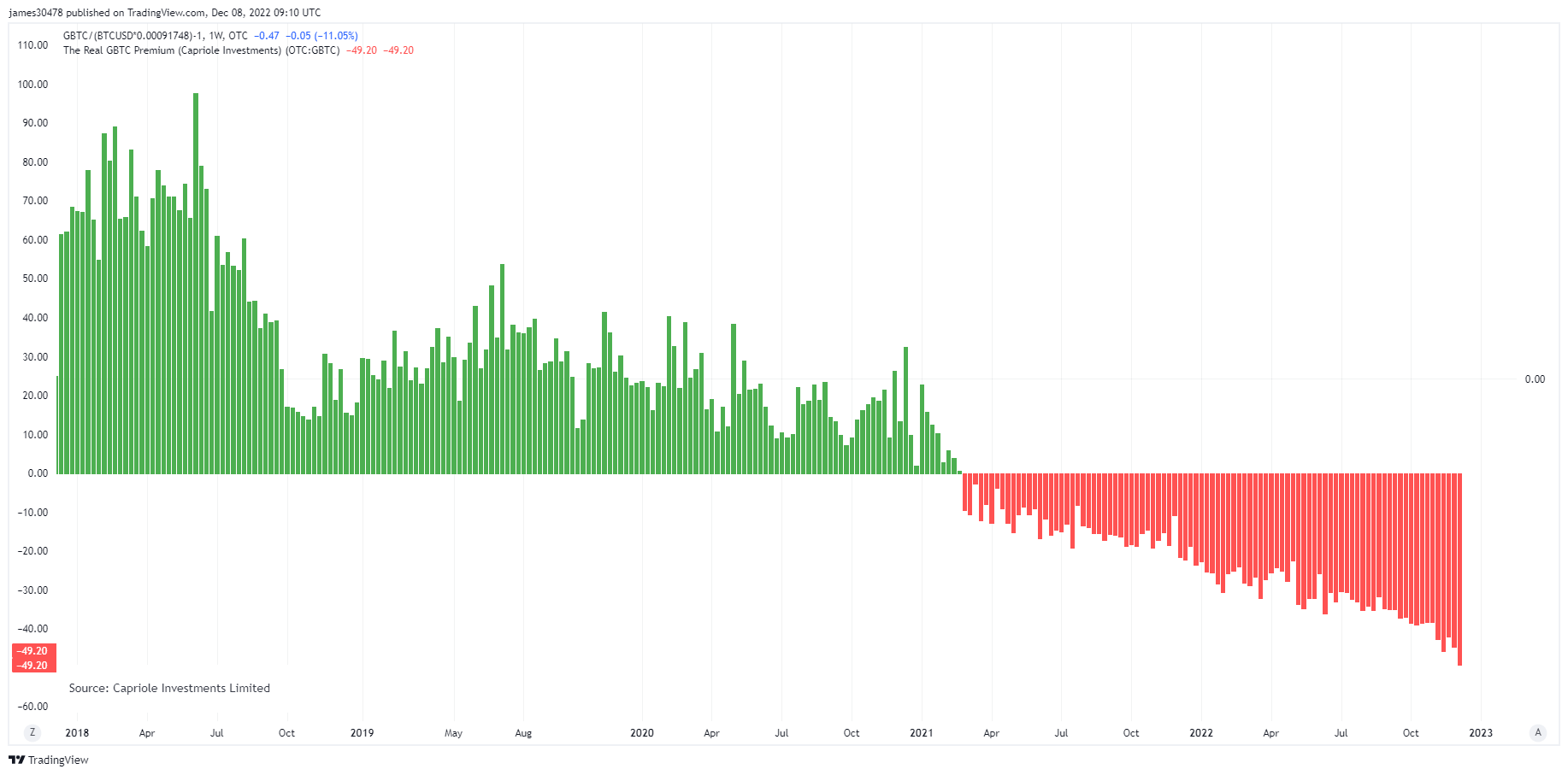

Grayscale Bitcoin Trust (GBTC) is trading at record minimal price reduction 49.twenty% to the net asset worth (NAV) of the underlying asset, as of December eight.

According to ycharts information, GBTC stock is trading for $eight.eleven at a price reduction of 47.27%.

GBTC rate drop raises crypto neighborhood curiosity

The crypto neighborhood is more and more interested in GBTC’s record-breaking rate drops.

Speculations have swirled all around the products as its sister business Genesis halted withdrawals due to consumers citing the boom in FTX. Subsequent reviews uncovered that their mother or father business Electronic Forex Team had about $two billion in debt – with most of it owed to Genesis.

Lumida Prosperity CEO Ram Ahluwalia declare that DCG may possibly have applied its GBTC holdings as collateral for its loan to a crypto loan company.

four/ Here we will emphasis on Loan #one – (‘GBTC Loan’) – DCG commits its GBTC holdings to borrow $575 MM from its subsidiary Genesis Lending. We do not know the time.

DCG purchased $778 million in GBTC from March 2021 to June 2022. DCG stopped purchasing soon after 3AC boom, Source: 10Q

— Ram Ahluwalia, Cryptocurrency CFA (@ramahluwalia) November 25, 2022

Meanwhile, Grayscale’s refusal to disclose evidence of its Bitcoin (BTC) holdings more fueled rumors that it was impacted by the crash of FTX. However, Coinbase custodian spouse has launched a thorough report on the assets it holds on behalf of the investment company.

Grayscale is now face legal action from investor Fir Tree, who has accused the business of “stakeholder-unfriendly practices”. According to the investor, Grayscale really should proceed to obtain back and lower costs.

Analysts hold diverse views

Bitcoin analyst Willy Woo has argued that the worry of GBTC/DCG/Genesis generates a bearish cloud in the crypto marketplace but that marketing GBTC is “counter-intuitive… bullish on BTC.”

The GBTC/DCG/Genesis worry is a bearish cloud hanging in excess of the marketplace. But intuitively, aspect of the effect has been to raise the rate of BTC.

37.five% of these who offered GBTC purchased spot BTC to hold. Selling GBTC does not have an impact on BTC rate, purchasing on the spot does. https://t.co/wUh5m8OVrm

– Willy Woo (@woonomic) December 5, 2022

Peter Schiff is skeptical of crypto Written that GBTC has misplaced 74% in worth by 2022, whilst Bitcoin is down 63%. He extra that gold and silver only misplaced two% and one% of their worth in the very same time frame.

Meanwhile, Natalie Smolenski, chief executive officer of Texas Bitcoin Basis, thinks that this recent situation could have been prevented if SEC chairman Gary Gensler had authorized GBTC’s request to convert into an exchange-traded fund (ETF).

If @GaryGensler authorized conversion $GBTC for an ETF, this situation can be prevented.

Instead, Gensler tries to ruin #bitcoin by rejecting ETFs and proping up #FTXflooded the marketplace with paper BTC.

This has destroyed hundreds of thousands of retail traders. https://t.co/KMVNyaR8yf

– Natalie Smolenski (@NSmolenski) November 17, 2022

Smolensky says:

“The state cannot destroy Bitcoin, but it can make life extremely difficult for ordinary people trying to take advantage of this new saving technology. People are collateral damage as incumbent elites scramble to protect their prerogatives.”