GBTC’s share cost towards Bitcoin continued to plunge just after information that Grayscale’s subsidiary Genesis Trading halted withdrawals due to its involvement with FTX.

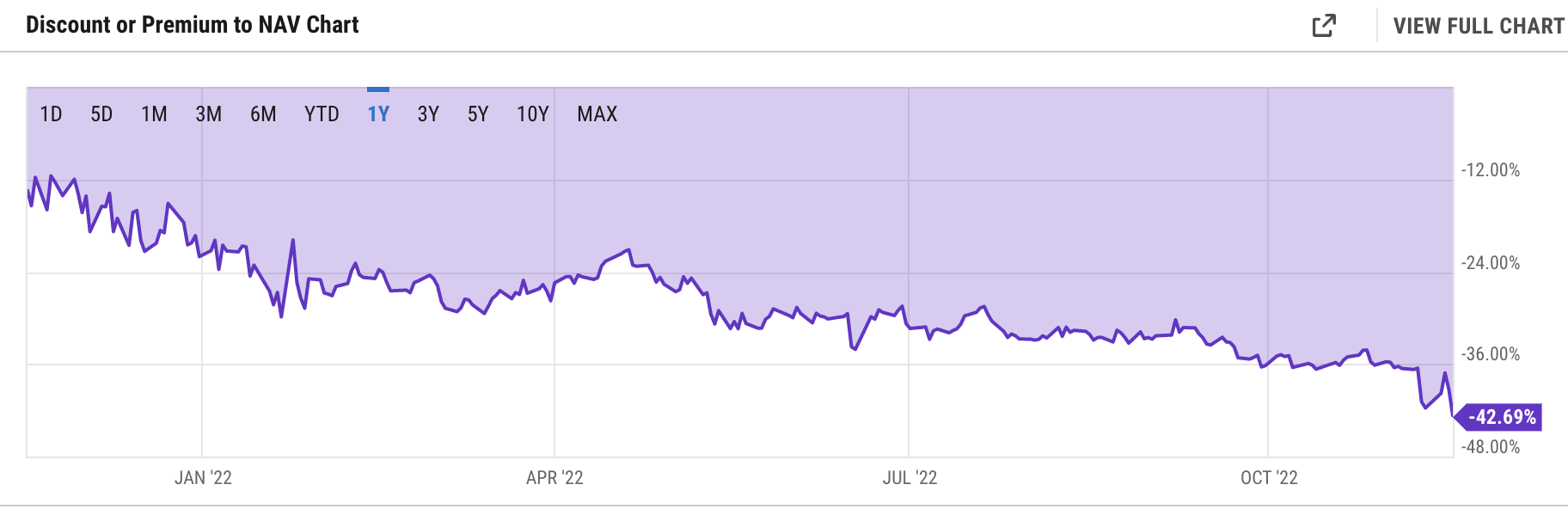

According to information from yCharts, the distinction involving the cost of GBTC shares issued by Grayscale and the authentic Bitcoin asset is -42.69%, the lowest because the product or service was designed in 2017.

GBTC is a fund issued by Grayscale. As a outcome, the business will hold a selected quantity of Bitcoin (BTC) in the Grayscale Bitcoin Trust (GBTC). The fund’s GBTC shares can be bought by personal and institutional traders by way of a US stock brokerage account, generating it a approach applied by quite a few US entities to achieve indirect publicity to Bitcoin.

During the time period 2017-2020, the cost of GBTC has usually remained over the market place cost of Bitcoin, when the demand overwhelms the provide. The cost of GBTC was after a hundred% greater than the cost of Bitcoin, but has constantly declined to close to twenty-forty% in subsequent many years.

Thanks to the recognition of GBTC, Grayscale has subsequently designed additional related fund merchandise for Ethereum (ETH) and other big altcoins in the cryptocurrency market place. Data supplied on Grayscale’s web page confirms that as of Nov. 18, 2022, Grayscale manages assets of up to $14.seven billion, of which BTC owns $ten.five billion, followed by ETH with $three.six billion.

However, because early 2021, GBTC’s share cost has constantly declined as demand has declined. Going into 2022, when the cryptocurrency market place crashed just after quite a few big occasions, GBTC continued to be offered by traders. In November, when it was announced that Genesis Trading had halted withdrawals due to its involvement in the FTX bankruptcy, GBTC manufactured a new very low by dropping nearly 43% from the genuine worth of Bitcoin.

The motive GBTC is interested is mainly because Grayscale is a business with the very same proprietor as Genesis Trading, so traders are concerned that because the recent crisis in the cryptocurrency market place has proven no indications of abating, the meeting with Genesis La issues could lengthen to Digital Currency Group subsidiaries this kind of as Grayscale and the mining company Foundry. Both Grayscale and Foundry have launched statements that they are not affiliated with Genesis.

In the most recent set of statements on the morning of Nov. 19, Grayscale representatives continued to reassure traders that their merchandise are nevertheless harmless and completely deposited by Coinbase, the greatest cryptocurrency exchange. However, for protection good reasons, Grayscale will not be ready to publish addresses of wallets that incorporate coins this kind of as the “Proof of Reserve” motion manufactured by big cryptocurrency exchanges following the FTX crash.

[NEW TODAY] Due to current occasions, traders are understandably digging deeper into their cryptocurrency investments. In this thread, we have gathered additional info about the security and protection of assets held by our digital asset merchandise. https://t.co/MvTfUoK4o6

— Grayscale (@Grayscale) November 18, 2022

Synthetic currency68

Maybe you are interested: