After the collapse of FTX, one particular of the biggest fiscal merchandise in the cryptocurrency marketplace, Grayscale, continues to encounter strain.

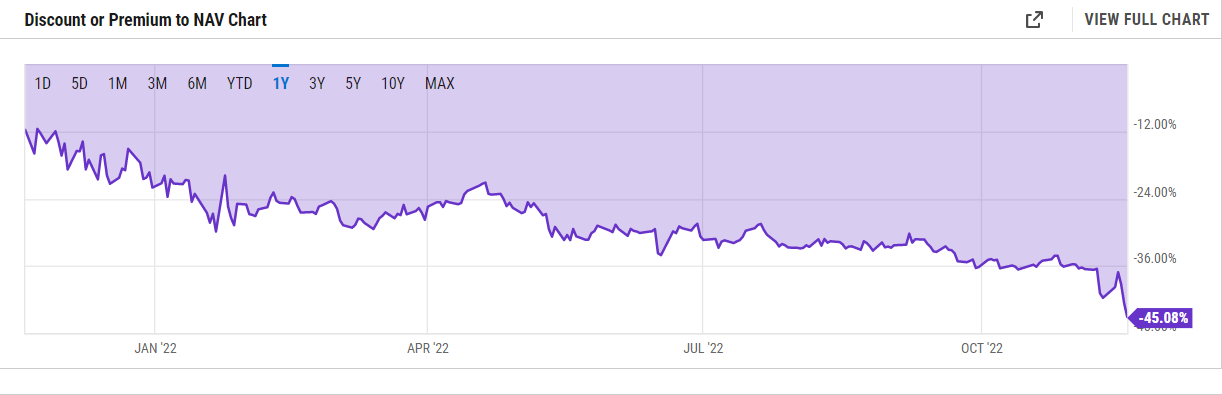

Grayscale Bitcoin Trust, a item that supplies traders with publicity to Bitcoin by means of a fund construction in the type of GBTC shares, is trading at an all-time minimal towards the selling price of Bitcoin, hovering about -45.08%.

The adverse effect on GBTC stems primarily from the “wave” of skepticism that has swept more than Grayscale’s mother or father firm, Digital Currency Group, which also owns struggling cryptocurrency loan provider Genesis Trading. announced it would halt withdrawals final week.

Also mainly because there are so several chaotic rumors surrounding Genesis Trading, Bitcoin selling price early Nov 22, 2022 failed to hold the $sixteen,000 assistance degree considering the fact that the FTX crash, but identified a new 2022 minimal at the $ 15,400.

Faced with the over nerve-racking condition, a part of the local community asked Grayscale to display evidence of the bitcoin reserves underpinning its GBTC item. However, the firm did not accept it, citing safety worries.

two) Each of Grayscale’s digital asset merchandise is set up as a separate legal entity: an investment believe in for single asset merchandise and a restricted liability firm for diversified merchandise.

— Grayscale (@Grayscale) November 18, 2022

Even so, as of Nov. 18, 2022, executives at the Coinbase exchange, which holds custody of Grayscale’s reserves, have explained that the asset underlying all of the crypto merchandise supplied by Grayscale is even now protected by Coinbase Custody and these assets are unable to be utilized for external lending.

four) All digital assets that underpin Grayscale’s digital asset merchandise are held in the custody of Coinbase Custody Trust Company, LLC. Read a lot more from @CoinBaseAlesia Haas CFO and Coinbase Custody CEO Aaron Schnarch: pic.twitter.com/InBP9zPDkC

— Grayscale (@Grayscale) November 18, 2022

Synthetic currency68

Maybe you are interested: